How does MSTR buy bitcoin without bumping the price?

Michael Saylor buys bitcoin and he has a handy tool to track his purchases, at, well, https://saylortracker.com

Mondays have been Saylor's buy-days, and rumors are that he may be at it again.

Yet, with all the mega-buying, why does it seem like the price doesn't jump? This is a question that comes to my mind seemingly each week now with the next MSTR buy.

Grok AI seems to imply that even though Saylor's purchases are huge, they're still not big enough to move the market. Average daily volume traded for BTC seems to be in the $15 billion upwards to $60 billion. So, Saylor's 1 to 2 or 4 billion dollar purchases evidently still aren't enough to eat up the order book.

This is a little hard to swallow considering that Grok estimated, "MicroStrategy owns approximately 2.81% of all Bitcoin in circulation and 2.64% of the total Bitcoin supply that will ever exist." I guess that other 97% is just moving their bitcoin around, back-and-forth?

The standard answer I've heard as to why the market doesn't move has been, "Oh, MSTR buys bitcoin over-the-counter, not off of exchanges where the prices come from."

That's a simple elevator-ride one sentence answer that seems plausible. I could meet someone on the street and say, "Hey, you got any bitcoin and do you wanna sell it?" If they said, "Yeah, and sure," then I could hand them some cash and they could send some BTC to me. The exchanges would be unmoved by this over the counter transaction.

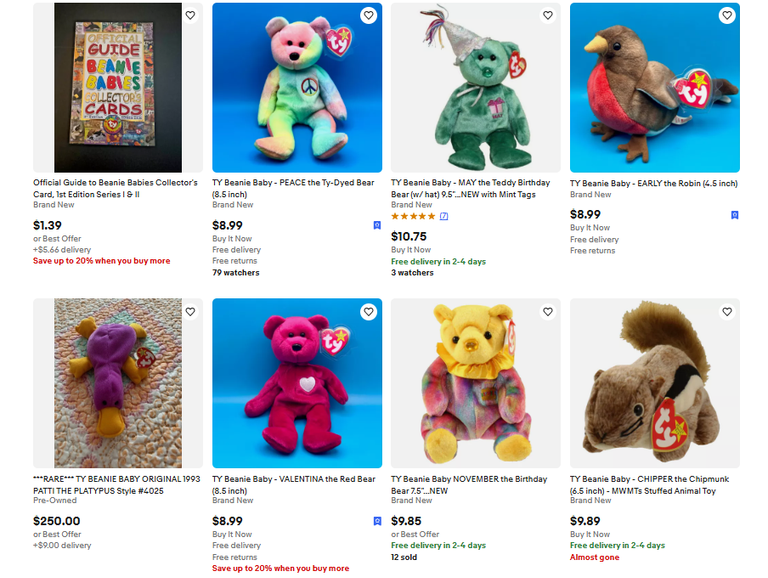

Or, I might be interested in buying a Beanie Babie tie-dyed PEACE bear. The market, ebay, seems to list them around $8.99. But, if I buy a hundred of them off that bitcoin guy on the sidewalk, ebay and the price their isn't affected at all. Not are the 79 "watchers" keeping an eye on the PEACE bear.

But still, to me, that one-line OTC answer somehow seems off. Seriously, does Saylor have connections with people who want to sell thousands or tens of thousands of bitcoin? Every week? Who are these people with all that bitcoin to sell? Can Saylor connect me to a seller of 100 tie-dyed PEACE bears?

Maybe Saylor actually does have those kinds of connections to make those kinds of purchases. Or, maybe Grok is right and Saylor's moves aren't as big-fish as they seem. Anyway, I don't know, and those are circles that I don't move in. And, after all, I guess I still really don't know how he buys so much without moving the market.

!HBIT

This article originated on Nostr

Auto cross-post via Hostr v0.0.13 at https://github.com/crrdlx/hostr

The etf's allow naked shorting, the price hasn't recovered since they came online.

I have to wonder if such shorting would have that much of an impact, and wouldn't those shorters get wiped out considering the price has generally gone up since the ETFs? I really don't know much about shorting though, never played that game.

When you have infinite naked shorts, you can set the price to whatever you want it to be.

High speed traders are who gets it done.

The only problem they have is a bank run.

Ever wonder why we don't have nyknyc days, anymore?

Because the exchanges would collapse.

'They' have to be able to hide the inflation debt based money needs to stay relevant.

IF prices were allowed to rise folks would lose faith.

Instead, they pump money into real estate, stocks, and when those couldn't hold any more, gold(the banks have most of it).

At some point the bank runs occur and this house of cards falls down.

Btc will force this to happen.

They can't just print more and hide it off the books.

But, as long as enough people buy into this fraud, it will limp along to its inevitable demise.