There was a rude awakening for crypto investors on Friday morning.

After Bitcoin and other currencies had already started to weaken on Thursday evening, there was a real downturn in the hours that followed.

Bitcoin price fell 12 percent from just under $43,500 in the afternoon to around $38,200.

As expected, altcoins such as Ethereum, Solana and Cardano fell even more.

Technology stocks also weak

The crypto market, which has been under pressure for the past few weeks, is increasingly feeling the nervousness of the stock exchanges.

The tighter monetary policy in the USA, which is planning three to four interest rate hikes in 2022, and less edifying economic data have caused the market-wide S&P 500 stock index to slip to its lowest level since October after a mini-recovery.

Technology stocks are particularly affected by the downward trend.

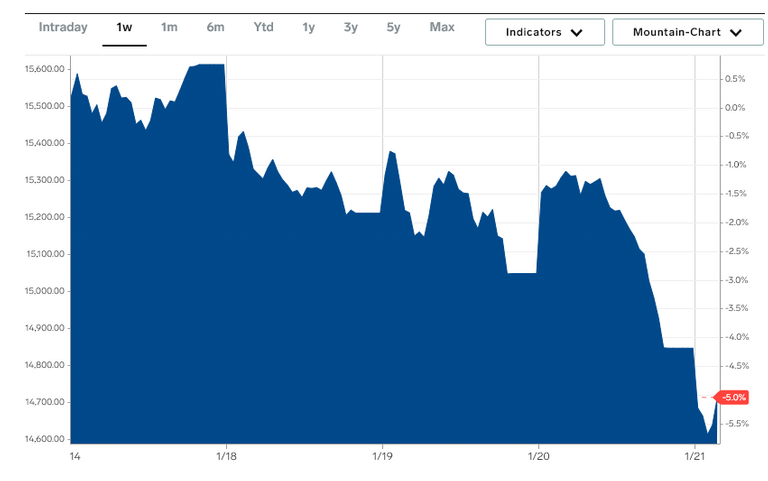

The Nasdaq 100 index, which tracks the 100 most important technology companies, fell by more than seven percent in the past five days. Individual titles such as Netflix, which disappointed with its outlook in terms of customer growth and sales, even lost 20 percent in after-hours trading.

The Asian and European stock markets are also pointing down on Friday morning.

NASDAQ 100 - Source

BTC - Source

The curves are pretty similar... aren't they?

Bitcoin cannot emancipate itself

The current fall in the price of Bitcoin and other Coins shows once again that the decoupling of the crypto market from the classic stock market and thus from the established financial system remains wishful thinking.

In particular, the correlation to technology stocks shows that Bitcoin and other cryptocurrencies are seen more as a risky investment in this category.

If the classic tech stock market weakens, Bitcoin also goes down accordingly.

The entry of professional investors and financial institutions into the crypto market is once again proving to be a double-edged sword. The fresh capital that has flowed into the market has ensured huge profits for Bitcoin and altcoins after the stock market crash in March 2020 (rise of the Covid19 pandemic).

If investors get nervous on the stock exchange, they quickly withdraw investments from the crypto market.

Lets await if both worlds rise together after the went down together - I am actually pretty optimistic in that regard.

today was the bad Friday of all of my life.