Margin calls ring like Christmas bells as Bitcoin collapses some more. There is gold in the Pilbara hills - panning for more. Holding off to see the bottom of the selloff. A few income trades and some forced margin action.

Portfolio News

Market Selloff

The selloff widened with every stock on Dow Jones Index closing down.

The root of the problem lies in the China rhetoric which came to a head in the speech by Vice President, Mike Pence, at the weekend's APEC summit.

Cool heads say that this was just part of the Trump hard line negotiaion tactics on the China Trade deal. Hard heads say it is a whole lot more and this is the next round following on from Pence's October speech in the world hegemony battle. Now that is something I have written about before. It is not about trade - it is about power. He did allude to regime change. The market does not like the rhetoric and the possibilities

Of course, we cannot talk about the selloff and China without talking about the Fed.

Donald Trump did have another go at the pace of rate hikes as he headed off for his Thanksgiving holidays. The market is beginning to soften on the number of rate hikes - maybe not 4 before the end of 2019. Jim Cramer is very vocal in his Mad Money segments - the Fed needs to talk to CEO's about market conditions rather than look backwards at data. 4 rate hikes will push the economy over the edge as it is not as robust as the data suggests is his view - I agree.

Bought

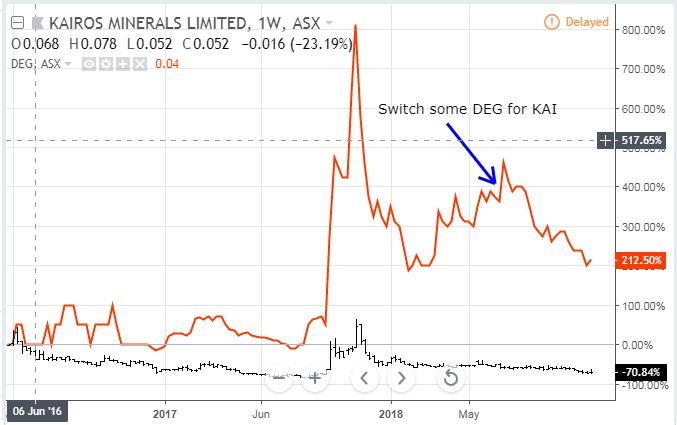

Kairos Minerals was Mining Project Group Ltd (KAI.AX): Gold, Nickel, Lithium Exploration. Kairos released gold discovery news pointing to meaningful gold nugget discoveries on its Pilbara, Western Australia tenements. Price did pop a little though it remains below my most recent entries. These tenements are adjacent to De Grey Mining (DEG.AX) which says that its gold resources rival the biggest in the world. I have been steadily increasing my holdings in Kairos on the back of De Grey's discoveries. My guess is alluvial gold does not recognise the boundaries between tenements.

I have written before about the frustrating side of Kairos. Its prior name was Mining Project Group and their model was to develop a portfolio of mining projects mostly in the Kalgoorlie area of Western Australia and focusing on nickel. They have since spread their wings to multiple regions in WA and also across to gold, lithium and cobalt. Their weakness is going to be on focus and capital raising cability if any, or all, of these projects pop. That will explain why their stock price has not moved like De Grey has.

A quick look at the chart shows the divergence since I bought in mid 2016. Kairos has only twice been in positive territory (bars above zero line) and De Grey has been as high as 800% higher when the big gold discoveries came through. I did sell some De Grey in June 2018 and convert portion into Kairos - still waiting for results to work through. This is the challenge of resource investing.

Shorts

With collapsing Bitcoin and Ethereum prices and falling interest rates, my IG Markets account is ringing margin bells like a proverbial Christmas sleigh.

Swiss 3 Month Interest Rate Futures (SZ): I closed three short December 2018 futures contracts for 3 and 4 basis points loss each. These rates are just not wanting to go higher - they jockey around but mostly drop a basis point at a time. I will close the other contracts when market opens tonight - trade over.

Euribor 3 Month Interest Rate Futures (IZ): I closed two short December 2020 futures contracts for 5 and 8 basis points loss each. I remain convinced that European interest rates will start rising before expiry in December 2020 - hence I am reticent to close these trades to release margin. I have just reduced my exposure - now exposed to 15 contracts short = €3.75 million

Sold

Bitcoin (BTCUSD). Closed two half contracts to release margin. Losses were $4059 (48%) and $2517 (36%) per contract

Income Trades

Two covered calls writen overnight as new trades.

