Sustainable returns need economic activity ...

So Nuri (a German Fintech with 500 000 customers) went belly up... Never heard of Nuri before, but I always try to learn. Turns out Nuri had repackaged and offered a Celsius "savings" product ... When Celsius filed for bankruptcy, Nuri was forced to admit it could not reimburse its clients...

I met Celsius for the first time more than 4 years ago, in April 2018 at a conference. Although their presentation had a good slide, I didn't think much of their business model and was skeptical. Indeed who borrowed crypto back in 2018? And what for? How could anyone offer to pay interest at scale on a Bitcoin savings account when there never was significant economic activity backed by Bitcoin? Where would the interest come from (in the long term)? At no moment in time I considered Celsius's business anything but a scam and a Ponzi - the only way for them to pay interest on Bitcoin deposits to existing users was by using Bitcoin from new customers.

... but what qualifies as "economic activity"?

That is a good question! And it deserves more than a quick answer. Let's think of it this way: paying interest in a sustainable manner requires "value creation" - captured in the "new" money which are paid as interest.

Money are a signaling device for the society: they signal that members of the society have produced value for other members of that society. As I said in a previous post, Bitcoin is "too good" (in Gresham's sense) to function as money. Fiat currencies can function as money. Hive, which is inflationary, can function as money.

Playing an instrument in the street qualifies as economic activity - the street musicians entertain people, who in turn signal that they have received "value" by chipping coins in the collection box of the street band.

Street musicians near St. Stephen's Cathedral in Vienna, frame from a video I filmed in 2017

Hive returns are sustainable

If you read my post and upvote it, you signal it provided you some value - here with a "not quite money"-crypto asset rather than with coins or bank notes. This signalling in itself (voting) provide value to other people who may decide that the post is worth their time - hence the "curation rewards" voters receive.

In other words, Hive sustains economic activity - value is being created on Hive not only by bloggers and curators, but also by games such as Exode and ancillary services such as @dlease.

Try out Exode. Is it entertaining? Does it provide value?

Hence returns on investments in Hive are sustainable, not "Ponzi-like" (as were those of Celsius) ... but who produces returns for Hive investors?

Hive had DeFi long before "DeFi" became a thing

As I explained in a previous post you might want to read, once you bought Hive and brought it in your personal wallet, you might want to stake it ("power up" in the jargon). From there on, what you can do with the resulting "Hive Power" (HP) is discussed in the Hive for investors - ROI comparison for "delegators".

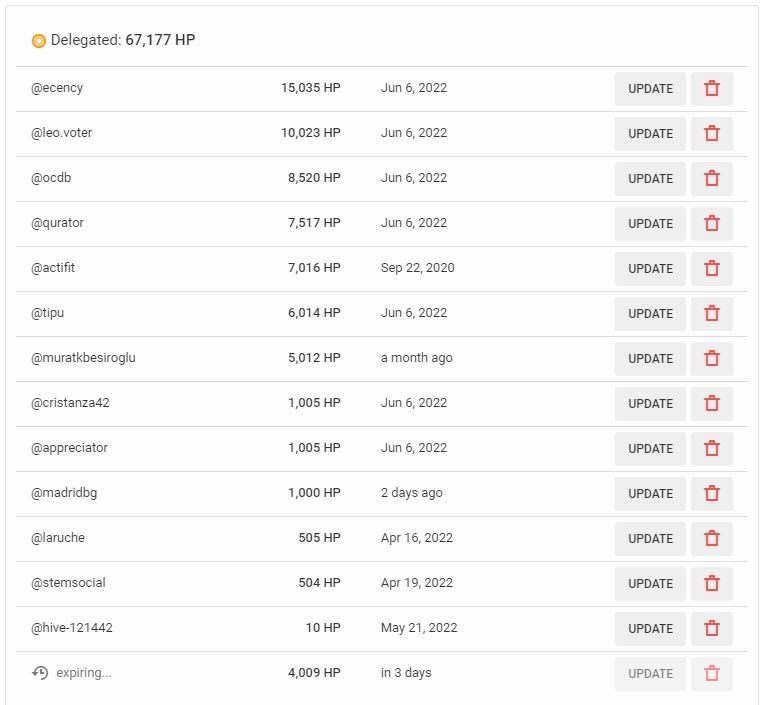

In my case, after having tested with 1000 HP I chose to allocate 65000HP as in the below figure:

- 15000 HP (23%) to @ecency

- 10000 HP (15%) to @leo.voter

- 10000 HP (15%) to the highest bidders on @dlease

- 8500 HP (13%) to @ocdb

- 7500 HP (12%) to @qurator

- 7000 HP (11%) to @actifit

- 6000 HP (9%) to @tipu

- 1000 HP (2%) to @appreciator

And the winner is ...

