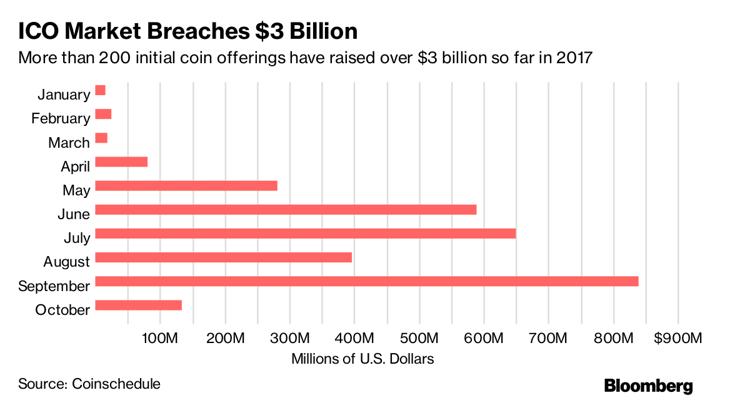

Contrary to Bitcoin, which has found its users by organic growth, ICO projects (Initial Coin Offerings) are supported by initial investments. These investments are made by a large number of investors who receive project’s tokens in return. The underlying thought of ICO projects is not only to create a new currency but to bring decentralization to an existing market or to create a new market. ICOs were booming like crazy this year receiving more than 3bln USD so far. No wonder many compare the current state of the ICO market to the dot-com bubble.

Just another "dot-com" bubble?

At the time the internet started to be adopted by the mainstream in the 90s, the majority of investors were blindly buying shares of internet companies hoping to make quick and easy money. Especially in 1999, it looked like it does not really matter which company you invest in. The stock prices of internet companies were skyrocketing and almost everybody had a feeling that the stock prices will continue growing forever. For example, a company called pets.com (e-commerce selling pet supplies) raised more than 300 mils. USD in their IPO. Unfortunately, the management of the company later found out that the market does not need their startup idea as much as they thought. A similar thing happened to the majority of internet companies from that era. It did not take long for a stock market correction to come resulting in 80% market drop. Only companies such as Amazon.com, which were solving real problems and real customer needs, survived. So does it make sense to invest in newly born ICOs or are they bound to have a similar destiny like most of the companies from the dot-com bubble?

Raising hundreds of millions of dollars is not the only necessary component for long-term success

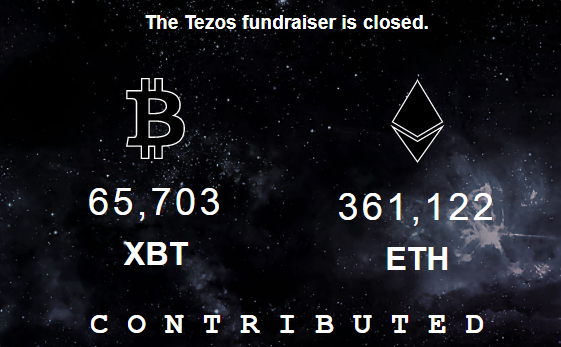

Many cryptoinvestors did not know that a pile of money is all that a team needs to succeed. Unfortunately, they learned it the hard way. Maybe you have noticed this article from Reuters, which talks about Tezos project. The founders of Tezos are currently suing each other to gain a control of their hundreds of millions of dollars worth of funds. This is unfortunately just another example of a project that is turning the wrong direction due to its overfunding. This is not a very intuitive rule, but the reality shows over and over again that a company that raises too much too soon loses its “mind”. So next time you see an uncapped ICO with no limit per investor please remember of Tezos.

Another criteria, which many projects fail to pass, is a solid team. Vitalik Buterin, the founder of Ethereum, had experiences from being part of crypto projects before he cofounded Ethereum. This is not a case of the majority of today’s teams. Not only they do not have experiences from previous crypto projects, which would be reasonable to understand since it is a new field, but they sometimes do not have a reputable history at all! Sometimes you can see ICOs that exploit identities of known advisors. Apart from other things we check this during our due diligence. So the projects we verified do not suffer this problem. Luckily there are projects such as Basic Attention Token, which has an all-star team led by the founder of Javascript and co-founder of Mozilla and Firefox. However all-star team does not guarantee success as well. According to Bill Gross, a well-known investor, and entrepreneur, the most of the startups fail due to bad timing. Companies like pets.com from the dot.com bubble are an example of this.

Investing in ICO projects is not for everybody like many ICOs suggest, however, if you know what you are doing, you can make a good amount of money. Most of the investors are buying tokens that will never substantially grow in value or that are outright scams. So in an article that will follow, we will describe how to eliminate the wrong ones.

But before we continue with the next article let us ask you: Which projects do you currently considering to invest in? Let's share to have a fruitful discussion.

Congratulations @icoindex.com! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP