Like I said in, in my previous post https://ecency.com/hive-167922/@wamiru/from-paycheck-to-paycheck-to, saving on a low income, even when viewed as a hard task, can be as simple as 1, 2, 3. By starting off with tracking your expenses, to cutting off some extra costs to boost your savings, to budgeting and making sure you at least save that 500 KES. Well, as promised am back with some tea. So gather around as I spill it.

WHERE TO SAVE ON A LOW INCOME IN KENYA?: MMFs ARE YOUR BEST BET.

We often opt to save on M-Pesa wallet - I am no exception. But we can agree that saving there is more like charity work for Safaricom. Whenever we have money in there, all it does is scream “use meeee” and then we end up back to square one. Am not saying M-Pesa is bad, it’s actually our best money wallet, but is it really smart saving there? I’ll leave that question in your court.

My focus today is a smarter way to save;* Money Market Funds (MMFs)* - a place where your money chills and grows instead of disappearing into impulse buying and Fuliza debts.

What’s an MMF anyway?

You know the phrase let money work for you? Well, an MMF is a platform that gives you that opportunity when you invest with them. Unlike Mshwari and M-Pesa, where your money can sit for months or even years without earning any significant amount, in MMFs it grows daily with their daily interest. This means if you put your 500 KES in MMF today, it’ll earn you more than what M-pesa or Mshwari would ever do.

Why MMFs?

“I am broke,” “I can’t afford 500 KES a month.” Well here’s why MMFs are your best deal even when you’re on a low income or broke:

1. You can start absolutely small – some MMFs let you start with as little as 100 KES. Yes I said that right. Instead of saying “100 KES can’t buy me Ferrari”, which is true, and spending it on bundles or snacks, MMFs are open to let that 100 KES work for you.

2. Your money grows – yes even that little 100 shillings will earn you interest on MMF that can’t be earned on Mswhari. Even way better than the banks can pay you.

3. Easy withdrawals – you can use them as emergency funds where, when needed, withdrawals are easy and smooth. They don’t lock your money and it’s accessible in 2-3 working days. And the good part, the money you leave in there will still hustle some other monies for you.

4. It’s safer than the cash stashing, or the piggy banks – MMFs are regulated by the Capital Markets Authority (CMA) so do not fret that it is a scam.

Where to put your money?

Well I did some heavy lifting for you. In my quest for how to save money even when earning low income, I came across some solid MMFs in Kenya that work well for young hustlers like us:

1. Etica Capital Money Market Fund

✓Start with: as low as 100 KES.

✓Interest: ~12-14% p.a. (one of the best in the game)

✓Best for beginners and aggressive savers who want their money to grow faster. Easy to use and accepts M-Pesa.

2. Zimele Money Market Fund

✓Start with: as low as 100 KES.

✓Interest ~9-10% p.a.

✓Best for beginners - easy to use and accepts M-Pesa.

3. Britam Money Market Fund

✓Start with: 1,000 KES.

✓Interest: ~ 9-10% p.a.

✓Great for flexibility – fast withdrawals and reliable.

