I know this may come as a shock to you but the markets just tanked. Yeah, I know this line is several hours too late and there's no good news in sight. At least to my own bias anyway. I've already shared my bearish bias about Hive on this Looking at Hive's Chain Data Stats. I'm not selling doom and gloom, and would actually welcome at the idea of being wrong since a Hive rally meant a pump in our bags.

I wanted to take a look at the recent developments on the on chain stats to confirm. Please note that this isn't financial advice and I'm only sharing my thoughts for journaling, community discussion, and self learning purposes. I'm no expert at interpreting data, I just look at it and draw my own conclusions which can still be wrong. This data is available from Hivehub.dev so you can see for yourself and track what's up with the blockchain. I wish there were more filters / dapps to extract data without the need for some coding knowledge like how Hive Financial Statistics retrieves individuals shows its report.

The chart says it's in red. Looking at BTC chart is no different and it's already obvious that Hive's trend follow's BTC's movements. For further context you can check out Using Correlation Coefficients BTC and Hive. Now what does the data on chain is saying about the recent developments?

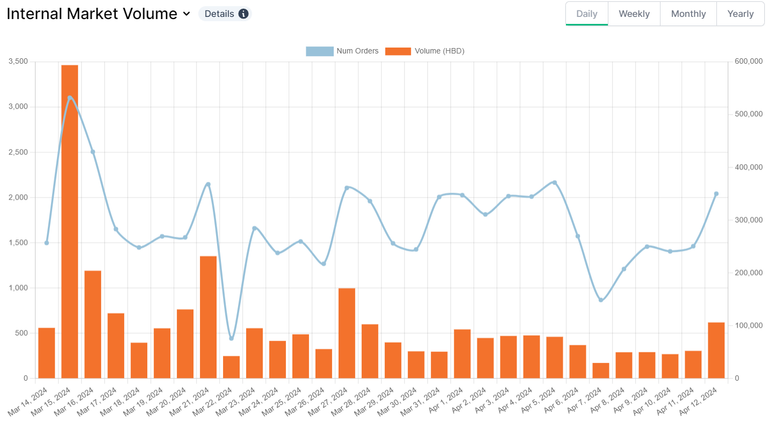

The internal market volume for HBD shows a steady rise in HBD volume for the past for days. But this is equivocal about the possible market direction, in my opinion anyway. I'm looking for signs that give a bullish or bearish indication in the short term. I checked the daily activity for HBD savings.

