Bitcoin since it emerged in early 2009, it was always present between Satoshi Nakamoto and his closest collaborators the question of how the public could buy or sell their cryptocurrency and in this way to obtain fiat money.

It was not long before a member of the Bitcointalk forum raised this concern, which would obviously slow adoption and popularization of Bitcoin as an alternative monetary system and all security properties and confidentiality that characterize it, so early 2010 the first exchange of which registration has developed.

Today, these platforms have evolved over time, and allows the purchase, sale or exchange of digital assets by fiat or vice versa money, they also offer users a wide range of services, including various forms are for obtaining passive income, with an extensive menu designed to satisfy the most demanding and risky investors who seek to increase their funds.

What is an exchange?

An exchange is an online platform that allows the purchase, sale or exchange of cryptocurrencies by fiat money or other digital assets.

Its origins date back to late 2009 when a member of the forum Bitcointalk responding to the user name NewLibertyStandard, raised the need for a website that would allow the buying and selling bitcoins to fiat money. Subsequently, in March 2010 Bitcoinmarket creation was proposed, the first exchange platform which has record, being the starting point of the exchanges that we know today.

Operation of an exchange of cryptocurrencies is similar to the currency exchange offices, where it is possible to change, for example euros to dollars or vice versa, and are characterized by the implementation of simple interfaces to operate. Many of these platforms usually add special features when buying or selling orders are created, such as the "stop loss" which reduces losses if the price of an asset experiences a sudden loss of value.

Commissions on exchanges depend on the type of services they offer to their users, and their most frequent sources of income come from:

Commissions on trading volume, usually calculated on the volume to 30 days.

Commissions for withdrawals and deposits of funds, becoming less frequent.

Services, such as premium rates, services leverage, among others.

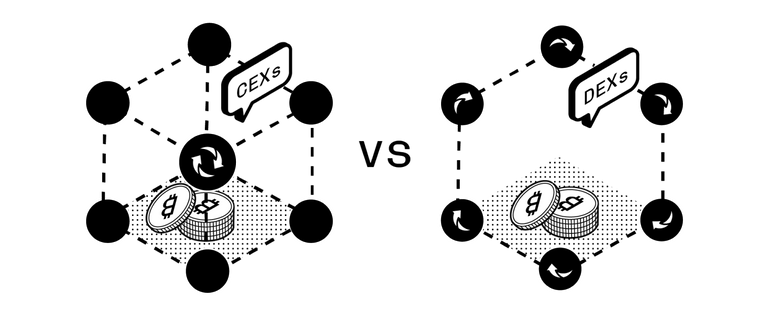

Exchanges can be classified into two broad categories, each with characteristics, abilities and different goals, but the opposite of what one might think, they all share something in common, and that are platforms developed to facilitate the participation of its members in Crypto markets, for which many have tools for technical analysis, and even made available for fundamental analysis services.

Centralized Exchange (CEX)

Operation of centralized exchange is based on the involvement of trusted third parties who mediate operations platform users. To enter them, you must register and pass the drivers "know your customer (KYC)" and sometimes "Anti Money Laundering (AML)" In addition, these platforms often share information with tax authorities or tax from different countries.

The amounts of fees for transactions within the platform are set by their managers, who also tend to set a minimum purchase or exchange of cryptocurrencies, or for withdrawal.

Among the most recognized centralized exchanges, are Coinbase, Binance, Bittrex, Poloniex or Kraken, among others.

Decentralized Exchange (DEX)

This type of platforms usually develop over a blockchain using smart contracts, most of them being deployed on ethereum.

As there is no reliable third mediate operations performed by users, exchanges are directly peer (P2P), therefore, charges are usually very low or virtually zero.

Another advantage found with respect to centralized exchanges, is his privacy because it is only necessary to register without passing KYC and AML processes, so it is not required to share personal information.

Among the best known decentralized exchange, are EtherDelta, Waves, uniswap, SushiSwap and Bitsquare.

It is also frequent exchanges categorize according to their characteristics in different generations:

First generation are the first exchanges that entered the market and are characterized because they are centralized platforms, with privacy issues, security and confidence described above.

Second generation: here the first exchange decentralized "basic" type, developed based on the smart contracts unfolding over a given blockchain are encompassed being preferred as indicated above, the network ethereum. Its main drawback is that we send our assets, losing possession of the same.

Third generation: the DEX platforms of this type do not require sending any platform cryptocurrencies simply allow you to open orders from our wallet. Contract work through a smart center that allows us to maintain our funds in our possession.

Posted Using LeoFinance Beta

Interesting breakdown of the use of exchanges and their importance to the world of crypto. I still think exchanges still have a lot of building to do especially DEX’s

Posted Using LeoFinance Beta