Oh Boy! This is so much down my alley, that it is making my eyes water! So tell me how much details you want me to put in here?

Ok, then with that, I will edit this comment and beef it up. There are many ways to answer it. A real honest answer will be 'yourself', and your health. But it is hard to put $100K into your health, so I won't try that cheeky route.

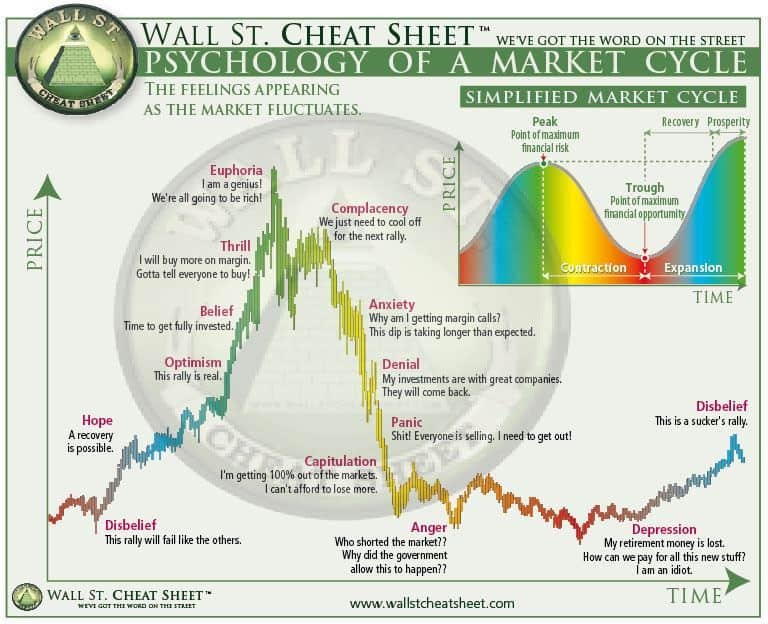

Before I start, let me put a popular market cycle chart:

There are many out there, but I like this one because of the comments are hilarious and I like the colors too. First, this chart is applicable to all markets, and at all time-scales. So it is a true fractal. Second, it is important to note the inset chart to see the color scale on where the point of max opportunity lies. From my experience, it is very difficult to buy in the red, and sell in the green. Only lucky people can do that. Personally I don't put my investment to luck, so throughout my life, I tend to focus blues to buy in stages, and sell throughout green and yellow in stages. Also look to short sell in the yellows for kick :)

That's a long intro: getting to the point...Deflation is not a fear. Inflation probably is. Central bankers know and studied Japan's deflationary history in detail, and they won't allow it. USD is still the king, and will be throughout my working life (15 years, I am hoping, 10 if I am lucky!!) Not because it is good, but because there is no other game in town. No, BTC is not a currency; it's a reserve.

One asset class, eh? Difficult... You want to hear crypto. I can tell from my personal portfolio, it is not heavy on crypto. It is heavy on physical real estate. Try buying a house Ash. Add money into the down payment. That is still the best option for someone who doesn't own a house. For someone who does, putting $100K in S&P500 Index (or any broad index) is still the simplest option. As it will outperform BTC with a lower risk profile. With a higher risk profile, crypto is possible, but timing becomes paramount. BTC at $3000 was a great deal. So was Hive at 10 cents :)

Don't know about BTC, but hoping I can see 10 cent hive again as Koreans unload.

I don't know if I answered anything at all, but hey, I tried :)

Well, I'm glad you asked as in the original post (before I dragged an image in and it cleared the lot), I was clearer in stating you are allowed one asset class, and preferably one asset.

Saved you some time hopefully!

Edit due to your epic edit!

Thanks for the effort here, some interesting stuff that will hopefully guide more than just myself.

I have seen that chart around, but perhaps not quite so verbose. It's everyone's goal to buy low and sell high, but even with this chart as a guide, many (including me) seem to be missing the sweet spots.

Naughty, but all part of the game!

This is an interesting statement, I would like to see you write about this topic in a post.

I think you've covered everything, all i need is that magical 100k and I will get some over-priced property and be happy I have my own roof :)

People can tell you the story about the journey to the top of the mountain and describe the view from the top vividly... but that’s incomplete. Nothing can beat your own experience about the journey.

I have a lot to learn, the 5 hindrances..... I recognize those.

Thanks for sharing this :)