Commonly, the key set of behaviours that distinguish the successful trader from those who burn out is money management, both in managing risk per trade as well as effective draw down and diversification strategies. Far from an empty colloquialism, diversification is in fact an essential tool for smoothing out equity lines and delivering more stable Return on Investment (ROI). One key aspect of diversification is allowing for differing yields delivered from products of varying risk structure. Low-risk, low-return products such as a superannuation fund, can steadfastly provide a typically reliable ROI but comparatively low profit when compared to a strategy that implements a higher risk structure. It would, however be a very limiting strategy to choose only one kind of investment product. Even the much vaunted steady ROI of superannuation funds is vulnerable to market irrationality. Diversification can be implemented in safe and effective ways, implementing a high-risk, high-return product into your portfolio in a manner that promotes risk-averting drawdown and locked-in profit.

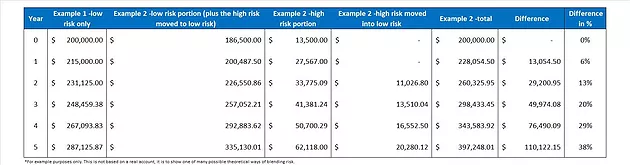

Figure 1: Example Table

Figure 1 shows an effective diversification strategy using both a low-risk fund returning 7.5% per annum, modelled on the average return on Australian superannuation (Example 1), and shown next to that is the same low risk fund where the expected growth for one year is transferred into a high-risk, high-return product similar to Countinghouse’s algorithmic system, making over 100% per annum and then drawing down 40% of that return back into the low-risk product (Example 2). This allows the high-risk, high-return product to accelerate the overall growth of your portfolio whilst drawing down at appropriate junctures and balancing the overall risk structure of your investments.

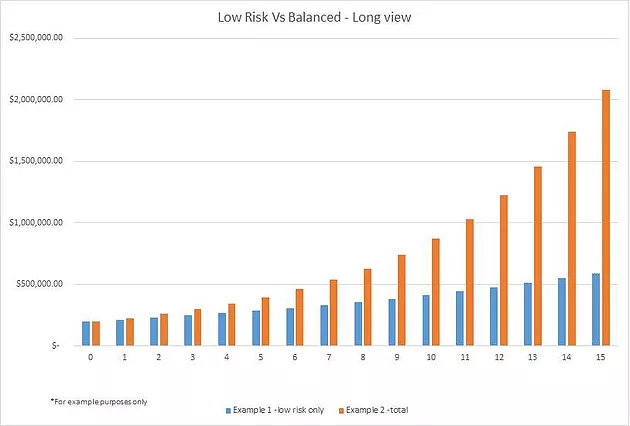

Figure 2: Example Chart

As seen in Figure 2, this balanced approach to risk structure, incorporating a high-risk, high-return strategy into your portfolio, along with appropriate draw down and money management systems will allow growth to accelerate beyond what would be yielded in remaining with a low-risk, low-return product alone. Adopting this diversification strategy, incorporating for example a Countinghouse algorithmic solution into your portfolio and adhering to appropriate money management system as outlined in Figure 1, will deliver exceedingly different ROI over the long term. Of course, money management and risk management will differ from investor to investor, though it is worth pointing out that expected growth in a low-risk, low-return product can be leveraged in order to balance out a portfolio with a high-risk, high-return product and therefore both accelerate equity growth and balance risk to reward ratios.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.countinghousefund.com/single-post/2016/12/22/Regarding-the-leverage-of-expected-growth-in-contribution-to-higher-comparative-returns#!

Our company believes in providing professional investors with Forex and Crypto-currency solutions by implementing algorithmic computer learning

Visit Please : https://www.countinghousefund.com/ico

#CHT #Countinghouse #hedgefund

Counting House is deep mathematical principles, combined with expertise in human and market psychology in order to bolster their investment portfolio and deliver market-beating returns

Visit Please : https://www.countinghousefund.com/ico

#CHT #Countinghouse #hedgefund

Tim Dawson,Mike Pomery is our Director

Visit Please : https://www.countinghousefund.com/ico

#CHT #Countinghouse #hedgefund

Counting House is deep mathematical principles, combined with expertise in human and market psychology in order to bolster their investment portfolio and deliver market-beating returns

Visit Please : https://www.countinghousefund.com/ico

#CHT #Countinghouse #hedgefund