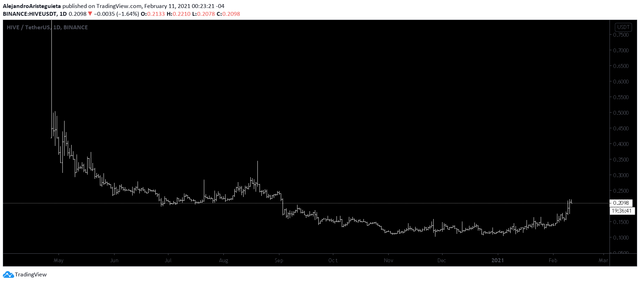

Since its release, HIVE has remained in a declining structure.

The price is currently breaking out of a range that shows clear signs of accumulation.

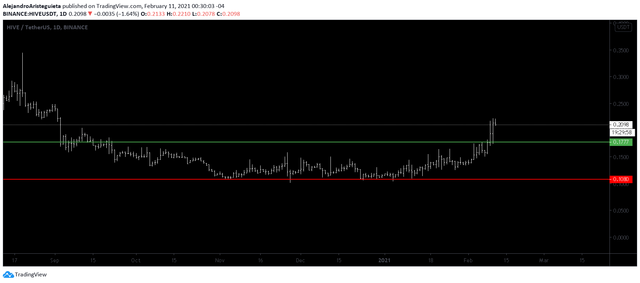

The range has been formed since September 21, 2020, revealing a demand that has remained solid at the 0.10 level (red) that has formed a growing structure since January 6, 2021. That has consolidated the price above the 0.17 level (green) on February 9, 2021.

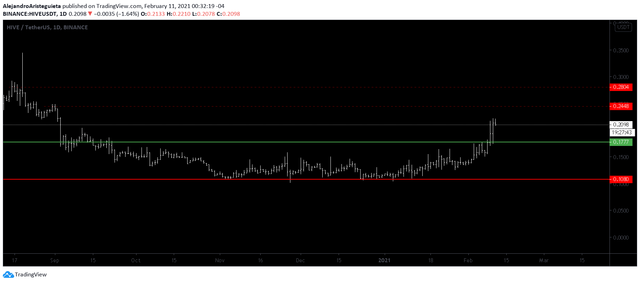

If the professional demand continues to push the price, it could have an expectation up to the 0.24 level as R1 and the 0.28 level R2.

However there is still a professional supply between the 0.17 and 0.24 levels so it is important to see clear intentions so as not to get caught up in the new range of motion.

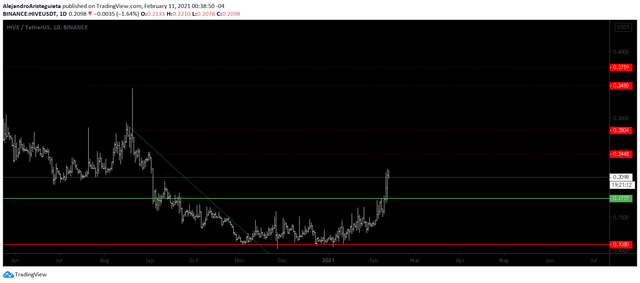

HIVE has room to grow, the breakdown of the bearish structure formed since August 16, 2020 ended on November 9 of the same year, which means that demand will want to test supply at each of the levels indicated in the image (above)

Trading Capital - First Trading Community in HIVE

click here HIVE

Follow my personal account for more updates: @ale.aristeguieta

Alejandro Aristeguieta

CEO in Aristeguieta Capital.

Investment Firm and Financial Analysis.