China retaliates on tariffs and markets bounce. The bounce puts the pressure on interest rates and they rise a little. New trades on interest rates and the General Electric opportunity I found yesterday. 56 Percent club has new leaders and strong risers in cobalt miners.

Portfolio News

Tariff Tantrum Bloomberg presenter this morning says he was expecting to be talking about a bloodbath (his words) in the markets and instead watched a 700 point swing in the Dow Jones Index from the trade war fueled fear low start. "If you had the wherewithal to buy at the entry of the day you could have made a killing" was his next line. 3% is not what I call a killing but it is better than a bloodbath.

The market is in a difficult place as the Trump agenda moves from the jobs done so far (tax cuts and healthcare) to the promises partly delivered - the Mexican border and trade protection. What became clear during the day was that the tariff announcement was the first stage in a negotiation process - if the negotiation is allowed to happen this may not be as bad as people fear.

Falling FANGs Mark Zuckerberg, CEO of Facebook ran a teleconference covering the fallout of the Cambridge Analytica data debacle.

Given the scale and sophistication of the activity we’ve seen, we believe most people on Facebook could have had their public profile scraped in this way, so we have now disabled this feature

They underestimated the extent to which people would go to get access to data and they misread what their responsibility was.

Hello!!

There is no shortage of Internet Marketers who will scrape any data they can lay their hands on - and market with it. That seems to be OK BUT when somebody does it for political purposes, is it any different? Facebook share price recovered.

Bought

General Electric Company (GE): US Industrials. Yesterday I wrote about US Industrials and old dog GE (see TIB212). The short term charts are giving me a feeling that the bottom may have been found for GE after its horror run. It would really be better trading to wait for a confirmation of the uptrend before taking the trades on but the thought of profit potential of well over 300% for a 50% rise in the stock price in the next 20 months proved irresistible. I bought a January 2020 15/20 bull call spread for a net $1.05 premium. This offers maximum profit potential of 376% if price reaches $20 on or before expiry. That is a 50% price increase from the $13.28 close.

There a several risks in this trade

- Managment may not make the changes that are needed

- There may not be enough time for the trade to work through to the targets

- China is an important growth market for GE especially in aircraft, power generation and hospital equipment segments - a trade war would not be good news

A quick reminder of the chart I posted yesterday with the new sold call (20) superimposed in green. Pink arrow repeats and this trade is a winner.

Shorts

Every time the stock markets have a wobble, short term interest rates slide.

Eurodollar 3 Month Interest Rate Futures (GEZ9): In the last 6 weeks price has tested the 9725 level 3 times and rejected it. This is a battle between those that believe the Federal Reserve will make 5 versus 6 rate hikes in the next 20 months. I added another short position on December 2019 futures.

Euroswiss 3 Month Interest Rate Futures (SU8): Keeping the Eurodollar chart in mind, I am baffled how Switzerland can still be projecting a negative interest rate. The chart shows a solid resistance line at 100.715 over the last 10 weeks. I added another short position on September 2018 futures. The cumulative losses as things stand are not that comfortable but there is enough time for this trade to test the lows on the chart in the next 7 months - it was there 4 months ago.

56 Percent Club

Another month passes and it is time to report on the stocks and options that have done better than 56 percent up. Each month, I review all my portfolios and tabulate the 56 percent movers from all time and highlighting the ones from the last 12 months. I review stocks and options separately.

First is the table of stocks. I have highlighted ones that are new to the club in Yellow. I have also marked up whether they have gone up or down since last time.

A bunch of things stand out:

- The list is shorter than last time (24 vs 27). I left Technology Select Sector ETF (XLK) on as it was 55.45% up

- Last month leader (Cobalt Blue - COB.AX) went up another 230% and is joined in number 2 by its largest shareholder (Broken Hill Prospecting - BPL.AX) up 185%

- Cobalt is the big winner with Alloy Resources (AYR.AX) making it to the list with 84% growth since July 2017.

- Climbers on the list are a surprising mix, cobalt, a gold miner, US solar power, European Mid Caps and Russian Gas. The Europe Mid Caps move tells me that despite the selloff economic fundamentals are still solid.

