KEY FACTS: Janover Inc., a Nasdaq-listed real estate fintech firm, has acquired 80,567 Solana (SOL) tokens for $10.5 million, bringing its total holdings to 163,651.7 SOL, valued at approximately $21.2 million, as part of its third major Solana purchase in April 2025. This move, driven by a new leadership team of former Kraken executives, follows a treasury policy that prioritizes Solana as the company’s primary reserve asset, leading to a 1,700% stock price surge since early April. Janover aims to generate revenue through staking and validator operations, supported by a partnership with Kraken, while maintaining its AI-powered real estate platform.

Image Source: Janover

Real Estate Fintech Janover Doubles Solana Holdings with $10.5M Acquisition

Janover Inc., a Nasdaq-listed real estate-focused financial technology firm, has significantly expanded its cryptocurrency portfolio by acquiring 80,567 Solana (SOL) tokens for approximately $10.5 million. This development was announced on April 15, 2025, through a blog post. This acquisition brings Janover’s total Solana holdings to 163,651.7 tokens, valued at roughly $21.2 million, inclusive of staking rewards. This month, the purchase marks the company’s third major Solana investment, indicating a strategic positioning to integrate digital assets into its corporate treasury and drawing comparisons to MicroStrategy’s Bitcoin accumulation strategy.

Janover, traditionally known for its AI-powered platform that connects stakeholders in the commercial real estate industry, has undergone a shift in recent weeks. The company’s new treasury policy, approved by its board on April 4, 2025, prioritizes Solana as its principal reserve asset, a decision that has propelled its stock price upward by over 1,700% since the announcement. This strategy positions Janover as the first publicly traded U.S. company to center its treasury on Solana, distinguishing it from other firms that have predominantly focused on Bitcoin for their crypto reserves.

The catalyst for Janover’s crypto-focused transformation lies in its recent leadership overhaul. Earlier this month, a team of former executives from the cryptocurrency exchange Kraken, led by Joseph Onorati, acquired a majority stake in Janover through the purchase of over 700,000 common shares and all Series A preferred stock. Onorati, who previously served as Kraken’s chief strategy officer, assumed the role of chairman and CEO, bringing with him a wealth of expertise in digital assets. Joining him is Parker White, now Janover’s COO and CIO, and Marco Santori, Kraken’s former chief legal officer, who has taken a seat on Janover’s board. This influx of crypto-savvy leadership has steered the company toward a vision that blends its real estate roots with blockchain innovation. Onorati said in a statement:

“We’re proud to be the first to introduce a digital asset treasury strategy in the U.S. public markets initially focused on Solana,”...“We’ve brought together an exceptional team with deep digital assets and public market expertise to make it happen.”

Despite the aggressive pivot to cryptocurrency, Janover has emphasized that it will not abandon its core real estate operations. The company’s AI-driven platform, which serves over one million web users annually, will continue under the leadership of founder Blake Janover and CFO Bruce Rosenbloom.

Janover’s $10.5 million Solana purchase is the latest in a series of rapid-fire acquisitions that began shortly after the adoption of its new treasury policy. On April 10, the company made its first Solana buy, acquiring $4.6 million worth of tokens. The following day, it added another $5 million to its holdings, bringing its total to 83,000 SOL before the most recent purchase. These transactions, funded through a $42 million financing round involving convertible notes and warrants, have been supported by prominent crypto-focused investment firms such as Pantera Capital and Kraken.

The company’s aggressive accumulation of Solana has drawn parallels to MicroStrategy, the business intelligence firm that, under the leadership of Michael Saylor, pivoted in 2020 to amass Bitcoin as its primary treasury asset. However, Janover’s choice of Solana over Bitcoin sets it apart in the corporate crypto landscape. While Bitcoin remains the preferred reserve asset for companies like Marathon Digital Holdings, Coinbase, and Tesla, Janover’s leadership views Solana’s high-performance blockchain as the “backbone” of a new financial internet, citing its speed, composability, and support for real-world applications. Onorati highlighted the company’s belief in Solana’s long-term potential, stating that Solana is more volatile than Bitcoin, considered a feature rather than a flaw, in the company's model.

