The cost of capital is an interesting idea in crypto. Chris Burniske lays out a great framework for valuing cryptos here. He combines monetary economics and a Dcf to arrive at a valuation. A part of the question left unaddressed is the cost of capital. Here is how I would tackle it.

What is cost of capital?

The cost of capital is the minium rate we would expect an investment to achieve in order to invest. In Dcf world one way to think of the cost of equity depends on the volatility of the cash flows among other things. More volatile , more expensive. In the crypto world we need something different.

How to derive the cost of capital.

One shorthand approach in finance is to take the inverse of the protocol (price to earnings) ratio of the market and that provides a cost of capital for the average stock. How can we back into cost of capital in Crypto?

The Ico Approach is one way to calculate crypto cost of capital

Without earnings it's hard to calculate a cost of capital but we do have the ico market. We can use the discounts embedded in icos to back into a crypto cost of capital and track how it has moved over time.

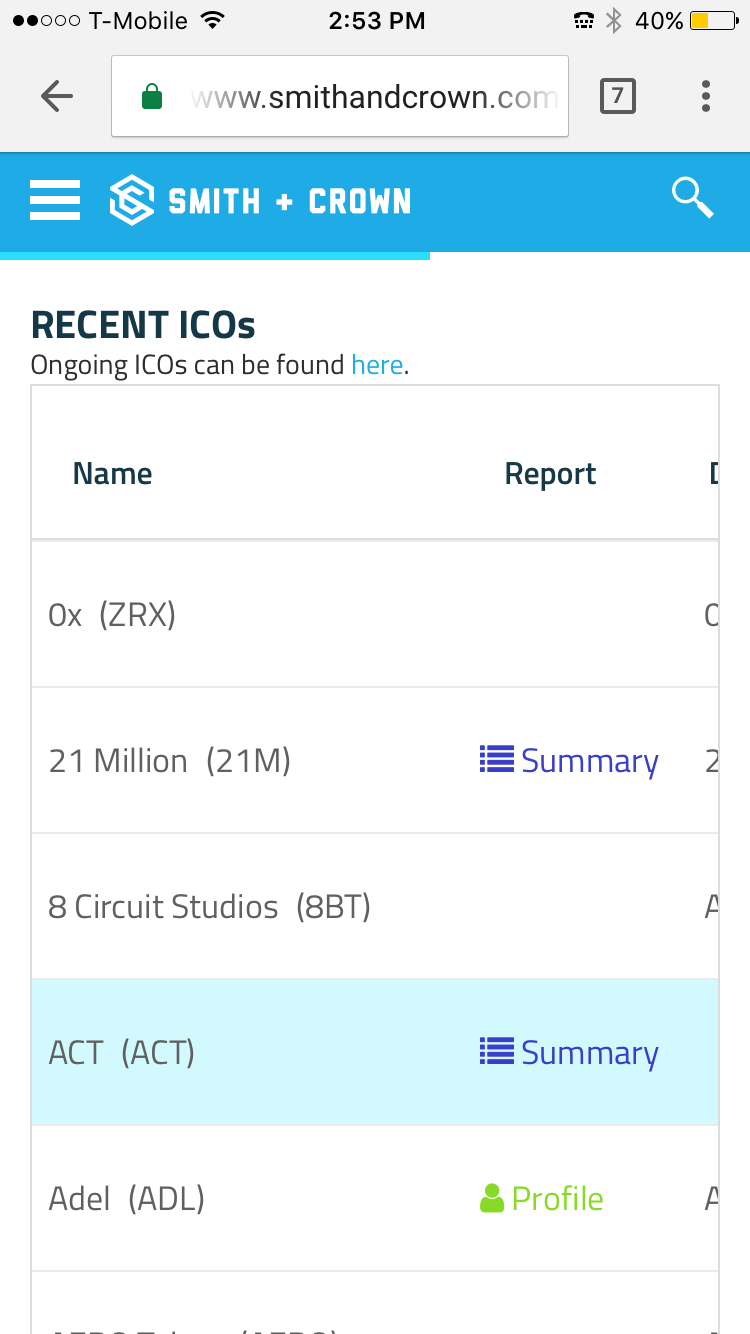

First take the top icos

I would take the top five Icos of each month by money raised. Then we need to look at the bonuses by time period. A lot of icos have 2-3 bonus levels to encourage early participation. We can look at the rate of decrease of the bonus from the start of the ico to the end of the ico to determine an internal rate. It's important to identify whether the ico hit its cap. If it didn't hit its cap it suggest the bonuses were too high for this analysis to work. In this case we should mark to market the first day price (which will likely be lower than the final period ico price) and calcuakte the bonus between early investors and first trading day ( which indicates a lower cost of capital)

Next sort the icos by cost of capital.

I suspect all these icos will have different embedded rates. We ought to be able to calculate a median and average cost of capital for icos for each month. I would few icos that hit thier caps and saw only a minimum first day pop as the best indicators. Icos with large pops are likely the second best group. Clearly the bonuses understated cost of capital but you could make an adjustment for the first day trading price to back into a good number. Lastly the icos that missed their first day pop. Again these could be indicative of a bad business model.

time series analysis

Taking this data we could track ico cost of capital by month. I suspect you will see a very high cost early in the year when it was hard to invest in icos followed with a decline later in the year as icos hit a bubble. Recently I suspect costs of capital are rising again as the ico market has not produced the large winners it once did.

finally takeaways?

Perhaps tracking cost of capital trends could highlight better times to invest in icos? It could also help identify bonus structures that are pricing in high.

sadly I do not have the data to perform this analysis.

It would be nice if someone would take on this project. I for one would want to see the results.