The "true" measure of inflation sould be applied to the virtual supply not the current supply. Although since perception is an important driver on the markets HBD conversions introduces a certain level of undertainty on the actual supply (by this I mean the amounts that actually hit the markets).

When the debt ratio is 10% or higher the virtual supply is calculated with the formula:

Each conversion will reset the virtual supply by virtue of increasing the current supply until it reaches a point of equilibrium (when there is enough virtual supply to support the peg for HBD).

Since there is no codeded mechanism in place to stop the DAO from printing HBD we can logically conclude that the tendency will always be to reach the 10% ceiling for the debt ratio and therefore for the virtual supply to get to it's limit in the long run.

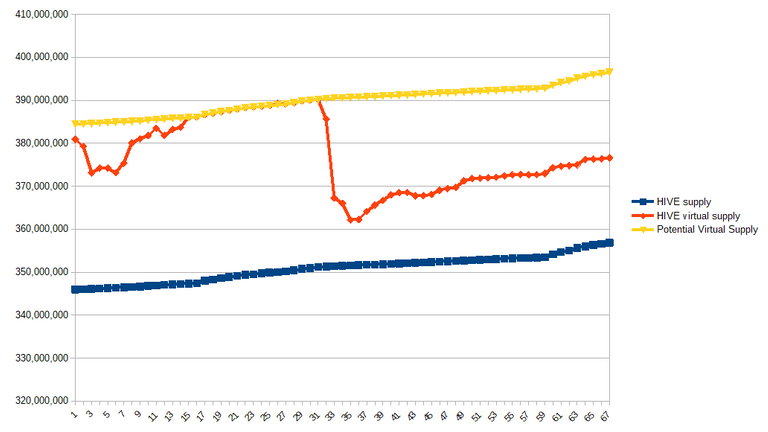

In the short existence of HIVE the evolution of the virtual supply has been pretty interesting:

Having said that, the existence of HBD in it's current form is to much of a wildcard and we should fix it. Instead of having a floating value of HIVE sustain the peg I believe that we should have a hard limit set by the amount on the DAO and remove it from the reward pool.

Otherwise we need use-cases that burn or lockup HIVE and/or HBD at a high rate.

Note: if you look at the graph you can see a spike in the supply in the last few days driven by the dumping of HBD on the Upbit market (right after they opened the pairs for trading). It wasn't driven by the debt ratio getting to it's limit but by korean holders just dumping their holdings.

You can't sell a virtual Steem on the market (at least not as STEEM) so I don't consider it realized inflation, but this is getting into pure semantics.

The potential virtual supply is ultimately unlimited, because it is increased every time a conversion is completed. The 10% ratio which triggers a haircut limit only acts to slow down such a potential expansion of supply to ultimately any amount. All you have to do is split the HBD into multiple convert transactions and you would easily, vastly exceed the 10% limit (assuming you're already at it). The Koreans dumping on UpBit did not increase the virtual supply, rather they made it attractive to people who used the convert contract on a large scale, and that increased the supply of Hive, increasing the "potential virtual hive" by the 10% rule.

In practical terms the potential virtual supply is not unlimited. The limit is the HBD supply, if all of it is converted there is no way to increase the virtual supply and therefore the current supply via that method.

Of course the dumping on Upbit did not increase the supply but rather it replicated a situation where the debt ratio exceeds the 10% limit and brakes the peg making it profitable to play the arbitrage game of buying HBD with the intent to convert.

I certainly do not disagree with any of your points. It is as clear as day that the existance of HBD introduces a volatile factor that determines the evolution of the HIVE supply outside of what is programatically set to happen.