With the huge price surge Bitcoin and other altcoins have experienced over the last few years, suddenly everyone is jumping to get a piece of the action and we have so-called crypto gurus popping up all over the place claiming to be able to predict the future (Bitcoin will rise to $100,000 in 2018 etc., etc.) by analyzing market patterns. On the other hand; the naysayers are calling for a “bubble burst” yet crypto currencies have rebounded from every price correction as crypto chasers hoping to make a quick buck beat a hasty exit disproving this negative reaction which was purely based on speculation such as the banning of cryptos, which will never happen anyway. “When speculation runs rampant everyone panics and sells, causing price drops.” Only sell an asset where there is a rational reason, not an emotional reason and, obviously, “Don’t put all your eggs in one basket.”

The truth is: most people just got lucky. Crypto currency is a unique product for which the only way someone can predict future trends is to know how all the major players will react and behave at each moment in time, i.e. the Governments, regulators, billions of people and other crypto currencies which may be introduced.

There is a ton of money to be made in cryptos but most people don’t have a clue what they are doing.

Crypto currencies are a speculation (albeit a very profitable one) rather than an investment which requires a reasonable knowledge of an assets real market value.

Bitcoin is now regarded as an asset rather than currency due to a failure to deliver on two specific points:

Failure due to inherent inefficiencies to become a mainstream alternative to money as we know it as was originally intended and

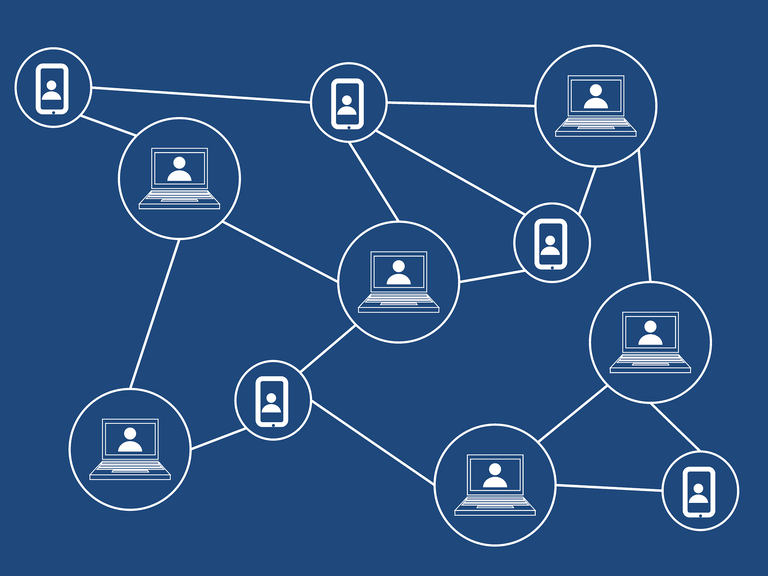

As one analyst put it “Bitcoin presented a choice that has never existed before. Its mysterious creator Satoshi Nakamoto described it as “a distributed system with no single point of failure” where “users hold the crypto-keys to their own money and transact directly with one another, with the help of the P2P network to check for double-spending.” The promise was to build security through cryptographic proof, replacing third-party trust and creating networks resilient to counter-party risk.” The rise of these “exchanges” has resulted in the exact single point of failure Bitcoin set out to provide a solution for.

Bitcoins current price does not matter so stop checking the price every 5 minutes.

As with any other currency and/or asset Bitcoin's and Altcoin's value will eventually stabilize and be driven by pure demand and supply and all the indirect variables influencing these.

For those who claim that Crypto currencies have no real value. Yes that is true, but neither does the U.S$ since its peg to gold was removed. In real terms the dollar is only worth the paper it is printed on. Rather what gives the US$ value is confidence. Confidence in what it represents, confidence in the US government and confidence in the economic environment and stability. The recent, almost overnight appreciation of the South African rand the moment people knew with certainty that Jacob Zuma was on his way out after Cyril Ramaphosa was voted in as the new leader of the ANC is a classic example of the effect business confidence has on the value of a currency.

A great part of Crypto currency’s success and future potential price rises is based on the blockchain's potential and people's growing dis orientation with their governments especially since the great recession with most central banks arbitrarily creating extra currency.

In the case of normal currency, databases exist and are owned and controlled by the banks. A country’s central bank controls the money supply via monetary tools such as the interest rate. As basic economics assumes: an increase in the money supply = an increase in the rate of inflation.

