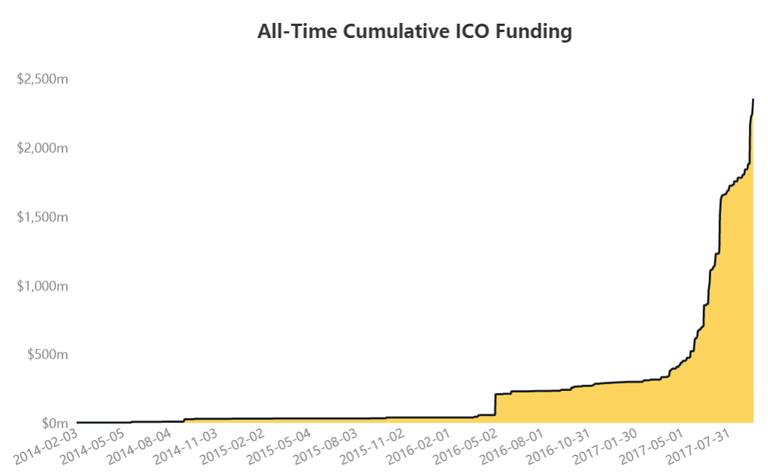

More than $2,2 billion has been raised so far by ICOs. What exactly is an ICO?

»ICO is an unregulated means by which funds are raised for a new cryptocurrency venture. An Initial Coin Offering (ICO) is used by startups to bypass the rigorous and regulated capital-raising process required by venture capitalists or banks. In an ICO campaign, a percentage of the cryptocurrency is sold to early backers of the project in exchange for legal tender or other cryptocurrencies, usually for Bitcoin or Ethereum.«

They have been hailed as the future and democratization of raising money, giving everyone access to the new and upcoming companies and recently surpassed early-stage VC funding for internet companies.

But they also have a darker side. In most cases, the tokens or coins being sold are for platforms and business that have yet to be fully built, or even worse, exist only as an idea. ICOs have been called »the wild west of financing«, existing in a legal grey area outside of securities law with no rules governing what a company should do with the money it raises.

As New York Times put it, »If you’re having trouble picturing it: Imagine that a friend is building a casino and asks you to invest. In exchange, you get chips that can be used at the casino’s tables once it’s finished. Now imagine that the value of the chips isn’t fixed, and will instead fluctuate depending on the popularity of the casino, the number of other gamblers and the regulatory environment for casinos. Oh, and instead of a friend, imagine it’s a stranger on the internet who might be using a fake name, who might not actually know how to build a casino, and whom you probably can’t sue for fraud if he steals your money and uses it to buy a Porsche instead. That’s an I.C.O.«

Even though ICOs are already a multi-billion dollar industry, there is still a huge intelligence deficit in the market. There is no S&P or Moody's to provide ratings as in debt, equity and commodity markets, and no investment banks that provide ICO research as they do for different companies. There is also no reliable ICO data aggregator, leaving investors with no choice but to gather all the data themselves from hundreds of different websites.

This is where icodata.io comes in.

Our mission is to provide high-quality intelligence, including ratings and research that will contribute to transparent ICO market and enable investors to make informed investment decisions. Our ratings are completely independent and might make a lot of people angry, but that is exactly the point. The market should not tolerate bad project raising millions of dollars from naive investors.

We ask the right questions. We do an in-depth analysis of the team, product and the market they are entering and try to determine whether they can actually pull it off. We check the ICO structure, its jurisdiction, and security and audit plans of the team. We also check the distribution of the tokens, hard cap and whether the team has any lock-up period on their tokens.

As transparency is one of the most important things in the ICO, we check the project's social media pages and Bitcointalk forum thread to see whether the team is communicating with the community and answering the hard questions. We also check if there is any code published on Github, how is it progressing and check the team's plans to decide whether they are realistic and measurable in the future.

All this data is input into our proprietary rating model that gives each ICO a specific rating, which aims to evaluate whether the project is one of those that will actually be successful in the long run. We will strive to constantly improve our model and offer better and better intelligence and data to our readers.

Check all the upcoming ICOs at icodata.io!

Congratulations @icodata! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!