When I really got into DeFi last year/early this year, I thought DeFi is going to be the new future. DeFi will take over conventional finance and change the world... I thik DeFi did something and changed something.

I still like DeFi and I still think has a future. I just don't know if it is going to be bright as I thought it would be.

I saw this article this morning and I kind of felt the same way.

Lending Stablecoins with DeFi

I have been experimenting and chasing new things and high interest rates and stuff... but

Is it really worth it?

I have been asking myself this question over and over lately.

I got email from Stellar today and found out that Stellar started their staking with 25% rewards I wanted to jump right in. Try it out and experiment a little, but I decided not to and this is the staking thing 👇

Introducing the Stellar Community Staking Marathon

Becuase I asked myself the same question again... "is it worth it?" idk for sure until I try but I will pass for now.

Back to lending stablecoins. Interest rates on stablecoins fluctuate a lot and they can be over 50% - 100% at times, and I have chased them. I have had some fun and tried that couple times, but I could never hold them long enough to become anything because those rates can go up crazy and drop down to 0% very quickly.

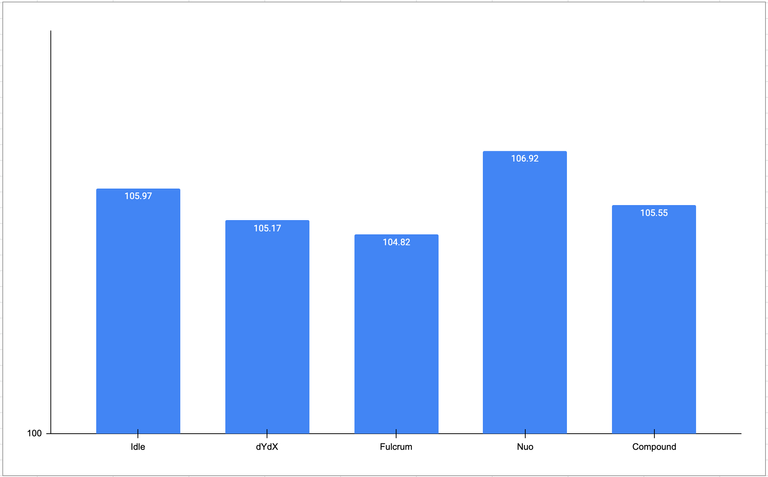

But this guy did it. He deposited $100 worth of stablecoins into different platforms and HODL them for a year.

source

Results are that those stablecoins can actually earn you interests.

source

If you deposit $100 into these lending platforms, you will earn about $5 each in a year.

If you have $100 in your regular bank account, you will never earn this much interest so $5 interest is not too bad?

But then he traded 3 ETH to get the stablecoins ready and deposited into the platforms and everything you do costs gas money. Taking out money will cost money so all the earning will disappear in fees and ended up losing money in the end. (and i have had the same experiences couple times)

If you DIDN'T spend that money for stablecoins and gas and kept the original 3 ETH deposit which was about $515 a year ago, that would be $1078 or more since ETH is having a big 5 year old celebration. So doing nothing and just HODL makes more sense?

I think so... at least for stablecoins.

There are a lot more stuff going on in DeFi that could make you lots of money even with the high gas fees and everything, but I feel like DeFi right now is an expensive people's game.

12 Months ago, $100 worth was a decent amount to play with experimental technology. Today, I wouldn’t bother with anything less than $1000 because of gas costs to get in and get out of protocol. Small deposits don’t make sense economically anymore.

I couldn't agree more... even though you could go small and end up big in DeFi is very possible.

You just have to be in the right place at the right time... and hopefully, you are in on it while it's hot like fashion.

source

In the end, I am not sure if chasing DeFi is worth it or not because DeFi is happening, things are changing rapidly, evolving in very fast pase, so I think continuous "education" and making smarter decision are the key. Fortunately, I am still in green overall. thank goodness 😝

Get Rewarded For Browsing! Are you Brave?

➡️ Website

What if the guy used the 3 ETH as collateral to borrow 170 DAI and bought 1 more ETH? How much would it be worth now?

($395 * 4) - ($170 * 1.5) = $1325 [assuming an unrealistic perpetual interest rate of 50%. Actual interest rate should be well below 10%]

Of course, I am not encouraging people to do this. I am trying to illustrate that is just a tool and it depends on how the user uses it.

Do you think that would work?! We should find out🤤 can I borrow some ETH from you 😆

I mean people are actually doing these things and making bunch of money so I’m sure it works sometimes.

How is your experience like?!

What do you mean whether it will work? Do you mean whether this strategy will work? Or do you mean if using ETH collaterals to borrow DAI will work?

I am personally slightly leverage by using some of my coins as collateral to borrow USDC. The USDC can be put into some other projects to earn extra yield or to buy more cryptos.

I mean are you making good profit for doing this?! I think my issue is my seed money is too small so I need save some ETH first and I will try something different.

Oh I see. I am making decent profits by buying the tokens of DeFi projects. Not really by participating in DeFi. At this stage, DeFi yields are still more for whales. You can only see decent returns if you have substantial amount of seed money.

Nice! I’m just a small fish so I will take a break from defi 😂

Hi @tomoyan

As you say, everything can change from one moment to the next. A few days ago someone told me, crypto-money and the blockchain are a great invention, totally, but being something technological they could change to something not very nice. Or someone could create something new much better that would bypass the Blockchain, I was surprised with the answer, but it's true.

Everyone is changing very quickly.

That’s for sure. Crypto has good opportunities but it can be very bad very fast at the same time.

@tomoyan since one has limited finances so it becomes a difficult choice to use BTC or ETH to get get into a De-Fi project.

It can be stressful to say the least to hold a de-fi based low visibility token for a 5% odd ROI

where as the top cryptos like BTC & ETH may give you a much better value just by HODLing

Yes, it can be a very difficult decision. BTC, ETH are more long term, DeFi are more short term I think... but I could be wrong

No you are right making a correct decision can be tough in terms of spotting the right opportunity

I use stablecoins to make timed trades because, you know, since they are stable I can use them to purchase normal crypto when it's low and then sell it back into stablecoins when it's high.

Posted using Dapplr

I think that could work. Just depends on the fees though?!

Hello friend, thanks for sharing your experience and knowledge. This publication has surely made all those who are targeting DEFI, including me, think.

I am taking a break from DeFi right now, but I am not discouraging people to get into DeFi. It has ups and downs and some people are making big money in a very short time so there are big opportunities there, but it definitely needs smart decisions in my opinion.

Upvoted 👌 (Mana: 16/32)