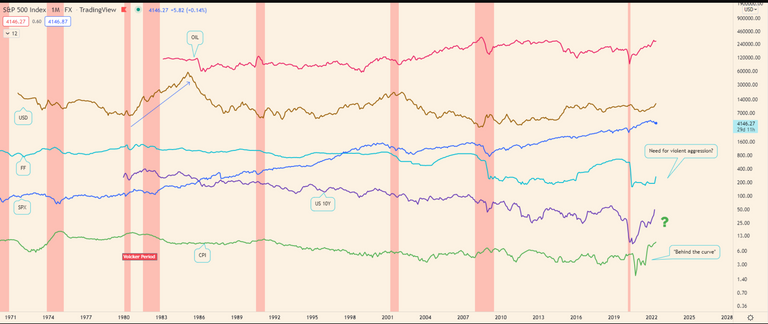

I start writing thinking there’s no chance Powell can raise over 50 basis points (that’s what’s currently priced in fully – 25 to 50). If you look at the below chart the ONLY time we have raised rates into a weak economy is the 70’s (The Volcker era) – when we actually went ahead and raised rates into a recession – FYI we are pretty much on a cliff edge right now and looking down at a recession, all we need to happen is this Q’s GDP figures to trend negative and boom… were ‘’in a recession’’ – Many indicators are already suggesting we’re in one. So yeah we raise rates here then we’re emulating the Volcker era

The Volcker era was around 2 years of pain for markets while he battled to reduce inflation. HOWEVER I don’t THINK Powell has the ammo to pull a Volcker

– Mainly for two reasons

- Consumer credit In the Volcker era we weren’t as credit dependant as we are now. The landscape here has completely changed and through access to the credit its weakened the consumer.

- One of the main killers in the market right now is the USD… Yeah USD was rising at the time Volcker did what he did but the after effect of what he did was a MUCH stronger USD. If we did that here we would cripple the US economy but we would also cripple global economies as we are much more USD dependent now. So this would be a total suicide.

Powell needs to crush demand to take on inflation and I don’t think we are there YET, but I actually think we are getting close. Consumer demand has fallen and continues to fall, I think its just corporate demand / high level demand that still needs crushing a bit here and I’m focused on OIL to gage this level of demand plus the supply chain issues in china subsiding as this should bring down a number of rising costs and ultimately the CPI + some other commodities and raw materials.

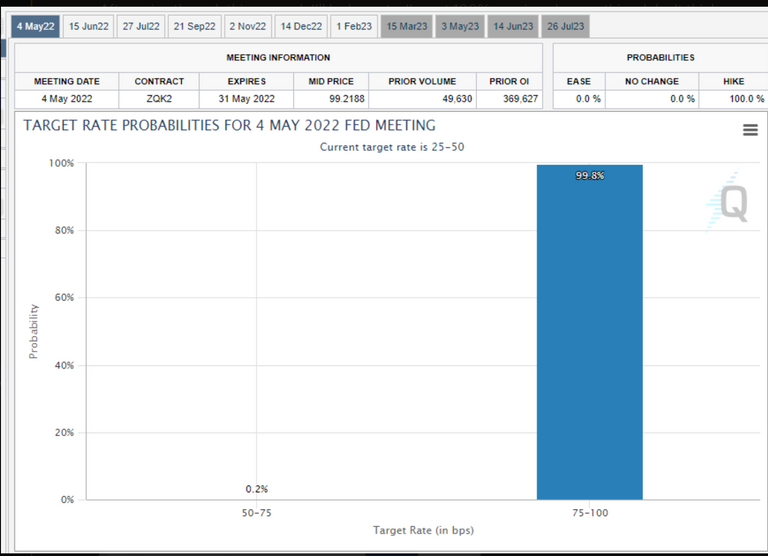

After going through this research I’ll be honest… I’m not 100% convinced on anything. I don’t think anyone is really because the situation is so complex and full of twists and turns. Currently the market is pricing in a 25/50 hike this month

If I had to GUESS here I’d say he goes with a 50/75 Hike THEN signals possibility of ANOTHER 50/75 in June. With the market only pricing a 25/50 this month I think this leaves the door wide open for him to surprise to the upside by doing a 75, crushing the demand / market a little further then NOT actually following through with an increase of 50/75 in June… More like an under expectations 25 to make markets rally again once the above demand destruction has taken place.