As a child, I always believed that school would prepare me for everything. After all, it was the place where I learned math, sciences, language, and history subjects I thought were very essential and necessary. So, I devoted a lot of time in reading and getting good grades. But no one ever told me that the real life would involve learning skills that I would not learn in the classroom or from the textbooks. When I look back, I realize that there was one thing school never taught me, the realities of life and one of them was money management. Even though we learned about things like economics in school, but no one sat down to explain what to do when you get your first salary or how to survive financially when you're starting from scratch, how to live on little income, how to manage money.

The first time I encountered money management was right after I left home to continue my university degree. I got a parttime job in a photo studio which gave me little income in addition to the allowance my parents do send me. At first, it felt like the best thing ever, I had the freedom to buy anything I wanted, go out, and enjoy life without asking anyone for permission. But I learned the hard way: just because you have money, and freedom doesn’t mean you should spend it all.

In the first few weeks, I spent almost all my earnings on things I didn’t need I bought clothes, gadgets, eating out and when I checked my account balance at the end of the month, I was shocked to see how little was left. I had zero savings and was already struggling to cover basic expenses. That was when I realized that I had to change.

What school didn’t teach me, but life did, was that money isn’t just about earning it’s about managing, saving, and planning for the future. The truth was that being broke wasn’t about having a parttime job with low salary or surviving on small allowance it was about not understanding how to handle the money I earned. One of the most painful experiences was when I found myself with just ₦200 left in my account, and no one to turn to for help. I had no food, bills were coming up, and I was completely unprepared. That was a humbling experience, and it became my turning point.

From that point forward, I decided to educate myself about personal finance. I started reading books on budgeting, saving, and investing. I watched so many YouTube videos to learn how to take control of my financial life. What I learned in those months changed my approach to money entirely.

After that tough experience, I decided to make a change. I developed a budget, tracked all my expenses, and set small savings goals. For the first time, I understood how to make wise use of every kobo. Here are the key things that helped me turn my finances around:

Track Every Expense: I now record everything I spend, from bills to small purchases. This simple act helps me keep my finances in check and avoid unnecessary spending.

Save, Even If It’s Small: I set aside a portion of my income, even if it’s just ₦500 a week. Over time, those small savings built up.

Prioritize Needs Over Wants: I learned the importance of distinguishing between wants and needs. I no longer buy things on impulse just because they’re trendy or because everyone else has them.

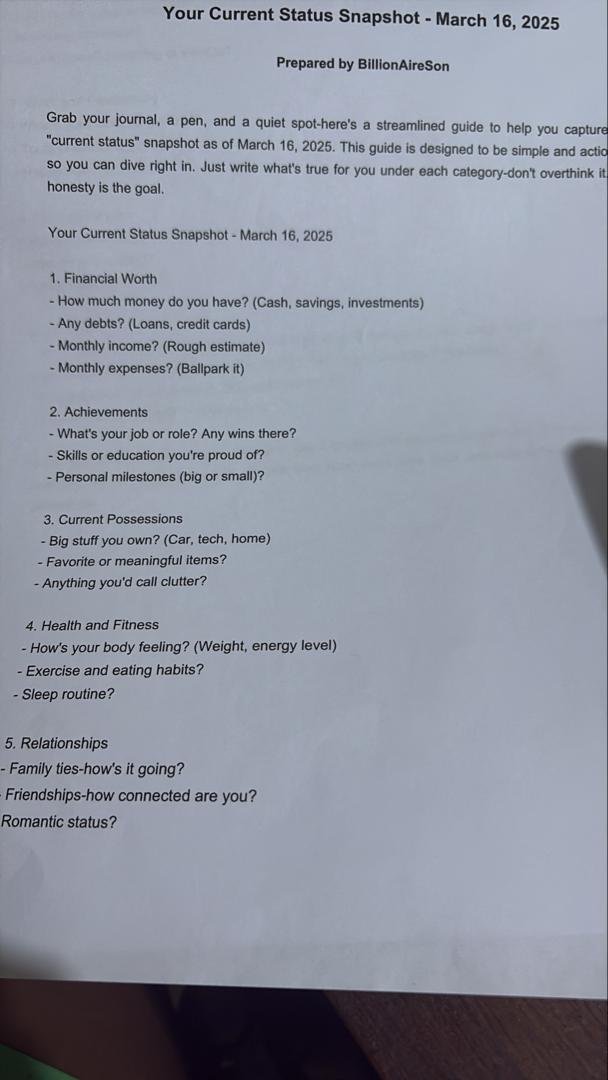

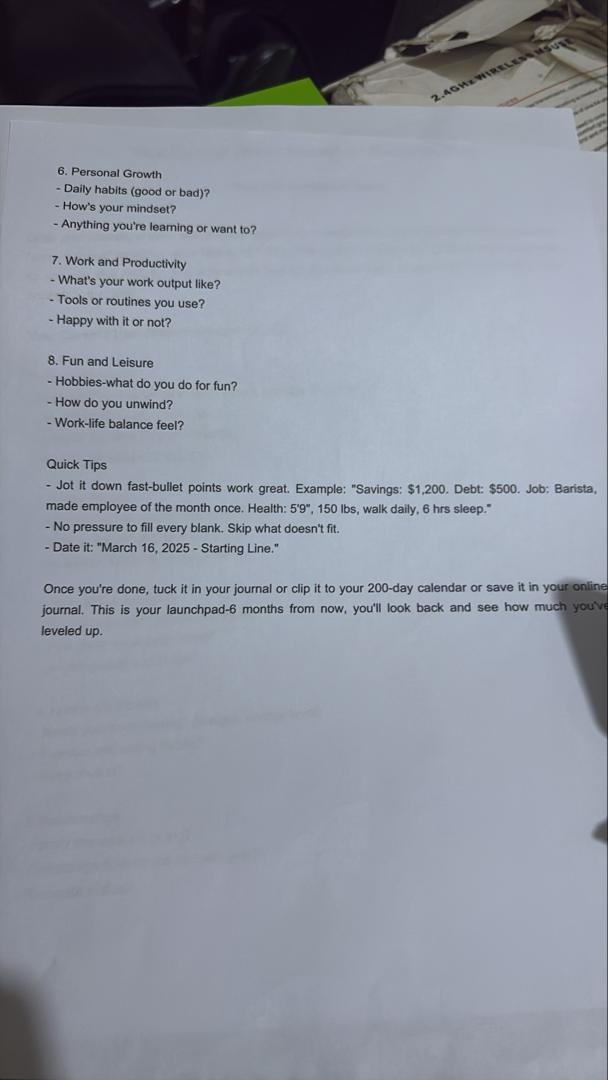

Below is a document i found online which also help me to prioritize my needs

Emergency Fund: I now have a small emergency fund set aside for unexpected expenses. This gives me peace of mind and lessens the stress when life throws a curveball.

Investing: I’m starting to explore investment options, like crypto.

Many people believe that effective money management is only for those who earn a high income. The truth is, no matter your income level, good money management is about how you handle what you have. It's about budgeting, saving, and prioritizing your spending.

What’s one life lesson that school didn’t teach you, but you had to learn the hard way?

It could be anything from handling money to relationships, mental health, or career growth. Let’s talk about the lessons that school missed and how those lessons have helped us . Share your story in the comments.

Posted Using INLEO

Being able to differentiate between needs and want is very important in tracking and managing your funds which does not require you to be rich first or earn high income.