Hey all,

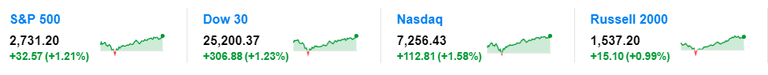

I hope everyone is having a fantastic night. Before I get to the main topic, I wanted to briefly talk about our markets today. We saw another green day for our stocks. Our indices have been recovering nicely after our dip early last week.

I've had a lot of friends lose a lot of money in stocks and more recently cryptocurrency. With a strongly volatile market such as the crypto market, it's really important to know what you are invested in, and most importantly, how much. That brings us to the question of discussion:

How Much Money Should I Invest With?

To be honest, I cannot answer this question for you. I can only give you tips to make sure you never put yourself in a financially unstable situation. The first thing I want to say is

Only Invest What You are Willing to Lose

While this is a very basic concept, it is one that we see investors trying to cheat the most. Take for example the crypto market in December and in early January. Bitcoin had just hit more mainstream news channels and everyone thought it was "going to the moon". Regarding Bitcoin along with other cryptocurrencies and the blockchain in general, many projects are very impressive and could be great to implement in the near future. However, this does not mean you should throw all of your money at something you don't fully understand.

Back in December, I've heard many stories of people putting mortgages on their houses or dipping deep into their savings account to buy Bitcoin when it was nearing $20,000. Twitter was blowing up with heartbreaking stories of people losing a lot of money that they couldn't afford to lose. This is why I say only invest what you are willing to lose. For some, that's $10,000. For others, maybe it's $100, or $20. The fact of the matter is, you shouldn't be emotionally attached with the money you invest. Prices go up and they go down. Everyone loves seeing their investment rise, but people get very emotional when their investment dips. These fluctuations are normal. If you invest what you are willing to lose, you will buy and sell less on emotions and focus more on percentages.

Get Your Feet Wet - Start Small

As I eluded to earlier, it is very important to understand fully what you are invested in and what news the company / projects are bringing to their shareholders, for better or for worse. If you are new to investing and do not know how much to start with, start smaller. If you start small and have a little money in the markets, you will be more inclined to do your research and keep your mind in the game. If you start small, you will learn and begin to develop personal market strategies. If you are comfortable with your strategies, you could consider adding more money to your portfolio. Until then, start small and learn from doing.

Congratulations @apinvests! You received a personal award!

Happy Birthday! - You are on the Steem blockchain for 1 year!

Click here to view your Board

Congratulations @apinvests! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!