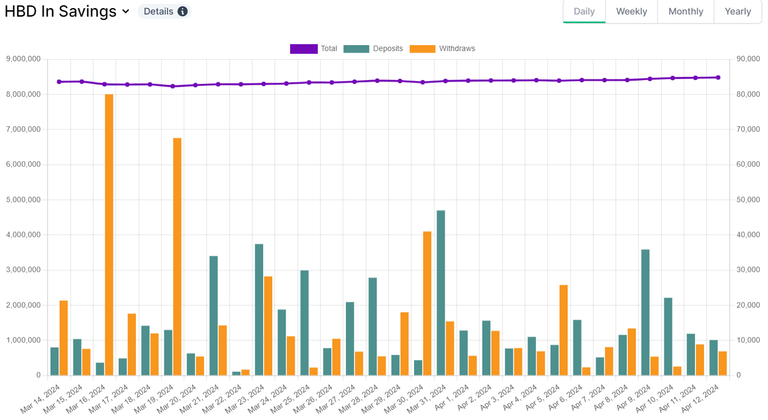

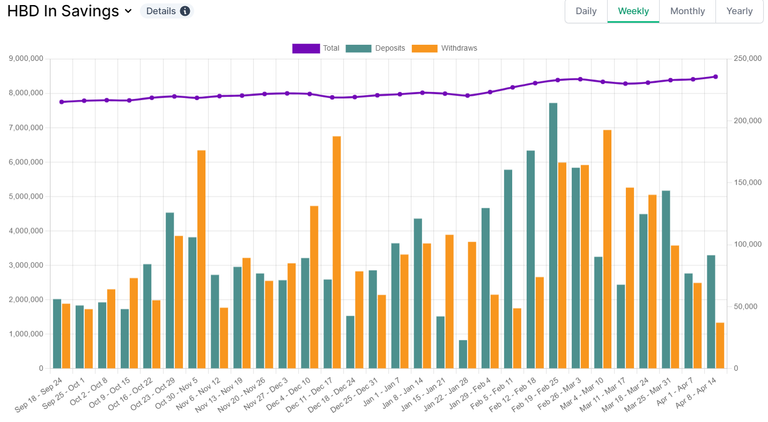

The overall weekly trend for HBD savings is decreasing but for the past few days leading up to the drop in prices, you'll see accounts are increasing their HBD staked. Maybe it's a response to the previous drops in prices and having an overall bearish sentiment in BTC or Hive but this chart gives me an indication that accounts are preferring to hold HBD for that 20% APR yield, relatively stable prices than holding Hive right now. So I check the net power up and down activity on chain.

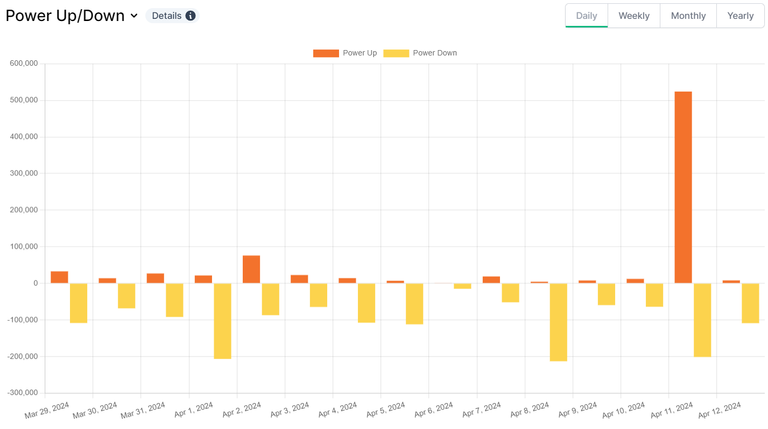

We have large spike in power up but only happened in a day and I'm more inclined to believe it's just one or few accounts that have a large stack. The bullish sign I'm looking for is a consistent trend of more power ups happening. And the weekly chart shows a consistent net power downs which is bearish.

