Interest rate markets are spooked especially in Europe as rates fall. US markets did not like the North Korea news last week. The back on summit news will buoy markets when they reopen after the Memorial Day weekend. Only one income trade to report with a lower strike price on Commerzbank hooking a buyer.

Portfolio News

Market Jitters I have written about an uncomfortable feeling in interest rate markets.

The headlines confirm this - in one news snippet we see headlines talking about "largest weekly drop" and "ticking higher" - all in the space of a week. It seems that I may not be the only one feeling the discomfort. I shared a chart on Euribor December 2020 futures on Friday. In the space of 9 days, European interest rates have given up 20 basis points from 99.50 to 99.70 and are back testing the highs seen in late 2017.

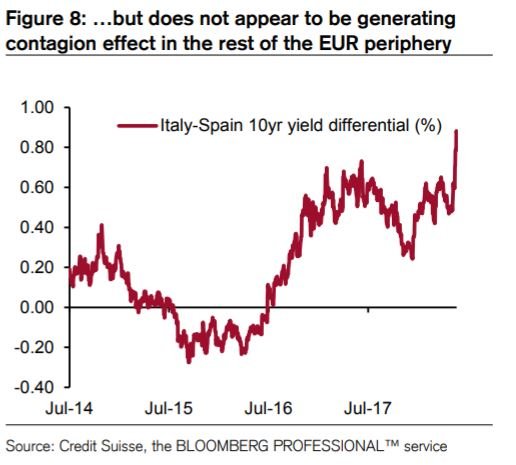

What are the drivers is anyone's guess. There is no doubt that inflation expectations are subdued. There seems to be a softening in European GDP numbers. What is certain is that the political shenanigans in Italy are rekindling some of the old fears of a debt crisis, that could spread into a Europe wide contagion. It is not what the headlines are saying but the FEAR is there.

Just read between the lines on the headlines. Will the ECB take action to protect Italy or the Euro? Will the EU evict Italy directly or push them to leave? Will markets do what the EU will not? Is there contagion risk?

There is some evidence that there is no contagion. For example, differential between Spain and Italy 10 year bonds has widened by 20 basis points which is about what Euribor has changed. This suggests that it is only Italy that is moving.

The ECB is a major holder of Italian bonds and is, therefore, acting as a sort of "anchor investor"

Markets always do the unexpected when there is a participant that appears always on one side of the market. We have seen it for years in the Japanese Government Bond market with the Band of Japan always on the buy side. We see it now in Europe.

My instinct is the way Euribor is moving is giving us clues about the real crisis that is emerging in financial markets. The European Central Bank is expected to be ending its bond buying program sometime in late 2018, early 2019. Ideally they will be doing this when market rates are quite a bit higher than they are now. Worst case scenario is, this could coincide with the Federal Reserve needing to drop rates as the next US recession begins. We will then see the two major monetary authorities moving in opposite directions. The Euribor price moves are already telling me that the market thinks the ECB will not be raising rates in the next 18 to 24 months. Somebody has got it wrong.

Of course the key news for US marklets when they open after the Memorial Day holiday is the "on again" North Korea summit. The TV images of the two Korean leaders meeting on Sunday gave me goosebumps - it is so important for the world. I hope this is not all a game of bluff.

Income Trades

One income trade taken up after I put out a bid at a lower strike price. German banks took a hit with the falling interest rates.

Commerzbank AG (CBK.DE): German Bank. Sold June 2018 strike 10.2 calls for 0.83% premium (1.13% to purchase price). Closing price €9.59 (lower than last month). Price needs to move another 6.4% to reach the sold strike (tighter than last month). Should price pass the sold strike I book a 44% capital gain. Income to date amounts to 26.6% of purchase cost.

Cryptocurency

Bitcoin (BTCUSD): Price range for the weekend was $448 (5.8% of the high). Price tested the lows several times over the weekend and seemed to respect the same level from the prior week's lows. If price does not hold this level, I will not be surprised to see a test down to the next level below ($6463).

This chart is beginning to feel like the inverse of the Euribor chart. Fundamentals vs Fear.

CryptoBots

Outsourced Bot No closed trades on this account (205 closed trades). Problem children was unchanged (>10% down) - (15 coins) - ETH, ZEC, DASH (-43%), BTS, ICX, ADA, PPT, DGD (-41%), GAS (-49%), STRAT, NEO (-46%), ETC (-42%), QTUM, BTG (-46%), XMR.

DGD joins the -40% club (now 6 coins) with GAS still the worst at -49%, letting go of -50%.

