Markets were hammered by the Italy story. I add to Europe bank holdings at the top and bottom of the pile. Some contrarian trades in Russia and Emerging Markets. I follow up on the lithium play by Korean steelmaker. Interest rates continue their fall

Portfolio News

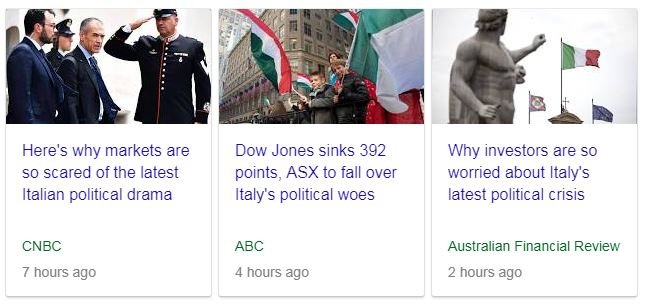

Europe Muddles US markets ignored the prospects of the on again North Korea summit and focused on Italy. The market response was widespread especially on the banks. Weirdest part was US banks dropped as much as European banks.

The fear flowing through the markets was that the crisis in Italy leads to a slowdown in Europe which will flow through to lower exports from US. The next leap of belief is that this could delay a Federal Reserve rate hike and impact bank profitability.

My first take is always that the market over-reacts - panic before logic. In time markets do come back to the data - US jobs data comes out this coming Friday. Here is some logic.

It's not a full-blown European sovereign debt crisis yet. For one thing, the Italian 10-year yield is a little over 3 percent. Back in 2012, it was at 8 percent. It's not the same situation yet

What is more the Italy yield is now about the same as the US yield - this is the way markets are supposed to look in normal times.

I did notice what looked like a topping out on short term interest rates while the bank markets were collapsing - see the last red bar. I am sure hoping it is a proper topping out as my short exposure is quite large. [Note: rates are falling when the price chart rises]

Mirrored also in European rates.

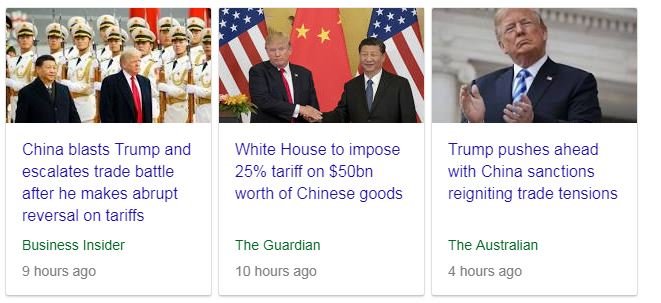

It was a perfect day to make an announcement about China tariffs with a 25% tariff on $50bn of Chinese goods containing “industrially significant technology”. Market was falling over already.

