Wall Street’s big banks have clearly had enough time to chew over the potential fallout for investors from the coronavirus epidemic and some are advising against dipping a toe in turbulent market waters right now.

Elsewhere, Citigroup’s global macro strategist Jeremy Hale and his team said “things may have to get worse before they get better” for the COVID-19 driven risk asset selloff. He cited several reasons why they are “reluctant to buy the dip” in those assets just yet.

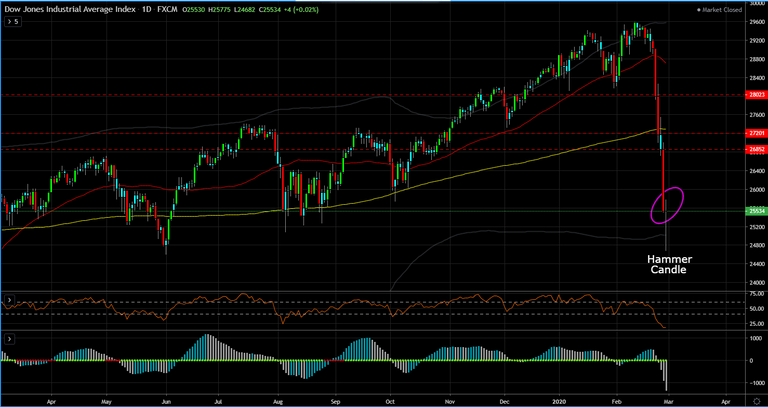

The US equity markets have had their worst weekly decline since the 2008 global financial crisis. This past week was highlight by back to back 1000 point losses for the DOW and the biggest single-day point drop in history of 1,190.95 points.

To put matters in perspective from a macro viewpoint, since Trump was elected, the DOW has climbed 61%. However, since Feb 12th, the DOW has lost almost 15% of that 61% gain. From a numbers perspective, the DOW has fallen from an all-time high of 29,568 to around 25,409 or over 3,500 points the past week.

You know how President Trump likes to take all the credit when the Markets are going up, and like to place blame on others when the Markets are going down. This past week was no exception. President Trump blamed both the threat of 2020 Democratic candidates as well as the coronavirus for the week’s steep declines.

One of President Trump’s cabinet members, National Economic Council Director Larry Kudlow said the coronavirus-triggered selloff has created a buying opportunity for long-term investors. Larry said the virus story is not going to last and investors that have a long-term point of view should consider buying the stock market at current levels.

Thomas Lee, founder of Fundstrat Global Advisor said fear surrounding the uncertain impact of the virus is a credible issue but added that he believes investors may be overreacting. Thomas went on to make the case that “markets are bottoming this week” and is forecasting a “V” shape recovery for the market.

The last time we had a “V” shape recovery was in late 2018. I remember it like it was yesterday, but the bottom in the Markets came one day after Christmas. Then the US Fed Powell did a 180 degree change in his monetary policy. In a matter of weeks, Fed Powell went from a hawk on interest rates to a dove in which he started taking a wait and see approach before lowering rates three times in 2019.

Getting back to the DOW, last week the DOW made lower lowers five straight days (6 straight days if you go back to the previous Friday, but who is counting):

Monday: -1032 points

Tuesday: -879 points

Wednesday: -124 points

Thursday: -1191 points

Friday: the closing price on Friday was actually 4 points higher than the closing price on Thurs

But what was encouraging was on Friday after a massive sell-off, I witnessed the Smart Money stepping in to halt the decline in price to the point Friday's candle formed a hammer candle. A hammer candle is a price pattern that occurs when an asset trades significantly lower than its opening, but rallies within the period to close near opening price.

So have we reached a bottom, I don't know, but the data points are indicating if we aren't at a bottom, we are very close to it?

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted via Steemleo

Congratulations @hive-180870! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!