A blockchain is exactly the same; an online database of every transaction with two major differences:

Rather than the banks or governments centralized ledger the blockchain's ledger is owned and shared by all users of the blockchain thus no one person can alter it.

The crypto market capitalization, or money supply is limited and thus valuable, hence it’s comparison to gold. In fact most crypto’s market capitalization pales in comparison to the money supply of most currencies.

The crypto currencies main advantage therefore is; it is not the US$ and it is not controlled by any government and therefore I am less likely to have my life savings wiped out in an instant. I can also keep Cryptos stashed away from the prying eyes of my government who will want 30% or so as taxation.

Crypto currencies are still in a very early stage and hence the speculation and wild price volatility. Once the market settles down and equilibrium is reached as the market determines the price, Cryptos will stabilize and become stable enough for retailers to accept.

In conclusion, the market capitalization is more important than the price. The demand is based on, number of users, velocity and volatility. If cryptos work, the current price is irrelevant. The major draw is the underlying blockchain technology which has the potential to greatly reduce costs and revolutionize life as we know it. Money is just the beginning.

resteemed!

Thanks, much appreciated.

Resteemed to over 10500 followers and 100% upvoted. Thank you for using my service!

Send 0.100 Steem or 0.100 Steem Dollar and the URL in the memo to use the bot.

Read here how the bot from Berlin works.

We are happy to be part of the APPICS bounty program. APPICS is a new social community based on Steem. The presale was sold in 26 minutes. The ICO will start soon. You can get a account over our invite link: https://ico.appics.com/login?referral=1fRdrJIW

@resteem.bot

Resteemed by @resteembot! Good Luck!

Curious?

The @resteembot's introduction post

Get more from @resteembot with the #resteembotsentme initiative

Check out the great posts I already resteemed.

Your Post Has Been Featured on @Resteemable!

Feature any Steemit post using resteemit.com!

How It Works:

1. Take Any Steemit URL

2. Erase

https://3. Type

reGet Featured Instantly – Featured Posts are voted every 2.4hrs

Join the Curation Team Here

This post has received a 100.00 % upvote from @steemdiffuser thanks to: @topgeek. Steem on my friend!

Above average bids may get additional upvotes from our trail members!

Get Upvotes, Join Our Trail, or Delegate Some SP

"The crypto market capitalization or money suppply" is not limited. Or please tell where the limit is? At 850 Billion Dollars or where? Why should "the market settle down and reach an equilibrium"? Which equilibrium between what? There will be a indeed an equilibrium but not between crypto currencies.

The market cap is indeed limited. There are a finite number of bitcoins and any other crypto that can be produced. For bitcoin it is 21 million BTC. That's it and bitcoin is estimated to reach that around 2110, a very shrewd form of monetary policy to prevent inflation. So that is the limit. Compare that to the Swiss Franc's current money supply of almost 1 trillion. If your argument is that cryptos can continue to be created, sure until people find a solution for their needs and there will always be those more in demand than other. Think how many currencies in the world today. Equilibrium is an economics term and describes the point or optimum where demand and supply cross and are thus equal i.e where the quantity produced is consumed at a particular price exactly as any other good. Or from study.com "Definition of Market Equilibrium. Market equilibrium is a market state where the supply in the market is equal to the demand in the market. The equilibrium price is the price of a good or service when the supply of it is equal to the demand for it in the market." I hope this answers your questions. For your reference: https://en.wikipedia.org/wiki/Economic_equilibrium and https://en.wikipedia.org/wiki/Bitcoin. I also notice that you yourself posted a cointelegraph article about 80% of bitcoins already having been mined. https://steemit.com/bitcoin/@manfredkurtauer/nearly-80-of-all-bitcoins-are-already-mined

Greetings! I am a minnow exclusive bot that gives a 5X upvote!

I recommend this amazing guide on how to be a steemit rockstar!

I was made by @EarthNation to make Steemit easier and more rewarding for minnows.

This post has received a 4.50 % upvote, thanks to: @topgeek.

Wish Granted. May all your dreams be True.

0.2 sbd transformed to $.66 upvote

Gratititude for @earthnation

One Wish/ Week

I Love You, Lila-Wish-Genie

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by topgeek from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

This post has received a 4.59 % upvote from @getboost thanks to: @topgeek.