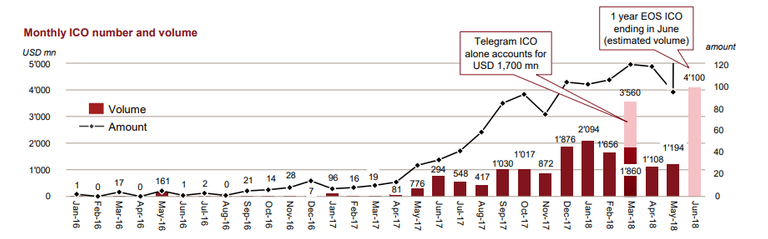

According to PwC - one of the four big auditing and consulting firms (Big Four) with Deloitte, EY and KPMG - 537 Initial Coin Offerings (ICOs) would have been conducted in the first 5 months of 2018. Those they would have managed to reap a total of $ 13.7 billion.

2018: more than 100 ICOs per month

ICO: Intial Corner OfferingThis study by PwC was led by Daniel Diemers, PwC Strategy's blockchain director for Europe, the Middle East and Africa. In cooperation with Crypto Valley and four analysts based in New York, Hong Kong and Zurich, this analyst has seen an acceleration in the activity of ICOs in 2018 - despite the 55% drop recorded by crypto-markets since beginning of the year.

Here's what we read in this report titled Initial Coin Offerings: A Strategic Perspective:

The researchers highlighted the rise in the popularity of ICOs around the world in 2018, with more than 537 ICOs conducted in the first five months of the year, raising a total of $ 13.7 billion. dollars - more than all ICOs that were conducted prior to 2018. This quarterly report on global ICO activity will continue to reflect changes and developments in the sector, with continued expansion and profound changes.

The vast majority of funds raised by these 537 tokens sales in the first 5 months of the year would come mostly from investors already holding large amounts of Bitcoins and / or Ethers, which they used to participate .

For the experts, the ICOs would have little influence on the price of the two main cryptocurrencies. Indeed, even if these startups will have to dump large amounts of BTC and ETH on the markets to finance their development, these currencies would then be bought by other investors to take part in new ICOs.

Last February, Fortune magazine reported that nearly half of the ICO-generated tokens conducted in 2017 had already failed, completely disappearing from crypto-markets: last year, these projects had a failure rate of 46%. A figure that climbs to 59% if we take into account the startups who are dying because of a lack of community support and / or capital.

A market that is gradually getting better

Mr. Diemers believes that after the frenzy generated in recent months by blockchain projects, the ICOs sector will gradually mature, thanks in particular to the regulatory changes that should occur in the coming months. He predicts that the failure rate of ICOs should decrease, and that an increasing share of these projects will be able to reap the financing they need.

After the frenzy noted in 2017, 2018 seems to be the year in which the ICOs sector is becoming more and more mature and established, focusing on the best practices around business dynamics, legal compliance, relations with companies investors and fundraising. Hybrid financing models combining venture capital and ICO now offer the opportunity to capitalize on the best of both worlds, validating the viability of a startup's business model, while being able to fully exploit its commercial potential through the support of many investors, "he said.

Hi i gave you an upvote dont forget to follow me for future upvotes & i always follow back

fb/john.thephotoeditor.56