Hi folks!

Investing can be difficult. Even experienced traders who try to read the market to buy at the most opportune moment can fail.

In many articles, I suggested to use Dollar-Cost Averaging.

But what is it? And does it really make a difference? We'll have some graphs to see if this strategy is effective.

In short, DCA is a strategy that can help you navigate automatic buying in uncertain markets. It also supports the investor's efforts to invest regularly. Averaging involves investing the same amount in a target security at regular intervals over a period of time, regardless of its price. By averaging dollar costs, investors can lower average cost per share and reduce the impact of volatility on their portfolios. In fact, this strategy eliminates the hassle required to find the best buy on the market. The $/cost average is also known as the "constant dollar plan."

source: Forbes

Example 1

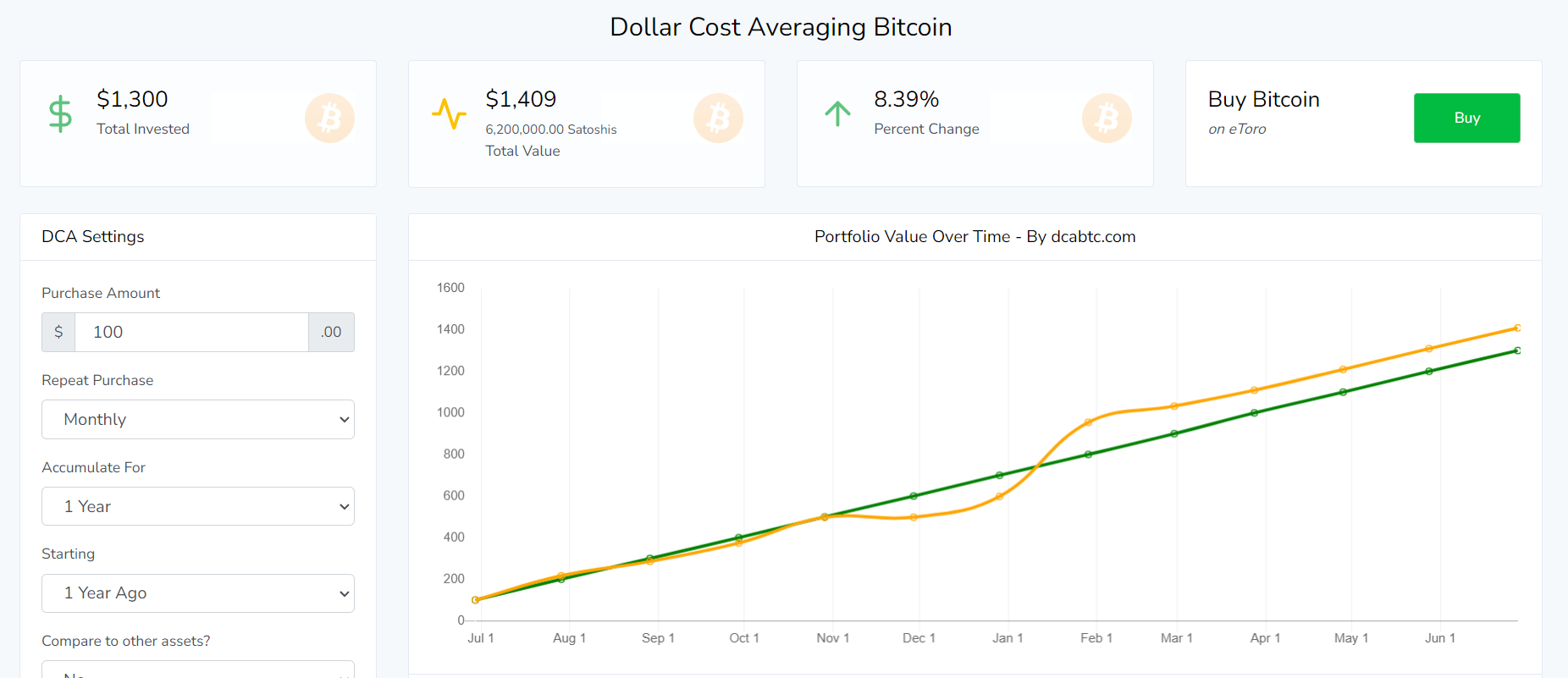

So, does it work? Let's find out with some scenarios with Bitcoin. Let say you decided 1 year ago to invest 100$ worth of bitcoin per month (june 2022 BTC = 19-20k$). You'll end up with a total invested amount of 1 300$ at the beginning of the new year (today BTC = 30K$). You would have now 1 409$, a return of 8.39%.

source: DCABTC.com

Well, that's not bad. The same strategy for Gold of Wall street would only earned you a meager 2%. In the other hand, Bitcoin made a 52% movement up in one year. What if... yeah, there's the thing, it's hard to catch the bottom, and your return will be less interesting in bull run period.

Example 2

Let say this time, you've been accumulating Bitcoin for 6 years (10k to 30k). You buy every month 50$ worth of Bitcoin.

Again you can see that you'll get a better return than Gold and probably most mutual fund. And again, if you buy the dip, you would have made much more money.

We could do the same exercise with Hive and Leo. Most simulation will show you that for now you're down 15-20% depending of the timeframe. But you have to consider that Hive and LEO staked give you curation (10-13%). Delegating Hive power to @leo.voter can give you a return of 16% in Leo. So again, in the long run the DCA strategy will give you a stress free return (If the SEC, Central banks, and the US don't fuck us all, but that's another story).

Let's wrap up with a Pros and cons list!

Pros of DCA

• Averaging dollar costs can lower the average amount spent on investments.• Encourages the practice of investing regularly to accumulate wealth over time.• Eliminates the excitement of investing and prevents potential damage to portfolio returns.Cons of DCA• Eliminates possibility of buying exact bottoms.• Takes time to get desired exposure.• Potentially lower performance in strong bull market.At the end of the day, you have to choose what is best for you. Markets are random and as we say in french "avec des si, on va à Paris" Which mean that the IF mindset is not realist, and in the trading world working in IFs is nothing more than gambling. Good luck and good Profits!GGPdisclaimer : This is just my opinion. Not an expert. Not financial advice. Just for fun. DYOR.

Posted Using LeoFinance Alpha

Congratulations @twoitguys! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 51000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Congratulations @twoitguys! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts: