The good old days when you thought everything was cheap isn't coming back. It's only going to get more and more expensive to live. This post contains some economic trivia about the Philippines so if stats and market reality aren't your thing, best to skip this post.

I've been continuing my hobby reading about macroeconomics and visiting webpages like Bangko Sentral ng Pilipinas and Philippine Statistics Authority. It doesn't matter if you learned something if there's no intended application after, you might as well wasted your time bothering. To think, this all started when I just wanted to learn more about earning money and investing.

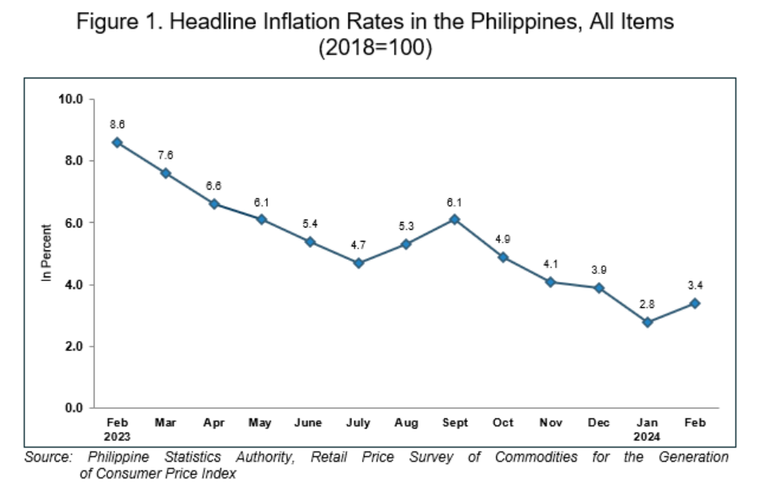

That one piece of candy worth 0.25 centavos is now 4-6x the value on retail. The fare rates on public transport I knew went x2 to x4 in the span of a decade or two. And it's all thanks to that invisible force called inflation. The prices of goods and services will increase over time and inflation is that number that tell how fast those prices rise. A healthy amount, based on Central Bank policies I've read should just hover around 2-3% ±1 %. It depends on the country you live but Philippines is targeting around 3$ with ±1%.

It's been a steady decline on the monthly charts.

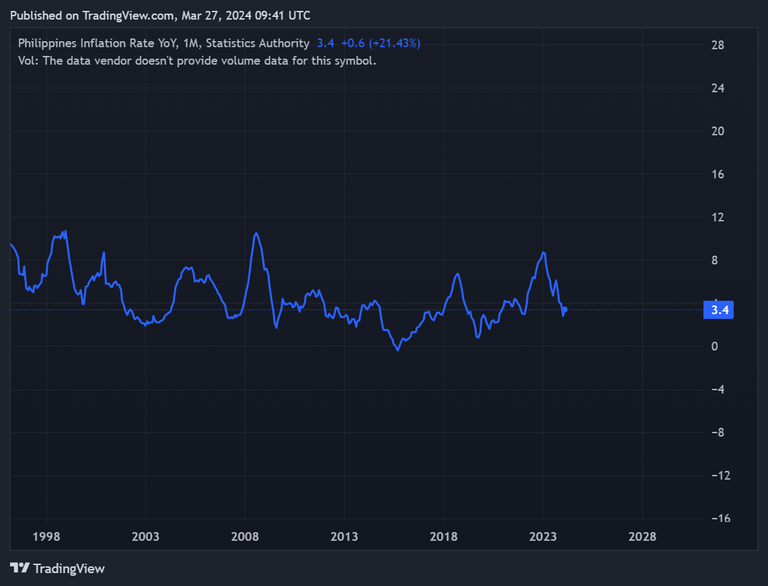

But it's just happening in cycles. If you ask a layman who doesn't pay attention to financial news or retained some information from their economics class back in high school, they'll think that a deflation or reduced inflation news would automatically mean the prices they find expensive now will eventually drop. But that's never the case because while there is a decrease in inflation rates from a monthly or yearly rate, prices will just creep up higher.

I went out to buy roasted coffee but the shop selling them went out of business due to the pandemic. The nearest store would take more than half an hour with commute. An added expense to the transportation cost and time. So I just settled for those instant coffee sticks which were previously priced at 1.5 Peso, now to 5 Peso. It's been like only 2 years? My head just went from figuring out whether inflation has to do with it, news about supply shocks, the store just sold it higher than competition and etc. Anything to rationalize the price I'm seeing.

It comes off as a surprise and nothing more. I paid for goods and thought more about the experience that it never bothered me that things were getting expensive. Well, most of the goods and services that got expensive were goods and services I rarely purchase because of a thrifty lifestyle. And even if they increased in value, I have that sense of financial freedom that I could sleep better at night as I can afford them anyway. I'm not rich, I'm just thrifty and easily contented with my material things.

Anyway, the past few days has been an eye opener as I dwell deeper into the economic statistics, world market news, and crypto. It seems this knowledge is life changing but the average layman who complains about money or needs the knowledge the most somehow missis the point. It's a mixed feeling of wanting nice things for strangers like them getting some financial literacy but those feelings get axed the moment you see their vices and unproductive habits. Not my life to live so I could still sleep better at night.

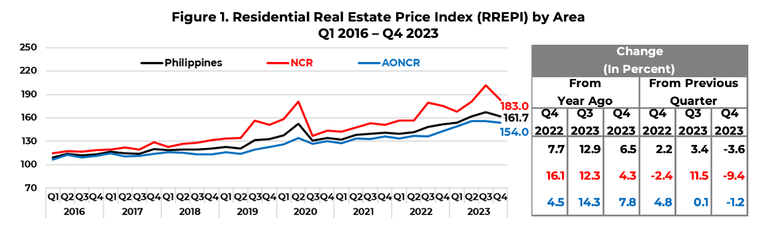

National Capital Region (NCR), Areas Outside National Capital Region (AONCR). Residential Real Estate Philippines Index

If people wanted to get married to start a family, they're going to have a rough time having a place of their own at these costs. The new it trend with real estate is buying up condominium units and renting them out for AirBnB and it works because the tourism here is one major source of income. Foreign investors are also buying up units jacking up the prices making it unaffordable for local Filipinos because the target market are expats moving in.

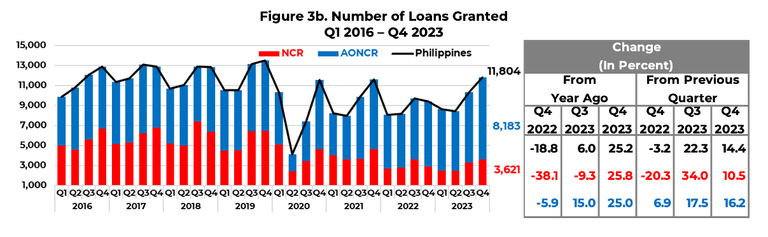

If you noticed a sharp drop in real estate price during 2020, this was during the heights of the pandemic. I checked the approved loans for real estate.

Despite the central bank having around 2% interest rates at that time.

The good thing about broadening my scope is now I can partly make more sense about why things are the way they are now. It's empowering but at the same time, it's also alarming because there are people out there who continue to live in bliss not wanting to know a bit about how money works even if money influences almost every part of their lives.

I haven't even touched the employment rate and wages survey yet. Even if the economy is doing well and inflation is controlled, prices will never revert back to how you knew it a decade ago, that's how inflation works. People will have a benchmark for the prices of goods and services and it creates an impression on that intrinsic value. It doesn't mean this impression is grounded by logic, if you see a piece of candy valued at 1 then come back to it after years and it's now valued at 2.5, you'll started to wonder whether if that thing is really even worth 2.5. It's not like the flavor or taste has changed, it's just inflation doing its work.

Thanks for your time.

People in general understand inflation as they experience it (comparing prices from the old days); however, they are ill-equipped to handle it. Even wage increases are not guaranteed to be higher than the country's inflation rate.

PH is a consumer driven economy. We may still be fueled by OFW and BPO money which helps sustain the spending; however, once this gets impacted consumer demand will go down.

Great to see posts like these, very informative and thanks for sharing! I remember it is from your post that you mentioned about PH already being an aging population. I think that will definitely impact PH in the future.

Ideally, this should be the case but it's also not a clear cut how to adjust wage rates because it all depends on the cost of living from where one is at. I've checked the stats on wage surveys and the wages for people living in NCR are higher than the rest of the country.

Not yet, but give a decade or two. Our fertility rate from 2022 record shows 1.9. We need a 2.1 level just to breakeven as 2 parents get replaced by 2 kids. It's a ticking time bomb considering the decades from now problem is us (becoming seniors) will outnumber the younger voters. And seniors will be voting more on retiree benefits funded by tax payer money. It's not like all seniors can still work so the burden of taxes get shouldered by the younger working class.

Maraming makabuluhang posts ako na isip pero maliit lang yung "audience" ko na makakaappreciate ng info because the investing types aren't what makes up a lot of pinoy user base here.

just discovered Filipinas still call his national coin with the Spanish word "peso" and "Bangko Sentral ng Pilipinas" is easy to understand for Spanish speakers

Similar problem with real estate in Spain , prices sky rocketing ,local governments corruptions blocks any affordable housing

Philippines has been colonized by Spain for 333 years, our national language "Filipino" incorporates the Spanish words and some local dialect too. So the feeling can be mutual when watching or hearing some Spanish speakers talking from abroad or tourist visiting here. Seems like everywhere in the world is having a hard time, part of globalization and ease of moving capital across markets.

Right , Manila was a very important commercial hub for the America-Asia ships crossing the Pacific Ocean

There are still many references to Filipinas in spanish culture in this days

"Los ultimos de filipinas"

"Manton de Manila"

5 pesos isang stick? Mahal naman.

At least dito makakabili pa ako ng 3 Pesos. hehehe

You are right, lowered inflation rate does not mean lowered prices. It's not not even deflation unless the inflation rate becomes negative.

Lowered inflation rate simply means, the prices will not increase as much as before. :D

Tataas pa rin pero konti lang. :)

It's a concept people don't readily grasp when it comes to watching today's prices. Given the current inflation rate ng pinas, everything will likely be twice in value in 2 decades or less if our country get's it down bad. And the target rate of 2% inflation gives us 3-3.5 decades before things double in prices (under ideal management).

Well...

Back in 1999, the Jollibee Champ costs only P60 (maybe less)... now...it's more than three times that price...

That's the effect of inflation and I guess few people look back at the prices decades ago.

I'm trying to remember the time when the minimum jeepney fare was 4 pesos and 1 kilo of rice was just 18 pesos. Those were the days. Mahirap intindihin ang inflation para sa amin mga layman. !PIZZA 🍕

Madali intindihin depende sa drive lang ng tao mag payaman. Pure hobby and motivation to earn more yung driver ko to learn and coupled with an innate want to learn new things. Pero minsan meron naman road blocks like how far can I go without a mentor or role model~

Very practical ang motivation. Good to be clear about it. Having a mentor is one way to go about doing it. Meron rin mga books at short courses. Thinking about it macroeconomics is a subject I would gladly have attended in university if I had the chance to go back.

That's just tough man...

Here I was thinking prices in my country had a hope of dropping as the rates reduced.

Although our countries are different in the fact that inflation rates have been climbing for over a decade now 😂😂

It's the opposite if the rates you're talking about is the interest rate set by central banks. If central banks set their interest rates high, it's supposed to curve the inflation rate downward. But this doesn't always work because it's a multifactorial things.

I'm lost here😂😂😂

Make another post on this maybe?😂😂

👍 !PGM

$PIZZA slices delivered:

@juanvegetarian(1/5) tipped @adamada