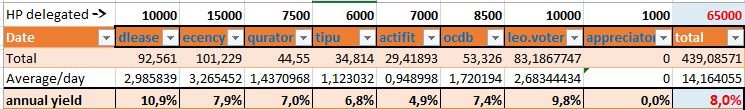

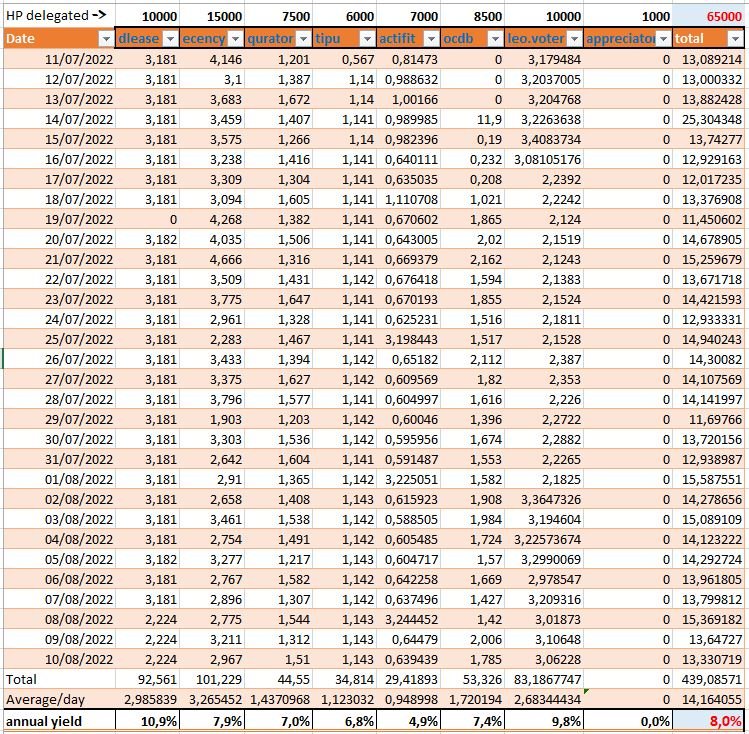

Here is the result after one month using this allocation.

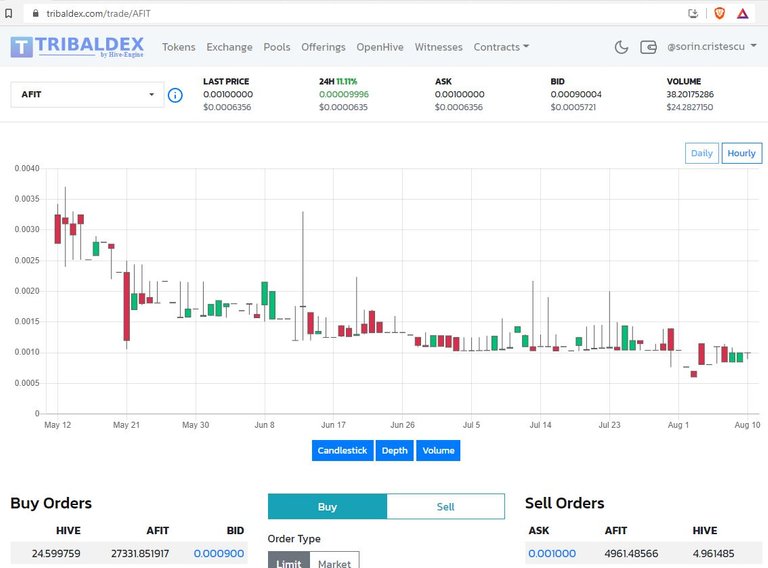

My 65000 "delegated" (secured lending - the blockchain makes sure no recipient can "default" on the loan, so I take no risk with the principal) returned the equivalent of ~439 Hive or a return of about 8%. To calculate this I used the daily "bid" prices of AFIT (from @actifit) and LEO (from @leo.voter) tokens on @tribaldex

Indeed, as I noted in the previous post, @actifit returns a bit of HIVE and HBD but mostly it returns its own L2 (Hive Engine) AFIT tokens. @leo.voter in turn returns LEO tokens (also L2, Hive Engine)

I would thus conclude that the winner is the Hive investor, who gets a nice, sustainable return.

Now the detail for the bean-counters

Here is the detailed table I used for accounting

DLease

Dlease produces the best returns, close to 11%, despite the fact that for mysterious reasons it skipped a day (19/07).

That being said, DLease is not very scalable. I kept the 1000 HP delegation to @cristanza42 from the previous month and looked to increase my total delegation to 10000 HP. @muratkbesiroglu was looking to lease 5000 HP and @anadolu was looking for four tranches of 1000 HP each. However the latter cancelled the lease a few days ago and returned the delegation, which impacted the return. I have to wait another 3 days for the 4000 HP to return.