Janover’s Solana strategy extends beyond mere accumulation. The company has begun staking its newly acquired tokens immediately, a process that involves locking up SOL to support the Solana network’s security and operations in exchange for rewards. Staking is expected to generate revenue for Janover while reinforcing the network’s infrastructure. Additionally, the company has announced plans to operate one or more Solana validators, specialized computers that verify transactions on the blockchain. By running validators, Janover aims to earn further rewards that can be reinvested to expand its Solana holdings.

A strategic partnership with Kraken, announced alongside the latest Solana purchase, will further bolster Janover’s validator operations. Under a non-binding letter of intent, Kraken will delegate a portion of its existing and future Solana stake, which is currently over 4.5 million SOL, valued at approximately $500 million, to validators operated by Janover. This collaboration, which builds on the longstanding relationship between Janover’s leadership and Kraken, is expected to generate significant staking revenue, supporting the company’s operations and its goal of becoming the largest corporate holder of Solana in the United States.

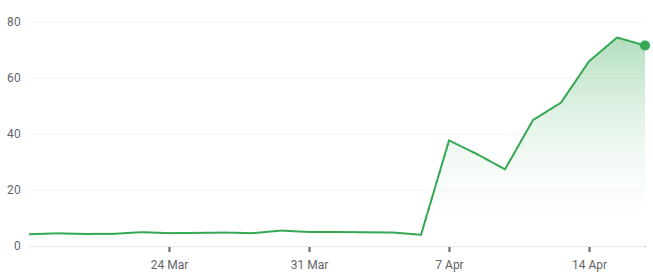

Janover stock price chart. Source: Google Finance

Janover’s crypto pivot has ignited a frenzy of investor enthusiasm, propelling its stock price to record highs. On April 15, the stock closed at $73.74, reflecting a 12% jump following the announcement of the $10.5 million Solana purchase. Since the adoption of the treasury policy on April 4, Janover’s stock has surged by over 1,700%, with shares trading at $77.00 in post-market sessions on April 15. Analysts attribute this meteoric rise to growing institutional confidence in Janover’s digital asset strategy and its potential to mirror MicroStrategy’s success with Bitcoin.

However, some cautionary notes have emerged. According to InvestingPro data, while Janover maintains a strong liquidity position with a current ratio of 5.52, technical indicators suggest the stock may be overbought, raising concerns about potential volatility. Nevertheless, the company’s commitment to the Solana ecosystem and its transparent approach to providing investors with exposure to SOL through a public equity vehicle have resonated with the market.

Janover’s investment in Solana coincides with a significant pricing season around $SOL. After reaching an all-time high of $295 in mid-January 2025, driven by retail hype around meme coins like $Trump and BONK, Solana’s price has since declined to $128 as of April 16, reflecting a 60% drop from its peak. Despite this correction, Solana remains the sixth-largest cryptocurrency by market capitalization, valued at $68.2 billion, and continues to attract institutional interest for its high-throughput blockchain capabilities.

As Janover, soon to be renamed DeFi Development Corporation, continues to execute its Solana-focused treasury strategy, it remains committed to its real estate fintech roots. The company’s AI-powered platform, which facilitates commercial property financing, will operate in parallel with its blockchain initiatives, creating a unique hybrid model that bridges traditional and decentralized finance. Further details on Janover’s Solana acquisitions and partnerships are expected in its upcoming regulatory filings, with the next earnings report scheduled for May 7, 2025. Janover’s bold bet on Solana is hoped to reshape its corporate identity as well as spark conversations about the role of digital assets in corporate treasuries.

Information Sources:

If you found the article interesting or helpful, please hit the upvote button and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO. What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application, Inleo.io, allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO

The rewards earned on this comment will go directly to the people( @dkkfrodo ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

@tipu curate

Upvoted 👌 (Mana: 25/55) Liquid rewards.