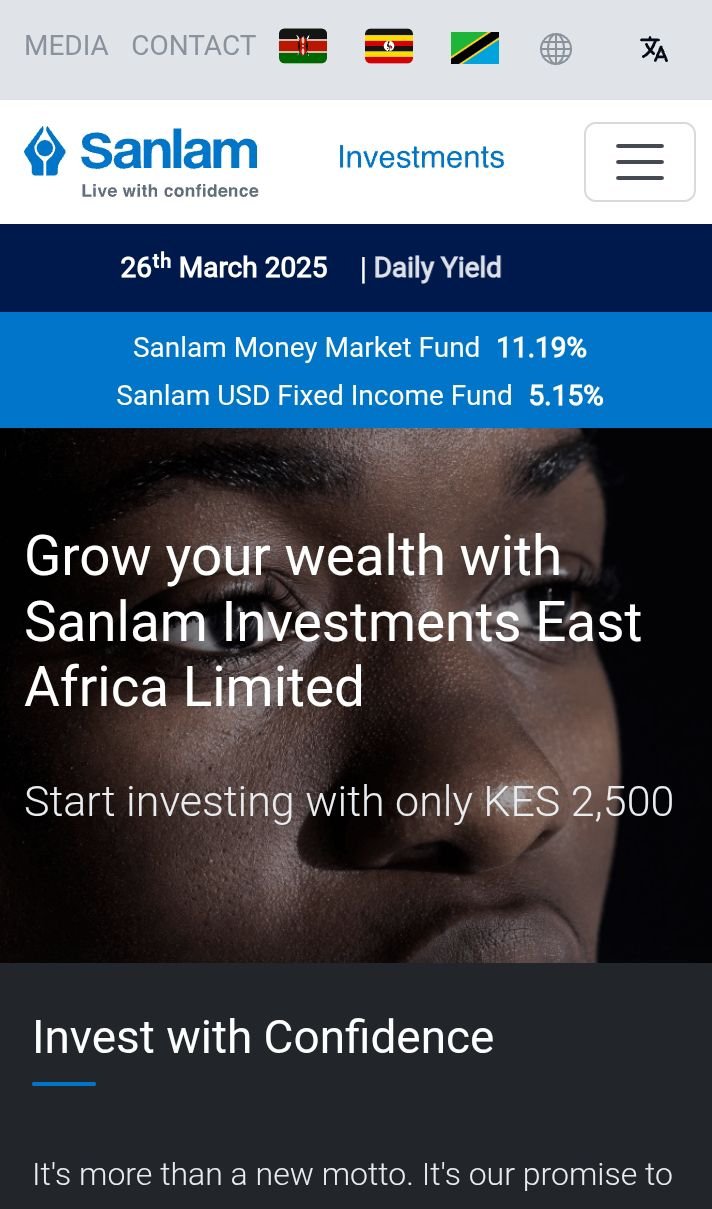

4. Sanlam Money Market Fund

✓Start with: 2,500 KES.

✓Interest: ~11.9% p.a.

✓Good for goal based savings – like rent or school fees.

5. CIC Money Market Fund

✓Start with: 5,000 KES.

✓Interest: ~11% p.a.

✓Good for serious savers – who want their money to work harder.

(P.S. these interest rates change, please check before investing)

How to open an MMF?

Maybe you’re thinking that opening an MMF is complicated. That you’d rather let your money sit in the bank or transfer it to Mshwari or put that cash in a piggy bank. Naah! It’s waay easier;

✓Pick an MMF (that feels right to you)

✓Go to their website and fill in a short form.

✓Upload a few docs ( ID, KRA PIN, proof of residence- simple stuff)

✓Deposit money via M-Pesa or bank transfer.

✓Start earning daily interest while you chill.

Easy, right?

How to get the most of an MMF?

Now that you are set, we can look at ways of making that money grow. Money attracts money, right?

✓Water your investment (Set a weekly/ monthly deposit goal)** - even that 100 KES a week adds up. If you manage to cut expenses by 100 KES give your savings a boost.

✓Re-invest your interest – instead of withdrawing your money let it compound. More money in the account=more interest earnings.

✓Set goals – rent, fees, emergency funds- things that matter.

Get away point: your shilling, your future.

Being broke is hard and stressful but, staying broke? - That is a choice. If you can afford to blow away 500 KES in a club on the night of your payday, in the name of appreciating your efforts of the month, you can afford to save in an MMF.

The goal is not to save because it is the “right thing to do” – it’s more because you want options.

Imagine waking up one day and not stress about money. Imagine affording things without borrowing from friends or Fuliza or asking for advances.

It’s more about building wealth rather than just surviving; paving way for your future generations.

Your future self is waiting - don't keep them broke. Pick an MMF and start with as low as 100 KES. What's stopping you?

Disclaimer: I am not a financial advisor and all I share with you is based solely on my experience in the financial struggle world. Before investing, kindly do your research and invest according to your goals.

Photos are screenshots from their respective websites.

Screenshots by me. Except the coffee. I took that with my phone.

Congratulations @wamiru! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 200 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: