More HIVE is moving out of vesting than in and more HIVE is moving out to exchanges than moving in from exchanges

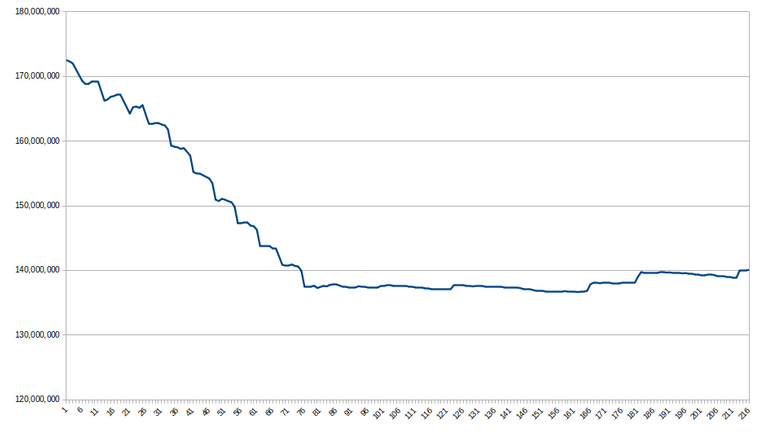

The first point is not accurate. After the exchanges were done powering down the amount of hive that they had vested after the Justing Sun fiasco the gross amount vested has increased slightly over time.

What this chart tells me is that in general the stakeholders are not selling their stake. What is happening is that most of the tokens issued via inflation (or via HBD conversions) are being sold on the market as evidenced by the price decline and the amount of hive on exchanges.

I think that before making any proposals to change the token economics we should ask two questions:

- What is keeping the current stake from being sold?

- What is preventing new stake from being created?

Is it the existence (or the size) of the reward pool or is it something else? Is the culprit the 13 week divesting period? Is it just lack of marketing? How can we get answers to these and other questions that are not biased by our own preconceived ideas?

One thing is clear to me...the price action is evidence that something is not right with hive...I am just not convinced that the problem is the social layer.

All that chart shows is that a lot of large and/or mostly dormant accounts aren’t divesting, so their accumulated vests slowly tick upward. The stats that track movement shows regular outflow that outpaces inflow.

After the colluding exchanges finished their power downs, we’re still in net negative vesting week over week.

HIVE is also leaving individual accounts and heading out to exchanges at a greater amount than the reverse, further corroborating the lack of vesting interest.

The first chart below is STEEM, which shows a 4.5-year trend of losing against BTC and a return to lows in Dollar terms. The same trend continues with HIVE in the second chart, once again corroborating a lack of desire to purchase and stake on our proof-of-stake platform. This is problematic.

Given the complete lack of growth and retention on the social media front after 4.5 years, I’m willing to say that being known as a social media blockchain isn’t attracting social media users or crypto investors. There may be many reasons for that, but none of them preclude moving that to the application layer like any other project.

But as I said in the post, this was mostly about what we could do with staking and inflation after we’ve already established that second layer solution for social rewards (or “SMTs”).

It's clear that there is very little interest in staking in the platform. What the comparison between vesting and divesting show is that in general the users of the network are more interested in treating Hive as a faucet. I am not convinced that removing the social layer will change that behaviour. If we do it stakeholders will simply shift from cashing out the curation/author rewards to cashing out their staking rewards.

Now that I say it out loud it sounds very bleak.

Although if we analyze what happens in the crypto world in general is that people buy into narratives. People buy into bitcoin because they believe the narrative that the limited supply makes it a store of value...for instance. So what is our narrative and what do we do to make sure that people that believe it want to participate?

Saying that we are the blockchain for web 3.0 (as it reads on the hive.io website) is not enough. What does that even mean to regular folks? Not much if you ask me. Even the steem.com site has more punch to it (it's a bunch of lies but nonetheless).

One thing is true...we can't sit around and wait.