Source

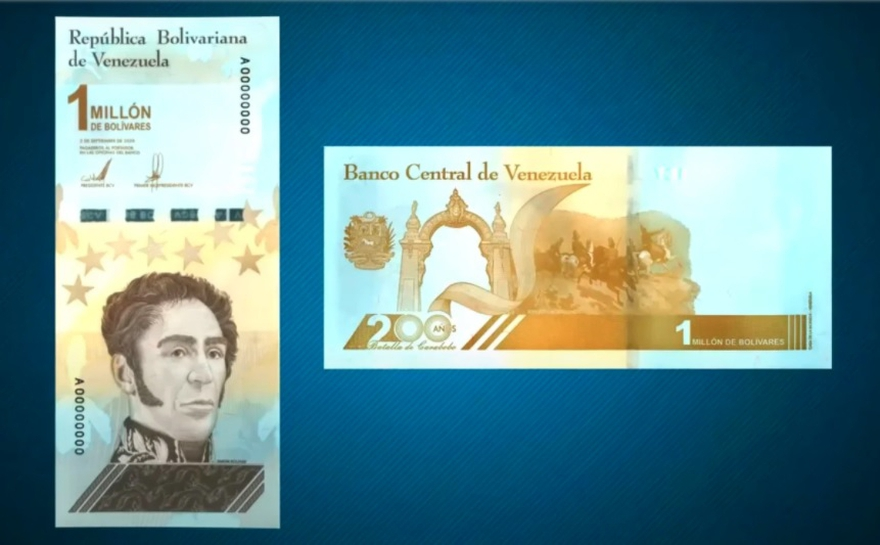

The Central Bank of Venezuela recently announced that as from Monday, March 8, three new banknotes began to circulate, expanding the existing monetary cone, these have a value of 200, 500 and 1 million bolivars, becoming the highest denomination banknotes that have circulated in the history of the country.

In a sort of contradiction with what President Maduro said a few weeks ago about the creation of the digital Bolivar and following some economists who saw this action as a possible solution to the shortage of circulating money, there is an unexpected turn of events in this field.

However, the denominations do not seem to be enough since they represent a very small value in relation to the dollar, since the 1 million bill represents only 0.52 cents at the official exchange rate, while the value of daily consumer products exceeds the value of the U.S. currency.

In June 2019, when the expansion of the monetary cone that began circulating since August 2018 after the reconversion took place, the 10, 20 and 50 thousand bolivar bills had a dollar equivalent at that time of 1.62, 3.25 and 8.14 respectively, however they ended up in a short time of being sufficient.

With hyperinflation and the new bills, by the logical action of not having intermediate currencies, prices will rise, since there will be no way to give change, even more so when prices are stipulated in dollars and merchants will not take the 1 million dollar bill to return half a dollar to the buyer.

For those who defended this solution, it has not been executed correctly since, according to them, the ideal would have been to equate the cone with the dollar and thus press for the price of the same to be maintained with few fluctuations, in other words, to dollarize the monetary cone so that the bolivars, having the same value as the U.S. currency, would replace the U.S. currency.

However, for obvious reasons of confidence, the above sounds utopian because the value of the currency is not based on the numbers on the bill but on the stability of the country in the economic field, something that continues to deteriorate and there is no pause in sight.

The one million dollar bill is enough for very few things, taking into account that its value is 0.52 cents of a dollar and a corn flour is 1 dollar, or a kilo of cheese is 3 dollars and a kilo of meat is 4 dollars, but the worst of all is that the salary of the majority of employees does not reach 1 dollar.

Versión en Español

Fuente

![image.png]

El Banco Central de Venezuela hizo el anuncio reciente que a partir del lunes 8 de marzo comenzaron a circular tres nuevos billetes, ampliando el cono monetario existente, estos tienen un valor de 200, 500 y 1 millón de bolívares, transformándose en los de más alta denominación que ha circulado en la historia del país.

En una suerte de contradicción con lo expresado por el presidente Maduro hace unas semanas atrás acerca de la creación del Bolívar digital y haciendo caso a algunos economistas que veían esta acción como posible solución a la escasez de dinero circulante, se da un giro imprevisto en este campo.

Sin embargo las denominaciones parecen no ser suficientes ya que las mismas representan un valor muy pequeño en relación con el dólar ya que el billete de 1 millón representa apenas 0,52 centavos de dólar al cambio oficial, mientras que el valor de los productos de consumo diario sobrepasan el valor de la moneda estadounidense.

En junio de 2019, cuando se realizó la ampliación del cono monetario que comenzó a circular desde agosto del 2018 tras la reconversión, los billetes de 10, 20 y 50 mil bolívares tenían un equivalente en dólares en ese entonces de 1,62, 3,25 y 8,14 respectivamente, sin embargo terminaron en poco tiempo de ser suficientes.

Con la hiperinflación y los nuevos billetes, por acción lógica de no existir monedas intermedias, los precios se elevarán, ya que no habrá forma de dar cambio, más aun cuando los precios son estipulados en dólares y los comerciantes no tomarán el billete de 1 millón para devolver medio dólar al comprador.

Para los que defendían esta salida la misma no ha sido ejecutada correctamente ya que según ellos lo ideal hubiera sido equiparar el cono con el dólar y asi presionar a que el precio del mismo se mantuviera con pocas fluctuaciones, en otras palabras dolarizar el cono monetario para que los bolívares, teniendo el mismo valor de la moneda estadounidense la sustituyeran.

Sin embargo por razones obvias de confianza lo anterior suena a utopía porque el valor de la moneda no está sustentado en los números que tenga el billete sino por la estabilidad que tenga el país en el campo económico, algo que se sigue deteriorando y no se le ve una pausa.

El billete de un millón alcanza para pocas cosas, tomando en cuenta que su valor es 0,52 centavos de dólar y una harina de maíz está en 1 dólar, o un quilo de queso en 3 dólares y uno de carne en 4 pero lo peor de todos es que es el salario de la mayoría de empleados no llega a 1 dólar.

Greetings dear professor @carlir

Although the circulation of this one million bolivar bill, which is certainly the highest denomination that has circulated in the history of Venezuela, from my perspective will not solve the great economic distortion that has taken hold of our country, organic strategies must be implemented that tend to solve in real terms this serious and disproportionate crisis. Thank you for this updated publication.

Be well.

Personally, I believe that the bill will bring more problems than solutions since it will encourage speculation and other vices. Already in Maracaibo they do not receive the 10 or 20 thousand bills and everything will cost a minimum of 200 thousand bs which is the lowest denomination bill of the new expansion of the monetary cone.

Hello @joseph1956, the new monetary cone that the Central Bank of Venezuela put into circulation as of March 8 will not be of great help, because the experiences tell us that every time new bills are issued the products raise their prices, this is because that money is inorganic and makes the levels of hyperinflation continue to rise, and very true your comment the putting into circulation of this new monetary cone contradicts what Maduro said a few days ago when he informed the country 100% of the digital economy.

Very interesting article.

As I said in a previous comment, this will bring more problems and as you say, everything will go up.

Hello friend @joseph1956, the socioeconomic crisis in Venezuela is complex and has intensified in recent years, an expression of this is the hyperinflation that scourges the pockets of Venezuelans and pulverizes the income in bolivars in addition to prices in foreign currency also subject to frequent variations. The issuance of a new monetary cone is not a solution to the problems and the causes they produce.

Greetings friend

There are no solutions to the crisis, only more production and income generation for the nation.