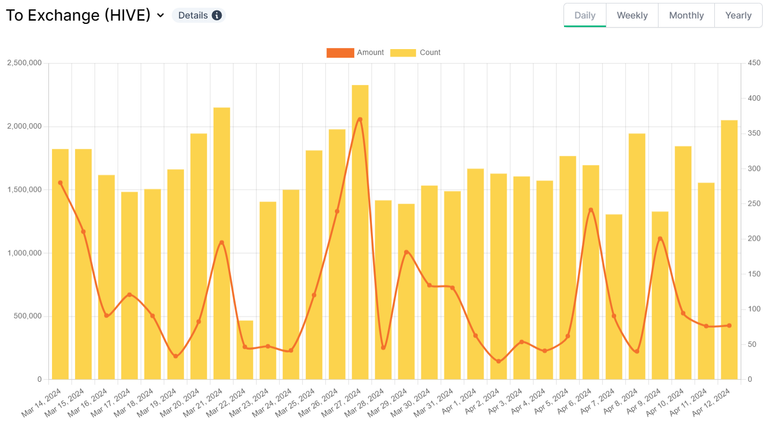

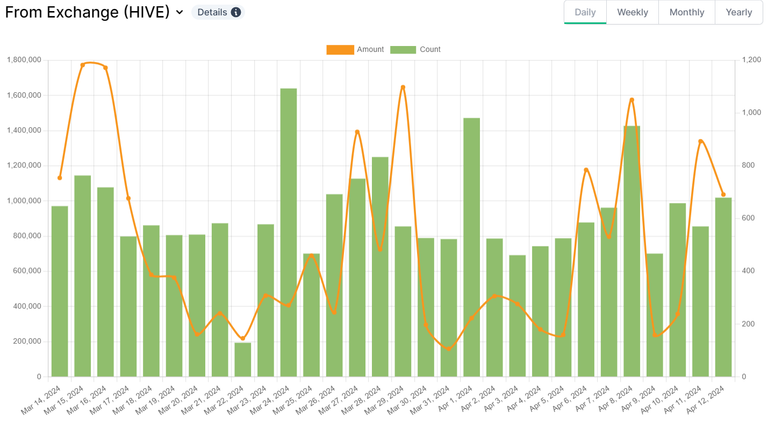

Looking at the amount of Hive coming in to Exchanges vs Hive coming from Exchanges.

Other a decrease in amount of Hive moving to exchanges in the past for days, this doesn't really mean much because it's the Hive already deposited at exchanges that are being used to move the price. What I'm looking for is some change of trend where more Hive is being brought back from exchanges which is shown at the bottom.

If I had to take this chart as it is, it suggests that accounts are now accumulating Hive but when I pair it with the chart that says more HBD is staked on savings, I could also look at this chart in support to the idea that people are converting their Hive to HBD for that stability when the markets are have been volatile in the past several hours. All recent inputs suggest a bearish stance.

Threats of WW3, BTC halving, Hive just isn't really getting that hype it deserves, Fed Rate Cuts / Hikes, Uniswap getting on the crosshairs of SEC, pick a narrative and something is bound to fit.

What are the signs of reversal am I looking for to make it possible to consider a bullish scenario?

- More HBD withdrawals

- More Hive goes from Exchanges to user accounts

- More powerups than powerdowns weekly > daily

- A decrease in Hive moving to exchanges

- A reversal sign from BTC from bear to bull

I don't need all these scenarios fulfilled to get some conviction as some of these didn't happen even if Hive was rallying along with BTC, but this gives me a guide to know what to look for when looking at the recent data.

At the time of this writing, Hive has reached the same levels as it did back in February. I don't think this movement is due to Hive being bad, it's just that BTC is a stronger currency and it show from SWAP.BTC movement or on coingecko that more people are interested in holding BTC than Hive. I know it's the obvious knowledge just from eye balling the charts but I like to arrive at conclusions where I go step by step rather than jump. Since we got less than 6 days before the BTC halving starts, I'm expecting a lot of FUD headline news or copium / hopium posts being sold here and there.

I know some riches are made from speculation but sometimes the lines get blurred and you may just call it gambling on impulse for people that think this is an automatic buy. I've been checking out some Crypto Youtubers that were posting their bullish bias and checking how they would backtrack on the claim on their recent content. Want to know why I bother? because I'm just curious at how people like to buy copium / hopium posts.

Has anyone heard of the "Shoeshine Boy Theory"?. The lesson was when normies are starting to take financial interest into something they previously took for granted, it's time to get out of the market. I got this sell signal when I some old buddies of mine I talked about BTC and Hive started asking me what's up and they wanted to invest.

That shoeshine story became one of my favorite lessons in trading / investing because I managed to apply the lesson without paying for the tuition.

Thanks for your time.

At this point I just hope btc does what it do best halvings, but if we base it in the previous "btc halvings" it take months to year before anyone is sure about where btc is going. Great presentation of charts po @adamada, thank you po for indtroducing hivehub.dev... Naka base lang po ako sa hive engine na market tuwing nag check ng price sa hive tokens, now I have one more tool I can use. Maraming salamat po for sharing comprehensive report.

Yung balance ko na hive na convert ko pa to zing tokens before nag drop ng price, iyak sana ako now. 😅

you'll be trading tone deaf if you only have one or few sources.

Hive going bearish would be ultimately bad for the ecosystem...

Hope we rally up soon.

Haven't heard of the shoeshine boy theory though 😂😂

It's the first thing I think about whenever someone whom I knew previously that was never interested in BTC ask me about BTC. It's a sell indicator.

Okay...

This may be a sell signal but I personally am very positive about the future of Hive.

but this is a nice informative blog about the current situation!