https://www.theguardian.com/world/2018/may/29/white-house-tariffs-chinese-goods

Bought

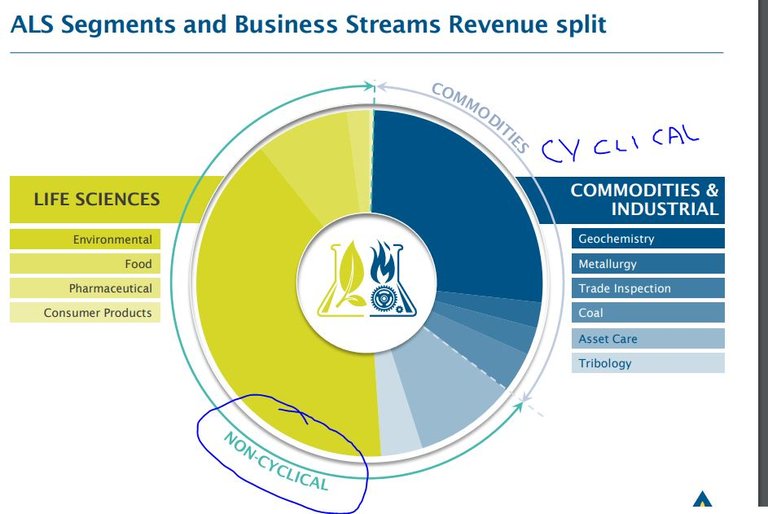

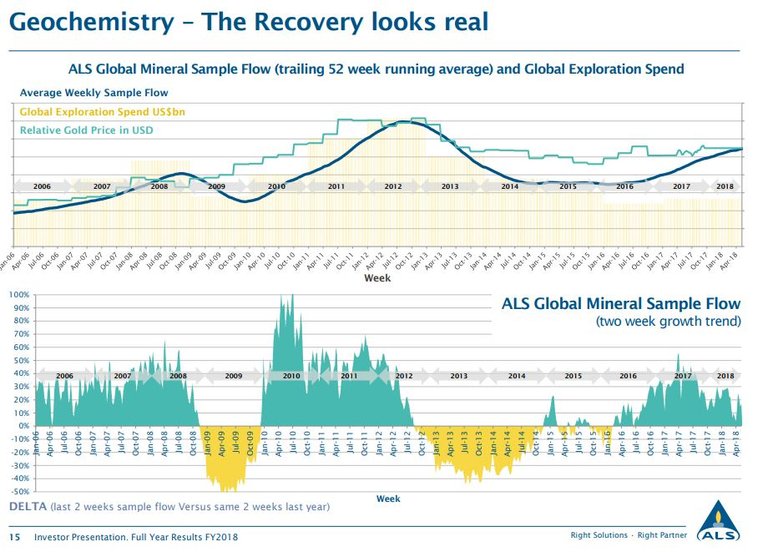

ALS Limited (ALQ.AX): Analytical Testing Services. ALS announced results on May 28 which showed a 21% increase in profits and an increased final dividend. Forward guidance was for more of the same as they felt the commodities cycle had bottomed out and that would flow through to the profit line. The market did not like the guidance and knocked the price back by nearly 10%. I had bought the stock as I felt it was well leveraged to the mining cycle.

I read through the investor presentation that accompanied the results which confirmed my thesis - here are the key charts.

The core life sciences business is highly profitable. The mining cycle adds revenue flows to a business that knows how to generate profits.

I added to my holding to average down my entry price and also grabbed the final dividend which is paid week after next.

Commerzbank AG (CBK.DE): German Bank. Italy/Spain muddles smashed all banking stocks across Europe with contagion fear running riot. When European markets opened Commerzbank shares dropped more than 5%. I had been looking across the European banking charts during the day. Commerzbank ranks lower than its European peers in France, Spain, Italy and Netherlands with only Deutsche Bank (DBK.DE) in Germany worse. It is the bottom line on the chart, some 200 percentage points below the leader ING (INGA.AS)

I looked at option markets but implied volatility had spiked and I am well invested there already. I added stock to one portfolio to increase my holding and to another portfolio to open a position. I will fund these new positions by reducing holdings of the Europe Index funds I hold (when the calm returns). I am pretty sure that the Europeans will find a way through the muddle and that interest rates and banking profitability will go back to a more normal path. It could take some time and patience.

ING Groep N.V. (INGA.AS): Dutch Bank. ING has been a strong performer compared to other European Banks (see the chart above). Its share price was also knocked back hard in early trading. I reviewed the possibility of adding to the January 2021 options trades I added in March 2018. I was able to buy January 2022 strike 14 call options for less premium (€1.25 premium with closing price €12.62) than I paid last time for one year less to expiry. It feels like a no-brainer. In 4 and half years from now we will have forgotten this Italian crisis, we will have interest rates appreciably higher than now and banks profits will be better than they have been. The next no-brainer part is price has spent the best part of the last 12 months above 14. In fact it has been above breakeven for this trade more than half of the time.

Rather than create a new chart, I will just update the one from last time.

Price appears to following the red arrow scenario I presented then - all I need is for the blue arrow to happen sometime and I now have another year to be right. (See TIB209 for the rationale for that trade)

POSCO (PKX): Korean Steel. I wrote in portfolio news yesterday (TIB237) about Posco buying the salt brine lithium tenements from Galaxy Resources (GXY.AX) as part of its electric vehicle positioning. I did notice that Bloomberg had seen the news too. I bought a small parcel of stock via the US-listed ADR's at market open. Had I been a little more patient I could have scored a lower entry price with a limit order as price did pull back lower than my entry. I will keep tabs for a few days and see how the selloff goes - I could add some more. I am hopeful too that some deal emerges for North Korea - that has to be good for South Korean steel apart from the lithium and electric car angle.

