Another video I made about my trading experiences on the social trading site Etoro. I was just starting to get to grips with trading a little, and was also learning about what HODLing is...

The information and opinions in my videos and this article are not intended to be investment advice. Seek a duly licensed professional for investment advice.

In case you're unfamiliar with the term, 'HODL' just means 'hold' basically.

Trading Cryptos vs HODLing Cryptos

When you're actively trading an asset - any asset really, including cryptocurrencies, the idea is always to buy low and sell high. OR, if you're 'Shorting' them (betting the price will drop and planning to make money off it as it drops - it can be done) you want to open your 'sell' trade (another name for a 'short' trade) when the value is high, and close your trade when the value is low. But most people are 'buying' (betting the value will go up and planning to make money as it does) so I'll stick with that as the example.

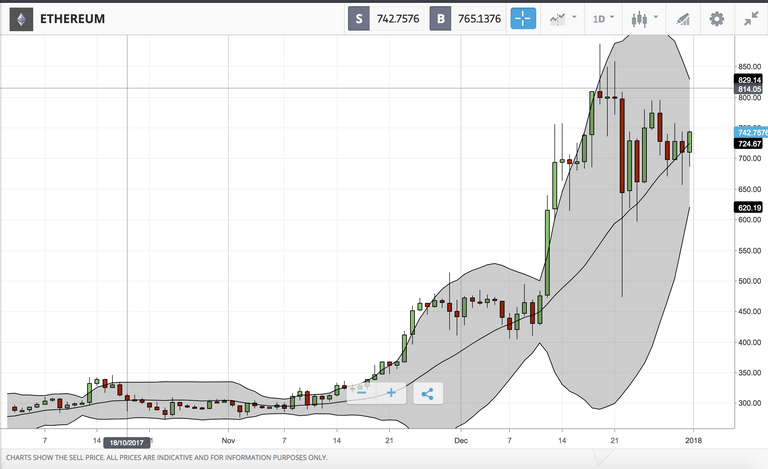

So, you buy your crypto, and you're always watching the price, hoping it goes up and up and you make some nice cash off it. People who are trading often look at different types of 'charts' which are just representations of what any asset has been doing over time in the markets - they're looking for patterns which they can analyse to possibly predict which way the price will go in future. Here's a picture of a chart for Ethereum:

In this example, you can see a bunch of green and red bars - they're known as 'candlesticks' and in this example I've set it so that each candlestick represents 1 day of price movement of Ethereum vs USD. So, it's showing the price of Ethereum in dollars. You can see the value in dollars on the right, and the time along the bottom line. A green candlestick means the price went up that day - the bottom of the green coloured part is where the price 'opened' that day (the price at the very beginning of the day) and the top of the green bit is where the price 'closed' that day (where it was at the very end of the day). The wicks (thin strands coming out of either the top or the bottom of the coloured bits) show where the price actually reached during that day, either high or low - but the coloured bit shows the range of where it opened and closed that day.

Now, these charts can be used by traders to analyse what might happen in future. You see that weird grey bit surrounding the candlesticks? They're called "Bollinger Bands" and they're just one of many different tools you can use in conjunction with charts to tell you what might happen next.

How can charts predict the future?

We're basically herd animals, us humans. It's true, unfortunately - we do what we see the herd doing a lot of the time... Now, I don't claim to be an expert at all with technical analysis - like it says at the top, I'm not a pro, don't take my advice, this is just my opinion, and there are many others, but when I look at these charts, what I see is a bit of a self-fulfilling prophesy going on and a lot of herd mentality... The fact is that so many people use these charts and these tools, and are all looking at the same data, that it sort of works... It's self-fulfilling. Everyone using these tools sees a possible movement indicated by the tool, and that information then leads to decisions, which in turn affect the price of the market and Booom, the charts were right :) It's a bit like that really... They use volume indicators (how much is being bought or sold), Fibonacci sequences (based on numbers discovered by a mathematician called Fibonacci in 1202 AD, which are meant to show the 'hidden mathematics' in all systems including nature itself), and many, many others. There are loads. And I think that so many people are using them, that they become self-fulfilling. Also, if people see the price dropping suddenly, they think something must be wrong and jump on the bandwagon - same's true for a sharply rising price. A lot of it's just herd stuff...

Back to trading vs HODLing

Traders want to buy low, sell high, and then as the value drops, close their trades, take their profits and wait until the price dips again so they can buy back in, and repeat their profit cycle again. That's the goal. They use things like the charts (known as 'Technical analysis') as well as more 'fundamental analysis' (analysing the actual asset) to predict when to buy and when to sell. Some people want to trade both directions - buy low, sell high, then open a 'short ' position to make more money as the value of the asset goes down... Now this sounds awesome, but it's a lot harder to do than it sounds. How do you know when to buy it? How do you know this is the top price - the best price to sell at? Traders frequently get this stuff wrong, and buy and sell at the wrong times, and either don't make much money, or else actually lose money.

HODLers don't need this grief. Their strategy is based on a longer timeframe. They're thinking - 'I'm going to buy this as I believe, over time, it's going up in value - so I'll just buy it and wait' They buy their crypto, and they hold it. And wait. And wait. And wait. The discipline of HODLing is how to not freak out and panic-sell when one of the many many dips in the value of cryptos happens. It's the same as how you grow long hair or a beard... You just don't cut it. Many people will tell you too. It'll get uncomfortable, and you'll doubt yourself. But if you just don't cut it, you'll end up with a full beard or a flowing head of hair. Same with cryptos. A lot of people say they wish they'd bought bitcoin at $30. But really, how many of those people do you think would have held it until $20,000? How many people would have sold it all at $200? or $2000? Can you imagine the discipline it would take to not sell it at $2000 per Bitcoin if you'd bought it for $30 or $5 or $0.03? Immense discipline... Or, they just weren't watching :) Which happened to a lot of people - apparently there's now a thriving business in people offering rewards and percentages of their Bitcoin if anyone can help them get into their Bitcoin wallet which they funded back in the day and have lost the private key for... Ouch.

Traders are more active in their approach

So, basically, a trader is actively in and out of the market, trying to make profits and avoid the dips. They work on shorter and more medium timeframes - from minutes and hours to weeks or even months. They don't want that period of time when cryptos dip and you just have to wait for them to go back up in value. They want to always be making profit.

HODLers play a longer timeframe

HODLers see it as a long term investment - they don't want to have to trade actively and possibly lose profits by buying and selling at the wrong time. They want to hold the coins - maybe for a year, maybe for 2, maybe 10. As long as it takes to make a massive amount of money on their cryptos. Often, they'll have a basic strategy of buying at ICO, waiting until the first 'pump' is over (sudden price surge spurred by early adoption) then take out the profits which equal their initial investment, and leave the rest to just sit there in case the coin ever really takes off. It's a clever strategy... They also maybe, just maybe actually want to support the coin and the project behind it, so buying and holding the coin is their way of supporting something they see as really worthwhile. But that's a different story...