The article below is originally published here. I am the original author of this work and am syndicating it to Steemit as well as Medium and a couple other platforms like InvestFeed to better reach my target audience of Initial Coin Offering investors, cryptocurrency traders, and traditional finance people, thank you!

PricewaterhouseCoopers: AUM 2020: A Brave New World

What is are Assets Under Management (AUM)?

In order to understand this article, we must understand what Assets Under Management or AUM are. According to Investopedia;

“Assets Under Management are the total market value of assets that an investment company or financial institution manages on behalf of investors. Assets under management definitions and formulas vary by company.”

In laymen terms, AUM are when you give your money to a company with the expectation of growing the amount you gave them by the time it is returned to you. Easy enough, right?

Example:

Jack had $100 left over after paying his monthly bills. Instead of spending that $100 extra dollars on, say, beer; Jack decides his financial future is more important and seeks out a trustworthy institution to deposit his money with to grow it. Since Jack is expecting the financial institution to do all of the work, they are going to charge him a fee. Fair enough, right? Well, not really…

The Transparency Problem

For decades now, financial institutions who manage funds for their investors have operated in a hazy fashion. What I mean by this is that the parties involved in the $70 Trillion AUM market are not necessarily required to publish all of their trades or their sources of profit. With the increase in technological innovation and the democratization of access to high-risk, high-growth investments increasing — transparency around money management has become a much more focused topic in the financial services industry.

Just think about it. Imagine you save up $1,000,000 and want to grow those funds, but do not have ANY technical finance knowledge because you worked at a computer tech firm. Years of hard work. Would you not want to know what is happening with your $1,000,000 if you gave it to someone to grow it? I mean, personally, I would want to know EVERY. SINGLE. TRADE that was processed from the very account my money originally went into. Especially because many times, the Broker and Asset Manager is being compensated not just a set percentage annually, but a percentage of the profits they earn you — many times before the portfolio has even begun to earn profits.

The “double-dipping” fee structure mentioned above is commonplace in the financial services industry— this is also why the Genesis Vision Leadership Team has come together.

PricewaterhouseCoopers — Assets Under Management 2020: A Brave New World

Striving to solve industry problems, specifically around transparency, GV Founders realized what was happening behind closed doors and are developing the platform with those aforementioned problems in mind. The various forward-thinking quotes included in the pictures throughout this articles are from PricewaterhouseCoopers, THE go-to audit and assurance, consulting and tax services firm among corporations. Published in 2014, AUM 2020: A Brave New World was a forward-looking, standard-setting report developed with transparency in mind.

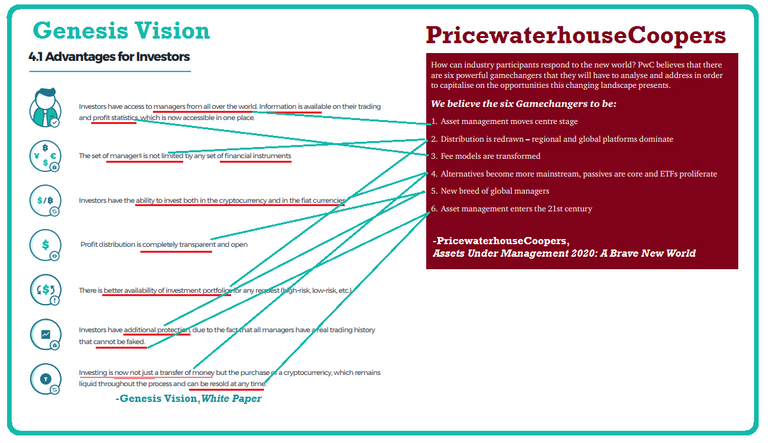

After diving very, very deep into the 40-page PwC report, I simply could not ignore how completely aligned this report was with exactly what the Genesis Vision project addresses. Taking a look at the “Advantages for Investors” section in the GV White Paper, we can see just that (image below) — a major match-up between the GV Advantages for Investor and what PricewaterhouseCoopers calls the “6 Gamechangers” influencing the competitive landscape for what is the $70 Trillion Assets Under Management (AUM) market.

GV White Paper/PwC AUM 2020

PricewaterhouseCoopers is a very, very well known financial services/consulting company that tends to set the standard for their markets of operation — seeing as though this is JUST the benefits for investors within GV’s ecosystem is pretty cool. I’ll likely include another article on why their project is advantageous for Brokers and Asset Managers soon!

Finance, A Language Created to Fool The Average Person

Another one gets caught. The rise in Forex Ponzi schemes has been remarkable over the last two years. -Finance Magnates, $30 Million Forex Ponzi Scheme unveiled

The quote above is from a 2011 article outlining just how bad some of these Ponzie Schemes have been in the world of FOREX — you might now see why people THINK Bitcoin is a big Ponzi Scheme, they’re confused. Just because an industry or market is regulated does not mean it is safe and free of scammers. In fact, with the democratization of access to technology creation, it’s becoming easier to put up more legitimate looking websites or platforms. With that said, we fast-forward to a 2017 article from AtoZ Forex about the CEO of a FOREX firm was arrested for “losing” nearly $300 million in investor funds, yes $300 MILLION. 10x the 2011 scam. Woah…how many times does this need to happen before someone steps in with a solution? Well, not much longer if we start to see the the Genesis Vision, vision.

The best thing about blockchain technology is the ability to implement smart contracts. You know the best part about smart contracts? They can be programmed to control very specific processes that an otherwise corrupt-able human being would control. Oh, the our buck doesn’t stop there.

Being built on the Ethereum blockchain, the record will be immutable, or not be able to be altered by ANYBODY — that is what PwC means when they say “Asset Management enters the 21st century.” With a very accomplished hacker who works at Kasperky Labs in the Financial Incident Department, I have no doubt these guys are out to create a very, very safe platform for Investors, Asset Managers, and Brokers all over the world to use. Add in the fact that you can create a the most diverse portfolio in existence…woah. Most diverse portfolio meaning — using the GVT, you can build a portfolio of a Forex trader, a couple of hedge Funds, crypto asset manager, a guy from Wall Street trading securities , and more— multi-asset classes, each having variable degrees of risk…this is something finance geeks and traders can really appreciate.

This article is getting a bit long, but if you enjoyed this read and/or want to follow along as I DEEP DIVE into the Genesis Vision White Paper — take a look below and you’ll find the other articles I have written on the project:

- An Intro to Genesis Vision Ecosystem, Token and Solutions to Industry Problems

- Can Genesis Vision Be The Catalyzing Solution to ICO Regulation Amid Jamie Dimon’s Public Deception, China Ban & SEC Charges?

- 8 Advantages of Contributing to the Genesis Vision ICO

- Genesis Vision White Paper

- Genesis Vision Website

@genesisvision - give this a resteem when you get a chance!