SOURCE

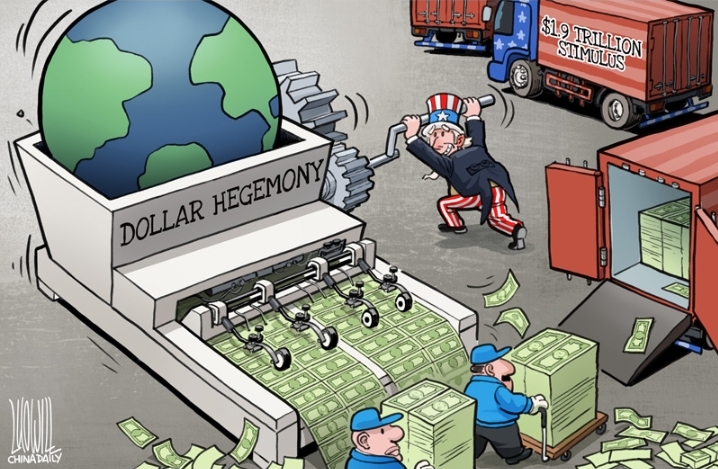

It was Bob Dylon who famously said "the times they are a changing".... I dont think he quite had in mind what may or may not unfold in the currency markets, over the next year or so, but the winds of change are sweeping through the global financial landscape. As the BRICS alliance emerges with a daring plan to introduce a new world currency, the USD begins to feel the pressure of someone, or more to the point, something that can stand up against its global hegemony. At the heart of the BRICS objective, lies a bold mission to dethrone the long-standing dominance of the U.S. dollar and establish their new currency as the world's reserve. If you had asked me would a global reserve currency challe ger come from any of theses nations, as little as 10 yeara ago, then you would have gotten a resounding NO!! But now, im not so sure... With unwavering determination, BRICS is making headway in its pursuit by persuading developing nations to break free from the clutches of the greenback and trade in a potential new globally recognised currency.

Across Asia, Africa, and Latin America, a growing discontentment has taken root against the U.S. amd its stranglehold on the global financial sector. The dissatisfaction has led a substantial number of countries, around 19 in total, to express their keen interest in joining the BRICS bloc and parting ways with the USD. The momentum behind this movement is set to peak during the upcoming BRICS summit this August, where the call for trading in a new currency is gaining fervor.

SOURCE

Enter China, with its 1.45 BILLION population and there drive to be the one true global superpower. They are a key player in this evolving financial landscape, as it spearheads efforts to encourage cross-border transactions settled in the Chinese Yuan. This strategic move not only bolsters other local currencies but also sets the stage for a gradual erosion of the U.S. dollar's supremacy in supply and demand dynamics.

Why arw nations worldwide drawn to BRICS and the opportunity to get frommunder the control of the US? Why are so many up and coming nations on a mission to bid farewell to the U.S. dollar in the realm of global trade and find a new path to walk down?.

SOURCE

While the U.S. dollar has long reigned as the de facto world's reserve currency, the overwhelming dominance exercised by the White House and leading American banks leaves little room for other countries to prosper. Its a case of do as we say, not as we do, or face the rath of the US might. The desire of these nations to free themselves from the clutches of the U.S. dollar stems from the aspiration to empower their own native currencies amd offer a way of exchanging away from the pryieye of the USA and any sanctions possibly.placed upon them. Developing countries yearn to determine their own financial destiny, free from the influence of the U.S. dollar and other American financial entities.

SOURCE

Amidst the backdrop of the U.S. dollar flexing its strength against other currencies, including the Pound, Euro, and Yen, native currencies find themselves perpetually subdued under the USDs global weight and punching power. Breaking away from this pattern could breathe new life into many smaller and local currencies, empowering them to play a significant role in cross-border settlements. For developing nations, the burgeoning strength of the U.S. dollar serves as a cause for concern and further reinforces their drive to explore alternatives.

The imposition of U.S. sanctions on developing economies has become a catalyst for considering alternatives to the U.S. dollar for trade. Acknowledging the adverse impact of such sanctions, U.S. Treasury Secretary Janet Yellen herself concedes that they inadvertently hurt the dollar's standing. She acknowledges that a onesize fots all approach may have suited a global economic system 40yrs ago, but as the USD has spread its influence globally, its beginning to recieve a biggger and bigger push back. BRICS has seized this opportune moment to rally other nations to embrace local currencies for their trade activities. China is leading the charge by encouraging nations to pay in Chinese Yuan, while India advocates using the Rupee for transactions. Russia is all to pleased to be able to trade outside of the USD and circumvent the sanctions placed on them, for their current "special military operation" in Ukraine.

SOURCE

So are the tides turning, or is this just a flash in the pan? In the realm of global finance, as the BRICS alliance champions a transformative vision to reshape the world's financial order, and as more amd more nations express interest in parting ways with the U.S. dollar, the stage is set for an exciting new chapter in the history of international trade and currency dynamics. The journey towards a new financial era has just begun, and the outcome promises to redefine the way nations interact economically on a global scale. This is no small change mind you, the potential loss of reserve currency status could mean a staggering influx of deficits back to the U.S., possibly leading to hyperinflation and a shift in the dynamics of global trade. Which is why the United States will do everytjing in its power, especially military power, to prevent any new global currency from becoming a threat.

If you dont own any precious metals, then why not tell us? As a community we encourage ALL engagements and encourage everyone to take the plunge and own at lease a sinlge ounce of silver or a fraction of gold. If your struggleing to find a safe and secure place to buy, reach out to the community as there is always someone willing to offer their time and advice to help you out.

40+yr old, trying to shift a few pounds and sharing his efforsts on the blockchain. Come find me on STRAVA or actifit, and we can keep each other motivated .

Proud member of #teamuk. Teamuk is a tag for all UK residents, ex-pats or anyone currently staying here to use and get a daily upvote from the community. While the community actively encourages users of the platform to post and use the tag, remember that it is for UK members only.

Come join the community over on the discord channel- HERE

Want to find out more about gold and silver? Get the latest news, guides and information by following the best community on the blockchain - #silvergoldstackers. We're a group of like minded precious metal stackers that love to chat, share ideas and spread the word about the benefits of "stacking". Please feel free to leave a comment below or join us in the community page, or on discord.

'The more the Empire tightens it's grip, the more counties will slip through it's fingers.' ~ Princess Leia paraphrased

So wise. Princess Leia was ahead of her time.

Why do you think that.

I unfortunately agree with @welshstacker the US has had 2 tools of control, the dollar and military and with the dollar falling off there is only one thing left to keep America on top, so before letting it get to that where now they only got 1 tool of control they might as well use the military to try to keep the dollar alive because if they don't eventually they will want to have their say and military action will be the only resort.

Are you saying that the US is going to war?

I think it's very likely on the horizon, also I want to make an important distinction it's not the American people but the industrial military complex and other big money calling the shots, a few years ago Princeton university did a study and determine that the US is no longer a democracy it's an oligarchy ... Not surprising when lobbying is legal

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Good write-up mate. I personally think it is inevitable that there is a return to commodity-backed sound money at some point and it makes sense for the BRICS to lead the change in the current geopolitical climate. Every fiat currency has inevitably failed - it's only a question of WHEN and not IF the US Dollar does too.