- Dropped off the list are casualties of the tariffs on steel (Arcelor Mittal - MT.AS and Osaka Titanium - 5726.TK) and the tech selloff (NVIDIA - NVID).

- Last months new entrant Aegon (AGN.AS), the Dutch insurer, could not hold the heady heights.

On the options side

What stands out here:

- A shorter list with 17 entrants vs 27 last time after 4 sold for profits

- A new leader in Cisco (US Technology). This surprised me as the backdrop has been a technology selloff. HollyFrontier (HFC) was number one last time but I sold that holding

- I did sell holdings in US media (DISH TV - DISH), US oil refining (HollyFrontier - HFC), US industrials (XLI) and US homebuilders (XHB). I also rolled contracts in US interest rates (TMV) and US regional (KEY and HBAN) and money centre banks (BAC) which took them off the lsit

- Fallen off the list are some solid themes - US regional banks (KRE) , US retail (JCP) and US Technology (XLK)

- More fallers than risers with rises in oil exploration (SGY), US airlines (DAL) and CISCO and two US regional banks. There is a divergence going on in regional banks with some doing appreciably better than others.

- The almost doubling of French utility Electricite de France (EDF.PA) is a story of fixing a business and safe haven flows to utility companies.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $720 (9.7% of the high) for an above average volatility day. Price looked like it wanted to go higher making a higher high on the 4 hour chart - and then the sellers stepped in against $7500 - don't you just hate those round number traders!!

CryptoBots

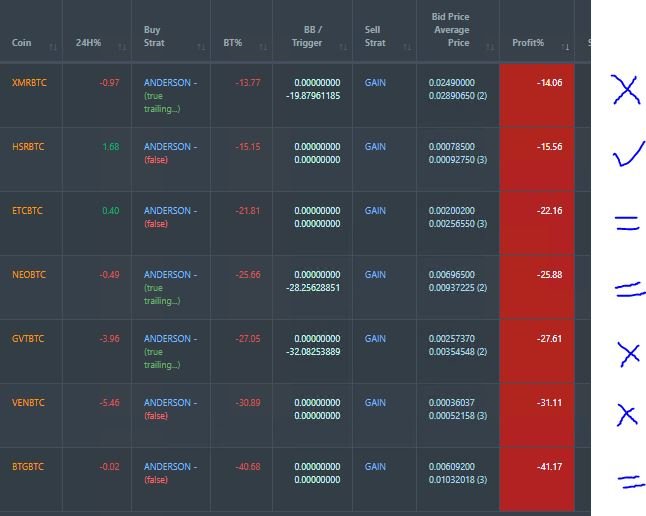

Outsourced Bot No closed trades on this account. Problem children (>10% down) list was unchanged - ETH, ZEC, DASH, NEO, ENG, EOS, STRAT, ETC, XLM, ADA, QTUM, BTG, ARK, GAS, OMG.

XLM went back to full problem child status

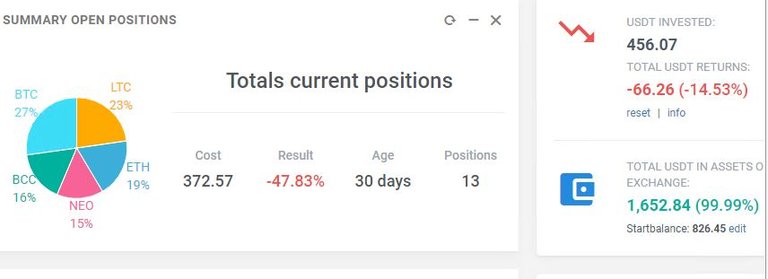

Profit Trailer Bot No trades closed

Dollar Cost Average (DCA) list was unchanged with 3 doing worse, 2 doing better and 2 somewhat unchanged. Only 2 coins went up in price during the day

New Trading Bot No change as this is now under buy and hold management and the bot is not trading. Overall loss average is worse to -48% (was -42%) with NEO still the worst with both trades down over 60%

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 9.6% (lower than prior day's 10.4%).

Outsourced MAM account I run an outsourced forex trading account with Actions to Wealth. They closed out 2 trades for 0.37% profits for the day. They trade AUDNZD pair exclusively now.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Bloomberg.com. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

April 4, 2018

so much info, nice

Thanks