Acquired some ETH selling DGTX tokens on Friday 31st July

This weekend, I noticed the substantial rise in the price of Ethereum (ETH) as I was trading some ETH after I liquidated another token, DGTX; Digitex Futures to ETH to sell and book profits of course.

Digitex Futures was finally launching it’s zero commission Bitcoin futures exchange on July 31st. That day was the launch date for the Digitex Futures Exchange which would be celebrated with some day trading competitions for which prizes and more DHTX token rewards would be given, along with some stellar speakers lined up for the event.

July 31st was a big date for DGTX with public launch of this zero commission Bitcoin futures exchange

I felt that these are the kind of events that usually result in pumping of the price of the token, so it’s a good time to sell DGTX and anyway with that day trading competition lots of buying was sure to happen for DGTX.

Along with continuous ETH's rising price action there was rise in ETH's transaction or gas fee

So, I got some ETH tokens after selling DGTX and I went about to sell part of that ETH for money, it was then I foresaw the possibility of further rising price action of ETH. In the order book lots of volume to sell ETH was at 366$ when that time around Saturday afternoon the resistance of ETH was at 350$.

*Continuing price rise of ETH on the weekend with brief resistance I saw on 350$

On Sunday evening I noticed the price of ETH was at 378$ and my ETH got sold easily. However, part of the ETH I transferred to my Celsius wallet, it was then I noticed that the transfer fee charges for that ETH was 3$!!

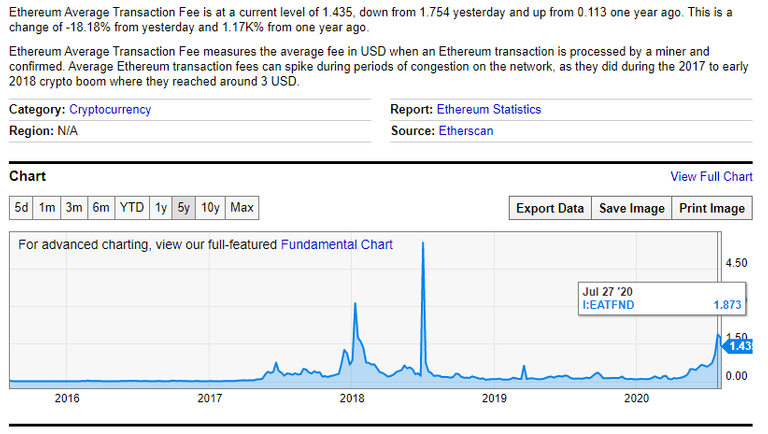

Source Average ETH transaction fee this weekend was 1.8$. Notice in earlier months ETH transaction fees was much lower - 0.080$ on Jan 30th, 0.158$ on April 27th

So, along with the rise of ETH price, the ETH gas fee prices had risen too this weekend. Looks like ETH transaction fees for transactions that involved use of smart contracts and token swaps were higher ranging from 5$ to 15$.

https://u.today/defi-is-so-hot-ethereum-fees-just-surpassed-levels-unseen-since-2017

Increase in the use of DEFI apps built inside the Ethereum Blockchain

The on chain activity happening inside the Ethereum Blockchain too is at an All time high(ATH) due to practical use of DEFI apps.

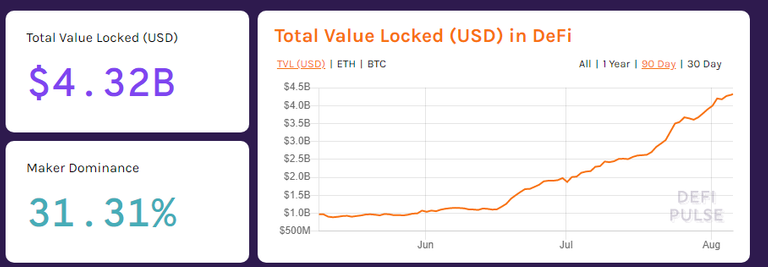

Increase in the total value of assets locked into DEFI apps. Source

The total value locked in DEFI apps has increased from 1.873$ billion on July 1st to 4.32$ billion now, that is the combined value of various tokens like DAI, ETH, USTD locked into DEFI apps has increased tremendously since past one month, which shows the increase of users for various DEFI apps that is built inside Ethereum.

