Literally 1-2 years ago there was a real ICO fever and most of the projects were able to get good funding without having a strong project, implementing a business model and a team.

This was a relatively new sphere, which was of interest to investors. But with lost funds, interest faded and it became increasingly difficult to raise funds for the ICO.

So in this post I want to talk about five ico's which collected a decent amount and disappeared.

Opair

Amount of fees: 1500 BTC, which is approximately $ 12.5 million at the current rate.

Essence of the project: a decentralized platform for the provision of banking services.

The developers promised to make a revolution in the banking sector by issuing a debit card with the possibility of decentralization. In addition, the "planned" to create of maps with the possibility of using in real life. Fraudsters used to hide behind the high speed of operations, as well as the additional creation of a crowdaming platform to raise funds for an innovative idea. Scammers collected $ 1,000,000 and disappeared with all the money, removing social network accounts.

Signs of the scum:

Fake and suspicious accounts of the team and project in LinkedIn.

Use the same IP in several projects.

DeClouds

Amount of fees: 300 BTC as of September 2016, which is approximately $ 2.5 million.

Essence of the project: to create a platform for the release of tokens, which are backed by precious metals.

The project received a great response from investors at the expense of the expected rapid rate of exchange of operations. This was planned to be realized due to a more favorable arrangement of the node structure.

Signs of the scum:

The incoherent facts in the technical part, which were published in WhitePaper.

Fake photos with representatives of the Swiss bank UBS.

Tokens had no value and were not used later in the service.

Authorship

Amount of fees: 232 BTC, which is about 1.9 million dollars.

Essence of the project: decentralized service, which was to connect writers, translators, and publishers. Scammers promised to solve the problem of copyrights, as well as help with the monetization of novice personalities.

The projects ico was successful and raised funds thanks to a bounty campaign .

The first suspicions arose from the analysis of the online bookstore, which developers used to analyze and search for problems of authors and publishing houses. The fact is that the site was almost not functioning, which caused some suspicion among users.

Signs of the scum:

Rent a fictitious office.

Use in their publications almost non-working site.

Changing rules for charging tokens (more than 80% did not receive their tokens).

A generous reward for the bounty program.

Numbers inconsistencies in the documentation.

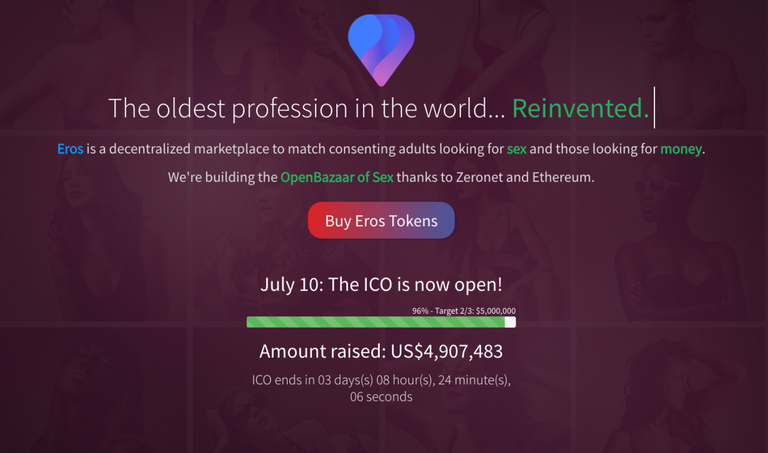

Eros.vision

Amount of fees: 7400 BTC or 61 million US dollars.

Essence of the project: a platform in the adult industry, which allowed to sell or buy non-standard services in the sex industry.

A key feature is the guarantee of complete anonymity, which is a key parameter in this area. Scammers offered the option of avoiding reality in the format: "no means - no fault" in the option of paying for services for tokens.

Potential investors were fed by the prospects for growth in the sex market. Accordingly, the cost of the tokens will also grow. After the collections fraudsters tried to play a script with a troubled history with the domain, and then transferred the deadlines, but eventually finished the work.

Signs of the scum:

Dummy accounts of the topic starters at bitcoitalk.

Fictional biography of teams.

The absence of a domain trust (the domain was purchased 7 days prior to the commencement of fees).

Tithecoin

Amount of fees: 5.8 million dollars.

Essence of the project: almost no information was published on the project, neither about the team, nor about the project.

Nevertheless, the project wanted to become a link between philanthropists and commercial organizations. This would solve the problem of financing, by paying out monthly dividends.

Signs of the scum:

Low activity on the bitcointalk forum.

Lack of detailed information about the team.

Doubt technical documentation.

Recommendations on how to conduct an ICO audit

Find profiles of developers and participants in social networks, on professional resources. Check their profiles in LinkedIn, as well as previous work sites. If there is no information, or it is very small, then most likely the projects are scam.

Analyze technical documentation, as well as see the presence of inconsistencies in numbers.

Ask a question in the social networks of the project and look at the speed of response and the adequacy of the answer. You can ask about technical features or clarify about the audit of smart contracts.

Check the real IP-address of the site, and also analyze whether there are additional sites on this server.

Check the availability of headquarters and legal documents.

Analyze the bounty program. If the team offers more than 10-12 percent of the total number of tokens, then most likely the project is a scam.

View the prototype of the product, which should be posted on the public service github.

Follow the road map of the project and statements. If the dates change constantly, plans are transferred and there are discrepancies, then most likely the project will not be able to fulfill its obligations.

Conclusion

Thus, a runaway OSINT will allow you to get a lot of interesting information, which will weed out an obviously fake project. For more in-depth testing, you need to test the beta version of the product and understand the token's economy. I hope the material was relevant and interesting. Do not invest in fake ICO.