VanEck Vectors Russia Small-Cap ETF (RSXJ): The talking heads were going on about Italy and the selloff and the contagion risk. One suggested that a way to avoid contagion risk is to find markets that are less affected by it all, like Russia or South Africa or Turkey. He was not wrong as two countries did go up despite the rout - Turkey and Indonesia following central bank action in each. Now the selloff did also affect oil which affects the overall Russian index quite deeply. Rather than buy the Russian index, I averaged down my entry price on Russian small caps which are somewhat isolated from Italy and oil prices. Life in Russia will go on.

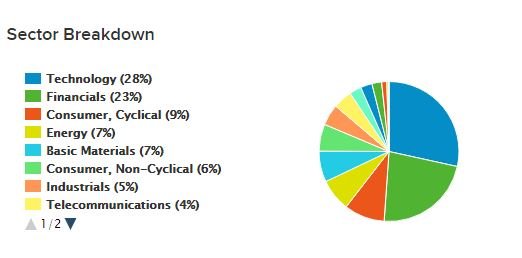

iShares MSCI Emerging Markets ETF (EEM): This is a contrarian idea which came from Real Vision. Emerging Markets have taken a pummelling with the rising US Dollar and falling emerging markets currencies. This is despite the fact that emerging markets economies, with a few exceptions (like Turkey and Argentina), are growing. The trade idea comes from the composition of the EEM ETF which has changed dramatically over the last two years say. See if you notice anything in the list of the top 15 holdings?

This is not the old EEM dominated by old world manufacturing and resources businesses. In the top 15 holdings are 9 technology companies accounting for close to 25% of the ETF.

[Note: Naspers is a South African publishing house which is the largest outside shareholder of Tencent, owning 33%]. Using the iShares classification we can see that 32% of the holdings are in IT or telecoms. I have dug into the detailed holdings and there are many listed under other categories that could be ranked as technology companies (e.g., Naspers is listed as Consumer Discretionary)

The contrarian idea is that this ETF will begin to behave more like the technology ETFs when earnings continue to flow strongly and prices move accordingly. How does this stack up on the charts?

For the chart I am comparing China Technology ETF (CQQQ - red line) to US Technology Index (QQQ - yellow line) to S&P500 (orange line) to Emerging Markets (black bars). Over the last 5 years, EEM has underperformed both the technology indices by close to 120 percentage points. If the thesis is correct, there could be a re-rating for as much as 30% or even 40% of the gap - say 35 points which would take EEM to +42% (the pink ray) which is a lot closer to where S&P500 is. This equates to a share price of $60 - 33% above current levels.

I chose to explore the idea with options trades with January 2020 expiry. Closing price on May 28 was $46.43 - I bought strike 46 and strike 47 calls (in different accounts) for 9.8% and 8.9% premium. If price does reach that re-rating target in the next 18 months, profit potential is 207% on the 46 strike (208% on the 47 strike)

The challenge is to guess how long this will take and to believe that investors will work this out and not get carried away in a wave of emerging markets fear.

Sold

Associated Banc-Corp (ASB): US Bank. Sold November 18 strike 19.77 call warrants for 255% profit since November 2013. This was a trade idea from my investing coach who identified a number of call warrants that were issued as part of the TARP bailout after the GFC. These particular warrants have been in-the-money since October 2016. It would have been better to sell them then and convert to stock as the stock pays dividends. The warrants do not.

ING Groep N.V. (INGA.AS): Dutch Bank. I am holding some June expiry short term options. These were looking fine until Italy/Spain story hammered the ING stock price. There is not enough time to expiry for price to recover. I sold the June options and rolled out to August options with the same strike (€13.5 vs closing price of €12.62). Premium was a modest €0.20 but I do have to recover the €0.35 lost on the sold leg and trading costs of €1.10 per contract (ouch!)

Shorts

Eurodollar 3 Month Interest rate Futures (GEZ): The margin call came along on my IG Markets accounts. I was holding one position of December 2018 futures (short) which was profitable. I closed that position and will hold onto the December 2019 futures. I topped up the margin account to avoid forced selling by the broker.

Cryptocurency

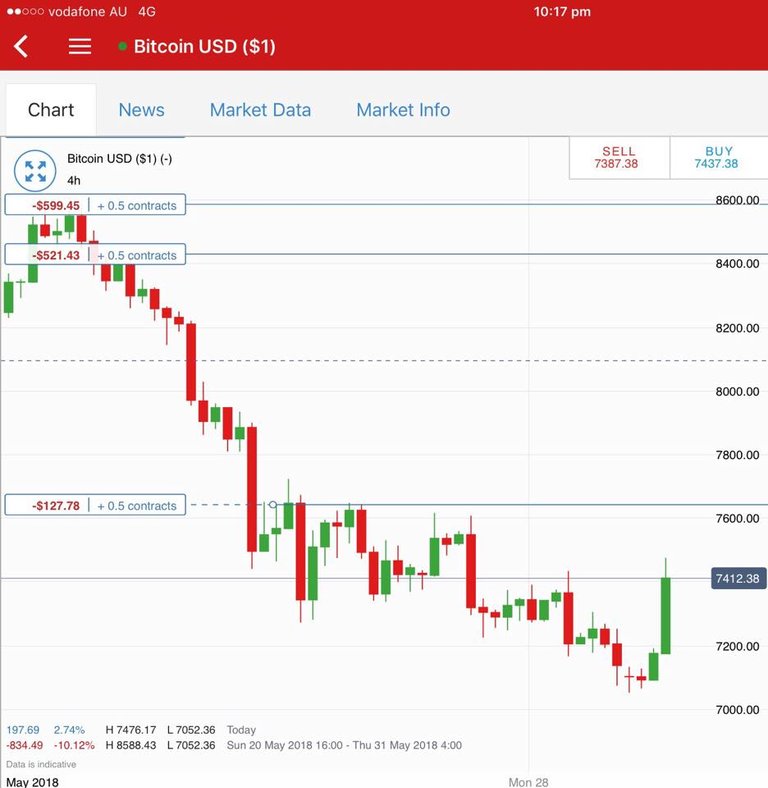

Bitcoin (BTCUSD): Price range for the day was $511 (6.8% of the high). Price made a bullish engulfing bar and closed above the support line. Whew!

Coupled with the falling interest rates on Eurodollar and Euribor, I got the dreaded margin call on my IG markets account when price plumbed the lows.

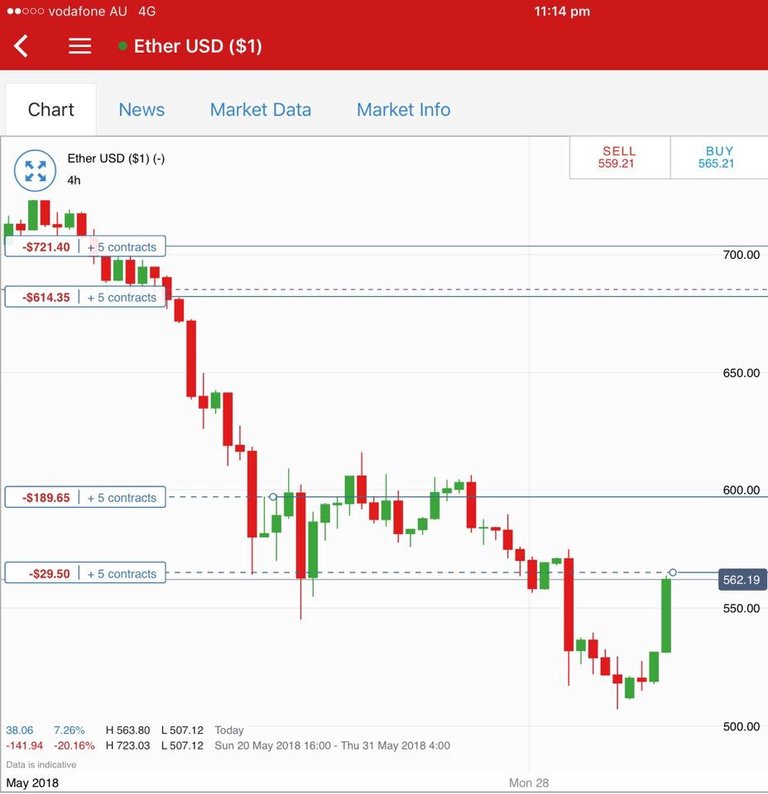

Ethereum (ETHUSD): I was watching the 4 hour charts which showed a strong reversal after some hesitation.