Consider the substantial increase in the usage of decentralised exchange, DEX, Uniswap which is built inside Ethereum. Some time back Uniswap had a daily trade volume of $126M, which is ⅓ volume of Coinbase.

Scalability solutions yet to be implemented into the current Ethereum network

Therefore with this substantial increase in the scale of user activity on the Ethereum Blockchain, at a stage when scalability solutions are still not completely implemented/integrated on the network, the ETH transaction fees paid naturally increased as a consequence.

Simply put the transaction throughput or TPS of ETH is only 15 per second, meaning with many transactions made waiting in the transaction pool to be confirmed by the Ethereum miner, only those transactions with higher fees were taken and processed by Ethereum miners.

A desktop smart contract wallet that’s more secure than Metamask hot wallet

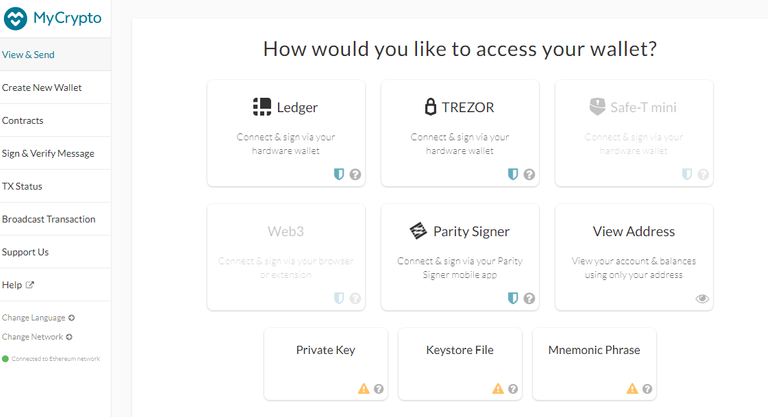

mycrypto.com's desktop wallet with smart contract abilities

Well… and something else I learnt this weekend. Earlier I thought a free smart contract wallet available for small money holders like me who cannot afford a Ledger hardware wallet, was Metamask which is a browser extension wallet, aka, hot wallet which is not a safe option as it can be hacked.

However, these days there are free smart contract wallets that are as secure as desktop wallets like Atomic wallet. I found out about mycryto desktop wallet from https://mycrypto.com/ , with this smart contract wallet, users can participate in DEFI activities like lending, providing liquidity etc while holding their crypto deposits securely in desktops only(: … I think that is pretty nice.

However, I have not yet tried putting my cryptos to work in any of the DEFI apps, but I know this smart contract wallet will come in handy for sure.

Bitcoin average transaction fee is high, so doing BTC transactions looks costly!!

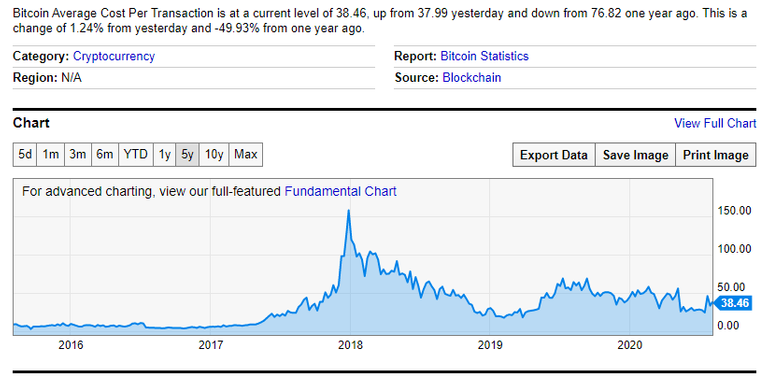

Lastly, I also was quite stunned to check the statistics on the average fee for making a Bitcoin transaction - its 38$, and that’s damn costly. Looks like with Bitcoin going to remain the same Proof Of Work (POW) Blockchain Network ,the transaction fees will keep increasing with more Bitcoin transactions clogging the Bitcoin network that would increase the miner’s fee.

Average Bitcoin fees for a transaction is 38$ !!! OMG . Source

So, Bitcoin’s only utility seems to be a store of value, as it cannot be a convenient digital currency to be used for transfer of value with the fees going to be this high and the network not getting scaled.

I would love to know if Lightning Network is a possible solution for this pressing Bitcoin issue, readers your thoughts please.