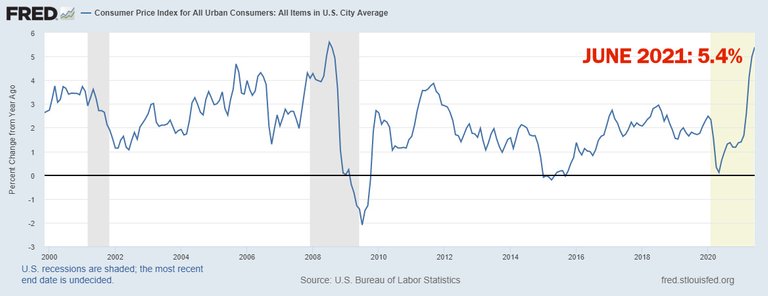

Die offizielle Verbraucher-Preis-Inflation ist im Juni 2021 in den USA auf 5,4% gestiegen.

Die Massenmedien sind zutiefst überrascht, die Krypto-Community ist es nicht.

Schaut euch mal diese Überschrift einer österreichischen Tageszeitung an 😂

US-Notenbank Fed mit nie da gewesenem Inflationsphänomen konfrontiert

Der Standard, 2021-07-15

Die reale Inflation dürfte sogar noch höher ausfallen, da die offizielle Inflationsrate einen gewichteten Warenkorb verwendet, der die steigenden Asset- und Immobilienpreise nicht ausreichend berücksichtigt.

Tatsächlich ist die Geldmenge in den USA alleine seit Corona um 30% gestiegen und anders als in der EU gab es sogar zahlreiche Airdrops (Stimulus Checks), die Teile der Corona-Subventionen unbürokratisch an alle verteilt haben. Eigentlich ist es eher ein Wunder, dass die Preise nicht noch stärker gestiegen sind. Oder werden sie das noch?

Der weitere Verlauf der Inflation wird davon abhängen, wie es mit Corona, der Wirtschaft, den Zinsen und vor allem mit den Corona-Subventionen weitergeht.

Das gilt auch für Österreich. Sollten die Subventionen wie Kurzarbeit, Fixkostenzuschüsse, Umsatzausfälle etc. noch lange weiterlaufen, wird das eine gewaltige Auswirkung auf die Preise haben.

Was denkt ihr? Wie geht es mit der Inflation weiter?

Source: FRED, Consumer Price Index for All Urban Consumers: All Items in U.S. City Average

English

Official consumer price inflation rose to 5.4% in the U.S. in June 2021.

The mainstream media is deeply surprised, the crypto community is not.

Check out this headline from an Austrian newspaper 😂

US Fed confronted with unprecedented inflation phenomenon. (Translated from German)

Der Standard, 2021-07-15

The real price inflation is likely to be even higher, as the official inflation rate uses a weighted basket of goods that does not sufficiently account for rising asset and housing prices.

In fact, the money supply in the U.S. has increased by 30% since Corona alone, and unlike in the EU, there have been numerous airdrops (stimulus checks) that have distributed parts of the Corona subsidies to everyone without a lot of bureaucracy. Actually, it is rather a miracle that prices have not risen even more. Or will they?

The further course of inflation will depend on what happens with Corona, the economy, interest rates and, above all, how long will the state print Corona subsidies.

This also applies to EU and Austria. If the subsidies such as subsidies for staying at home, fixed cost subsidies, loss of sales subsidy, etc. continue for a long time, this will also have a tremendous impact on inflation.

What do you think? How will inflation continue?

Sources

[1] FRED: Consumer Price Index for All Urban Consumers: All Items in U.S. City Average https://fred.stlouisfed.org/series/CPIAUCNS#0

[2] FRED: M3 for the United States https://fred.stlouisfed.org/series/MABMM301USM189S

[3] Euro-Geldmenge M3 https://staatsschulden.at/euro-geldmenge-m3

[4] Inflation in Österreich https://staatsschulden.at/inflation

[5] US-Notenbank Fed mit nie da gewesenem Inflationsphänomen konfrontiert https://www.derstandard.at/story/2000128219625/us-notenbank-fed-mit-nie-da-gewesenem-inflationsphaenomen-konfrontiert

[6] Prices Pop Again, and Fed and White House Seek to Ease Inflation Fears https://www.nytimes.com/2021/07/13/business/economy/consumer-price-index-june-2021.html

Live your Secrets and Hive Prosper 🍯

xx Viki @vikisecrets

Fiat is just dead, crypto is the new money

Usually, the consequences of money printing doesn't "react" immediately... Until a certain level, it will go slowly up, and then... who knows...

I hope that we wil lnot witnesses hyperinflation globally, as people would suffer a lot..

Good point, currently I see a risk for higher inflation rates but not hyperinflation yet. I think hyperinflation will depend on how long and fast money printing will continue. A 30% increase in M3 is a lot but it's not near the region for hyperinflation in my opinion and it also depends where the newly printed money is going. Does it mainly stay inside the financial industry or does it hit assets, real estate/housing, commodities and eventually the consumer market.

Ein Hoch auf das schnelle Geld (Fiat) was man ja gedruckt wird bis die Druckerschwärze ausgeht.

LG Michael

!invest_vote

!jeenger

It starts with small steps and with academia and student debts (at least of the less prestigous universities or useless so to say) we already can see some cuts or in cryptospeak "burns" 😂😂😂

https://www-forbes-com.cdn.ampproject.org/c/s/www.forbes.com/sites/wesleywhistle/2021/07/09/biden-education-department-approves-student-loan-cancellation-for-more-than-1800-defrauded-borrowers/amp/

Where exactly was the intrinsic value of fiat?

Posted using Dapplr

Wow that's high. Not surprising though. I think the effects will continue for some time. Inflation typically tends to be higher than what is reported by economists, for the reasons you mentioned and also because of hidden inflation - which is when companies begin to reduce the quantity of their products being sold (same price for less product) or the quality of material that the products are made with, which makes people buy more sooner than they otherwise would.

@mima2606 denkt du hast ein Vote durch @investinthefutur verdient!

@mima2606 thinks you have earned a vote of @investinthefutur !

Your contribution was curated manually by @mima2606

Keep up the good work!

Do you have a Gmail Account, Bank Account, Cryptocurrency wallet such as Bitcoin, Ethereum, Dogecoin, Litecoin, Binance and Forex Trading Account. Note you are illegible to earn income worth 2,050$ in 24 hour's daily.

👉📜 No Registration Fees 0$

👉📜 Refferal Mostly Required

Ask Me "How To Proceed"

Click on the link👇👉✍️📥

https://wa.me/message/ZUKERXIBTXXLH1