This matched the reversal on the BTC charts.

I added another long position to my IG markets account (after I added more margin).

DO NOT COPY THIS AT HOME - IT IS HIGH RISK

CryptoBots

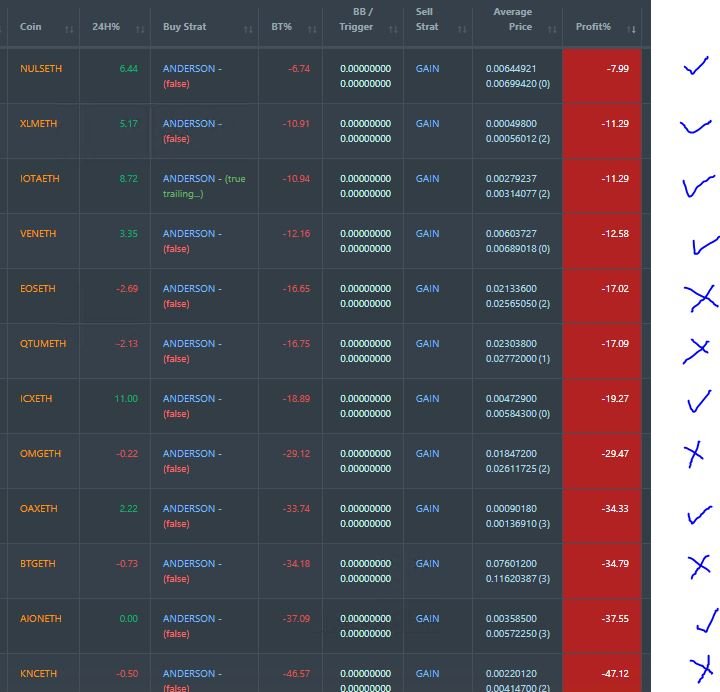

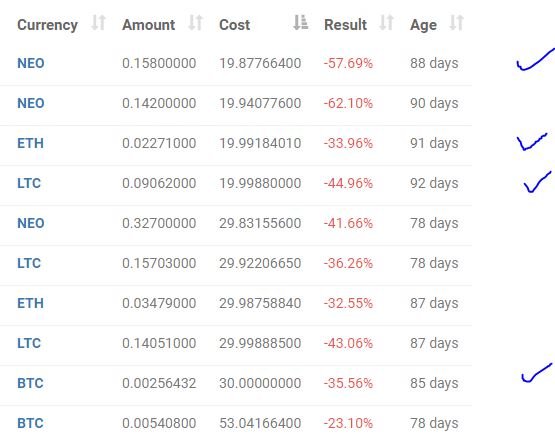

Outsourced Bot One closed trade on XRP (2.52%) replaced by ADA on this account (207 closed trades). Problem children was unchanged (>10% down) - (15 coins) - ETH, ZEC, DASH (-46%), BTS, ICX, ADA, PPT, DGD (-43%), GAS (-48%), STRAT, NEO (-47%), ETC (-43%), QTUM, BTG (-48%), XMR.

ZEC leaves the -40% club (now 6 coins) with GAS and BTG the worst at -48%.

Profit Trailer Bot No closed trades. Dollar Cost Average (DCA) list was unchanged at 12 coins with 7 coins improving, and 5 worse. The improvers moved well and the laggards drifted a little lower.

New Trading Bot Positions improved more than 10% (5 points) to -38.4% (was -43.6%).

All coins traded better by about 4 points.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 12.3% (higher than prior day's 8.1%).

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. EEM holdings images come from etfdb.com. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

May 29, 2018

Upvoted ($0.16) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

another thought provoking article that generates a number of good opportunities to consider. Excellent.

articles are full of other targets that generate some good opportunities to work on. Extraordinary @carrinm

Good job @carrinm, resteem