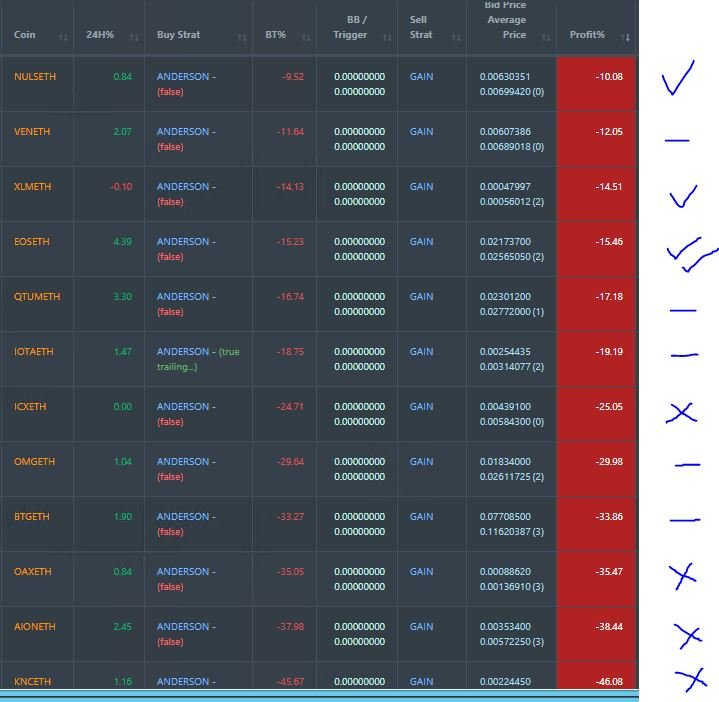

Profit Trailer Bot No closed trades. Dollar Cost Average (DCA) list was unchanged at 12 coins with 3 coins improving, 5 coin trading flat and 4 worse. Biggest move was EOS which improved 12 percentage points ahead of its mainnet launch this week coming

Their mainnet launch this week is the first real challenge in determining if, years from now, they will still be a relevant cryptocurrency. This is the week EOS converts from the ERC-20 platform to their own EOS blockchain

http://bitcoinist.com/3-cryptocurrencies-ico-major-events-june-etc-eos-ont/

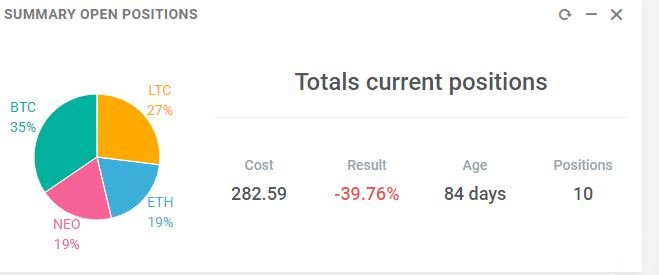

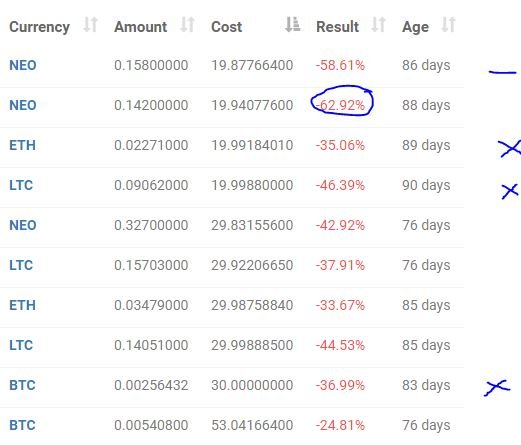

New Trading Bot Positions dropped another 1 point to -39.7% (was -38.5%).

NEO traded flat since last report and ETH, LTC and BTC all went down a little more.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 10.6% (lower than prior day's 11.0%).

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work. Italy image from Pixabay. Bond spread image is credited below the image.

https://pixabay.com/en/italy-flag-map-country-symbol-1021755/

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

May 25, 2018

Upvoted ($0.19) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

I love your posts, so informative.

I always follow you for always sharing information

Great content! I appreciate the insight!

Thank you very much for the information, I am very impressed with your post @carrinm, amazing.

Highly valuable information @carrinm, people seldom do the same as you, I really appreciate with your post and allow me to resteem as well.

I hope you will always be lucky in every transaction.

I always follow you perfect information sharing can be a motivation for me @carrinm

This includes one piece of information about investing heavily from you @carrinm and whether you are one who likes to invest. maybe you can invest with some people in Indonesia, I agree with what tib you share and hope success always accompany you @carrinm.