Leo voter

@leo.voter produced the second best returns at close to 10%. Trouble is, they are not in Hive but in LEO which is a different token ... I didn't sell it but rather paired some with SWAP.HIVE and added liquidity to the SWAP.HIVE - LEO liquidity pool. I kept a percentage of LEO liquid and am still thinking what to do with it. It can be powered up too, but that makes sense mostly if I use the leofinance.io front-end, which I don't like.

Ecency

Ecency came in third at almost 9%, but I only added the HIVE returned. The actual return would be much, much higher if I had also added the Ecency "points". However these are not a cryptoasset. I got 1500 point per day during this month but one can only use 500 to boost a post. I would have had to post three times a day every day to be able to spend all my points ... At any rate, a reasonable, conservative valuation of the points (anyway more than zero) would have certainly made Ecency the champion of this comparison, which conforts my decision to give it the highest allocation (23%)

OCDB, Qurator and Tipu

The "peloton" was led by OCDB once I corrected for the shifted window - as explained, OCDB starts returning after 7 days but also keeps returns 7 days after the delegation was cancelled. I took that into account by calculating an average and adding 7 times that daily average in the cell for 14/07 (which was otherwise at 0).

Qurator is second at 7% and Tipu third at 6,8%.

Actifit

Actifit was a bit of a disappointment. I had seen its returns were subpar but I wanted to support it as a nice idea. However I wish they made a greater effort to attract runners to Hive. Their website is really not up to notch and I don't see them competing effectively with non-blockchain fitness apps. As an investments, the number of AFIT returned kept diminishing day after day from more than 900 at the beginning of the period to about 750 at the end. The AFIT token on Hive engine is very illiquid and has kept depreciating in value. Besides, the tokens offered come staked and one cannot unstake more than 500 per day. Given that I currently earn 750 per day, it means my AFIT balance keeps increasing.

Appreciator

Finally appreciator was a mystery and a complete let down. It returned zero and it didn't vote on any of my posts in the past month. I cancelled its delegation.

Conclusion

I hope you find this post useful. As I said above, the winner is ... the Hive investor! I will adapt my delegations and also try @curangel and @discovery-it and will update this study in a month or so.

@tipu curate 😛

Upvoted 👌 (Mana: 30/40) Liquid rewards.

TipU used to be my favorite delegatee back in Steem's days ... I had all of 60K delegated to it and even with Hive, in early 2021, it returned about 17 Hive per day, which was cool. Then the return started coming down, and down, and down ...

The rewards earned on this comment will go directly to the people( @drlobes ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This is quite fascinating. Delegating HP is something I do but you always want to know where to do it.

I do delegate to a few people, most to leovoter as I like the LEO return. Interesting ecency did well, I don't use the points on my main account and didn't realise you hot points from your delegation.

It will be interesting to see your updated report:)

:)

good analysis

Yay! 🤗

Your content has been boosted with Ecency Points, by @sorin.cristescu.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

With this, would I be right if I say, Hive provides Passive income to Investors?

Well, that might be a shortcut which risks leading to misunderstandings. Hive provides the 2,95% HP inflation as passive income. Here I talk about passive income coming from delegating the HP ... it makes a signficant difference

And this would be gotten when you use your HP to curate, right?

And you don't even have to lift a finger which what passive income is supposed to be.

No, this is inconditional. You don't need to do anything. It rewards the mere fact that you turned your Hive (liquid, transferrable) into Hive Power (like a term deposit - not liquid, you can't sell it unless you turn it back to liquid Hive which takes 3 months).

If you use your HP to curate yourself that qualifies as work - you have to spend time, read articles, select those you want to upvote. That is better rewarded than not doing anything.

Exactly! If you have HP you can

Oh my goodness. This is a revealation, sir. Thank you so much for taking the time to explain.

I always thought the 2.95% I see promised in the HP description had everything to do with me using my Hive power to curate.

So, you mean even though I decide to let my HP sit there, I'll get interest annually?

If yes, then, do I still get that interest even after I have delegated to others for curation rewards?

What I mean is, can I have number 1 and 3 or only 1 and 2?

Yes, you can decide to do 1. alone and get the 2.95%. This used to be a nice rate when there was no fiat inflation, it doesn't look so great anymore. So it would be a pity to do 1. alone, a lost opportunity.

But 1. is a bonus, it's inconditional. While getting the interest from 1., and if you have time and feel motivated, you can also do 2. You should normally be able to get another 15 -20% on top of the 2.95% for a total of about 18 - 22%

If you don't have time or don't feel motivated, you can do 3 on top of 1. 3 is of course not as big an earner as 2. but then you don't have to do anything, it's purely passive income. So you can do 1. + 3. and that would get you about 11% sustainable passive income. Sustainable because it's not a reflexive activity like on most other blockchains, it's from a non-financial activities (blogging and curating)

Congratulations @sorin.cristescu! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 50000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPexcellent report.

This is very useful information.

Thanks for sharing it.

!CTP