Dear Hivers,

Over the last 3 days, I have been spying like an amateur detective trying to solve a case. It is an adventure I invite you to join.

Here’s the situation:

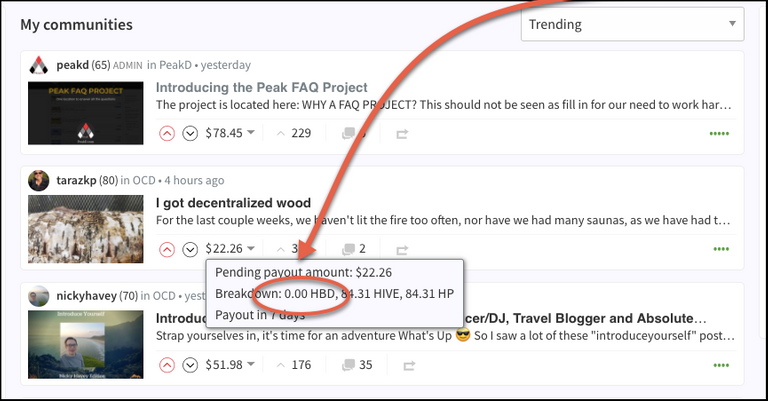

If you visit your profile — or anyone you know — and look at the recent payouts (within 7 days):

You can see 0 HBD.

No one is receiving these HBDs (Hive Dollars). The rewards, in fact, are currently split into Hive and Hive Power (HP).

It doesn't matter if you choose a 50/50 payout. You still won't be earning Hive Dollars. For now.

Interesting, isn't it?

I have read dozens of articles — digging into our dark past — our old platform — and nudging a couple of people to get closer to the truth.

I think I have found the answer.

In fact, to understand this, we have to take a step back and explore the basic concepts.

Why?

I mean:

Imagine one of us walking into a room with 1000s of people looking at us? They are all cheering for... us to talk about Hive.

As we are on a blockchain platform, knowing how a portion of it works — and why it works — will be tremendously useful.

With that said:

First, we have to explore the relationship between Hive and HBD.

Even today, Hive points to the Steem whitepaper:

This means:

The Hive/HBD model draws inspiration from Steem/SBD.

Based on this, here are two things you should know:

A rapid change in the value of Hive can dramatically change the debt-to-ownership ratio.

Second:

If a token is viewed as ownership in the whole supply of tokens, then a token-convertible-dollar can be viewed as debt.

To put it simply:

- HBD is considered as debt.

- Hive is considered as a token.

In other words:

1 HBD is a token convertible for 1 USD worth of Hive.

Let’s take an example:

Imagine:

- 100 HBD

- 100 Hive

- 1 Hive price = $10

So what can we buy from 1 USD?

Answer: 0.1 Hive.

(Simple calculation, right?)

This means:

Our 100 HBD converts into 10 Hive.

(Very important)

And finally, this means:

Our debt-to-ownership ratio is 10/100 = 10%.

Still with me?

Great.

Now here's something else to remember:

The amount of Hive Dollars produced is reduced when the debt ratio increases.

This debt ratio is the reason, you see?

Maybe if you saw some people talking about Hive and HBD's secret relationship... this is what they wanted to say.

The bottomline: The debt-to-ownership ratio matters.

It is what decides everything.

Currently, no new Hive Dollars are printed because of this debt-to-ownership ratio.

The question is:

What is the current ratio?

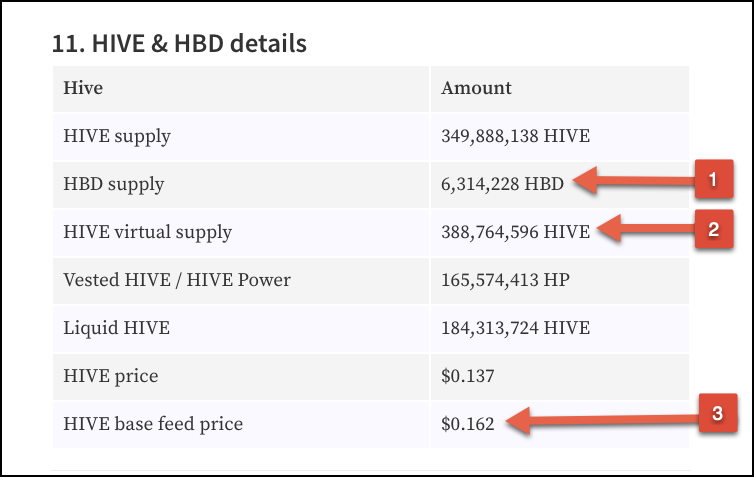

Let's take the current stats shared by @Penguinpablo.

We pay attention to 3 key numbers:

- Total virtual supply of Hive: 388,764,596

- Total HBD supply: 6,314,228

- HIVE base feed price: $0.162

So the marketcap of Hive supply:

- 388,764,596*(feed price)

- 388,764,596*0.162 = $62,979,864.6

HBD as percentage of Hive marketcap:

- 6,314,228*100/(Hive marketcap)

- 6,314,228*100/(62,979,864.6) = 10.0257885

The debt-to-ownership ratio is 10.02%.

Really, with this math, all you have to know is the last line:

The ratio is slightly above 10%.

And anytime the ratio is above 10%?

The HBD rewards are replaced by Hive. And no new HBD will be printed.

So as long as the percentage doesn’t drop below 10%, we will never have new HBDs generated.

And... that's it.

Case closed.

Cheers,

Sid

Liked this article? Feel free to comment and upvote and rehive.

Thanks @Deathwing @eonwarped @xyzashu.

Small correction, when the debt ratio is below 9% all the liquid rewards are paid as HBD. If the debt ratio is 10% or higher all the liquid rewards are paid as Hive. If it is between 9% and 10% then some of the liquid rewards are paid as HBD and some as Hive.

This change in the code was introduced in the hardfork that took place in the fall of 2018 on Steem and it was inherited by Hive. To my knowledge these rules were not changed with Hf 23 (which created Hive).

Hi, this is perfect. Can't thank you enough! :)

Made the correction.

So why does the blockchain try to keep a ratio of 9%-10%?

HBD is basically a smart contract where the blockchain pays the equivalent of one US dollar in hive if the HBD holders decide to redeem them by doing a conversion operation.

In others words it's a "promise" that you will be able to have the purshasing power of one USD. If the price of hive drops significantly then the amount in circulation can increase dramatically (via conversions since each HBD is worth more hive) which can lead to a situation where the price of hive goes even lower creating a vicious cycle.

The 10% limit is set so that this event doesn't happen. If the debt ratio exceeds 10% then the blockchain protects itself by progressively paying less then one USD's worth in hive via conversions.

When the debt ratio gets to 9% the blockchain will produce less and less HBDs to slow down this process.

Well written. I remember, There were a lot of posts on steem explaining this matter back in 2018.

Btw, it is high time HIVE should stop pointing to STEEM white paper. I'm of the opinion that UIs of HIVE blockchain apps should stop resembling that on STEEM. Still, a long way to go to create our own identity.

Yepp, I think it is just a matter of months before hive develops its different identity, which would be a lot better than steemit.

I disagree about the Whitepaper point. Unless we have new equations and drastically different way of functioning as a blockchain we can't have a new whitepaper for the sake of having it. I agree that the UI and links etc should be updated. But white paper link should be to the STEEM which was the product of mainly Dan Larimer's thought. You cannot substitute original idea. An alternative is to write a new white paper with updated equations and cite STEEM white paper in it properly.

Thanks for explaining, now I know tokens, debt, relation of hbd and hive.

Quite Informative Post!

Hehe! You are welcome!

Always learning huh! :P

This was a great post and explanation! Thanks, it’s always challenging trying to explain it to people who aren’t familiar with the platform. This will be great to reference to.

Thank you!

I was really thinking to write more of these.. if there's enough interest.

As there's a room for simplifying technical content. :)

Let's see.

Appreciate your comment!

Yeah there’s definitely room for the content. I think @steempeak is working on an FAQ page/community for new users. I think this would be important information to keep on there! There’s a big learning curve as we all know, so anything we can do to improve that, the better retention we will get.

You nailed it.

Eager to see us grow in the second and third month! :)

Thank you

this is something that is not

discussed enough and should be

essential for users to understand.

I didn't get this bit.

Even this. A few lines above you mentioned HBD is debt, right? Here then shouldn't it be 100/10?

Just join in the society and want to close the question-answer loop. According to the above post, 1HBD is always equal to US$1. @sidwrites example, when 1 Hive = $10, 1HBD can only get 0.1 Hive. Therefore the debt-to-ownership ratio is 10%.