Direxion Daily MSCI Real Est Bear 3X ETF (DRV): Inverse US Real Estate. Sold December 2018 strike 10 calls for 3.26% premium (3.26% to purchase price). Closing price $9.34 (new trade). Price needs to move another 7.1% to reach the sold strike (new trade). Should price pass the sold strike I book a 9% capital gain. This is part of dual strategy for DRV discussed in TIB324 after being assigned an additional parcel of stock at November expiry

WestRock Company Inc (WRK): US Paper Manufacturer. Sold December 2018 strike 50 calls for 0.87% premium (0.86% to purchase price). Closing price $45.73 (new trade). Price needs to move another 9.3% to reach the sold strike (new trade). Should price pass the sold strike I book a 10% capital gain.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $849 (17.3% of the high). The selloff continued. A one hour chart does show price trying to make a recovery twice during the day around $4800 and $4300. The sellers just keep coming.

I have a theory that the banks and their stool pigeons, the regulators, are coming to kill Bitcoin.

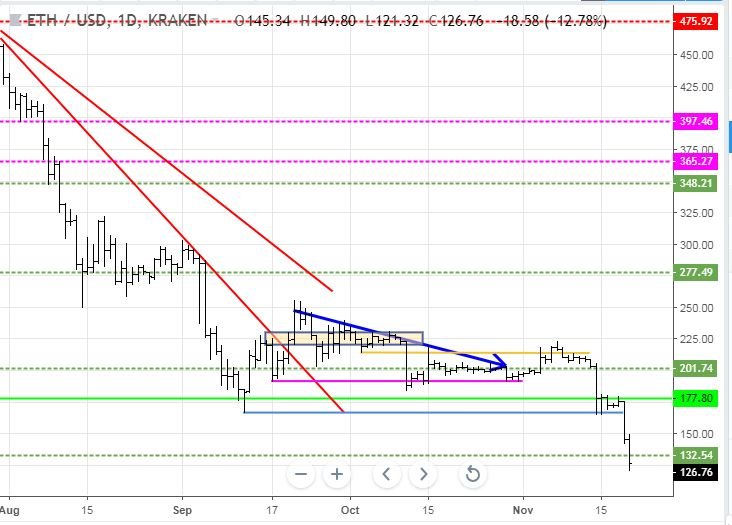

Ethereum (ETHUSD): Price range for the day was $25 (16.7% of the high). Price pushed lower (less than Bitcoin) but dropped through the support level at $132. Next support level is around $100.

CryptoBots

Outsourced Bot No closed trades. (222 closed trades). Problem children increased to 19 coins with AE coming in. (>10% down) - ETH (-72%), ZEC (-64%), DASH (-69%), AE (-25%) LTC (-56%), BTS (-64%), ICX (-87%), ADA (-75%), PPT (-86%), DGD (-83%), GAS (-88%), SNT (-66%), STRAT (-80%), NEO (-85%), ETC (-65%), QTUM (-79%), BTG (-72%), XMR (-45%), OMG (-73%).

Coins moved down 2 to 3 points. GAS (-88%) drifted another point and remains the worst coin. Only two coins held ground (LTC and BTG). PPT (-86%) and STRAT (-80%) dropped a level and joined the 80% down club. PPT was the biggest faller dropping 6 points. Of course AE was a shocker to arrive on this list.

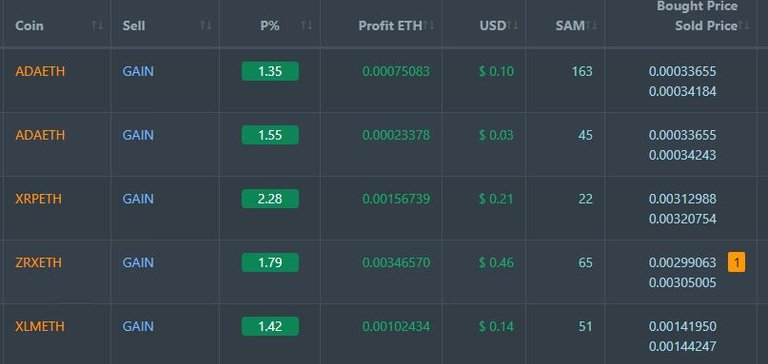

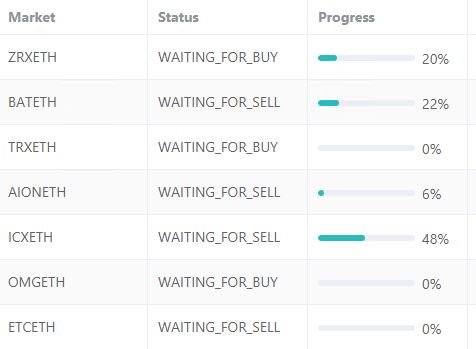

Profit Trailer Bot Five closed trades (1.68% profit) bringing the position on the account to 4.41% profit (was 4.29% - now corrected) (not accounting for open trades).

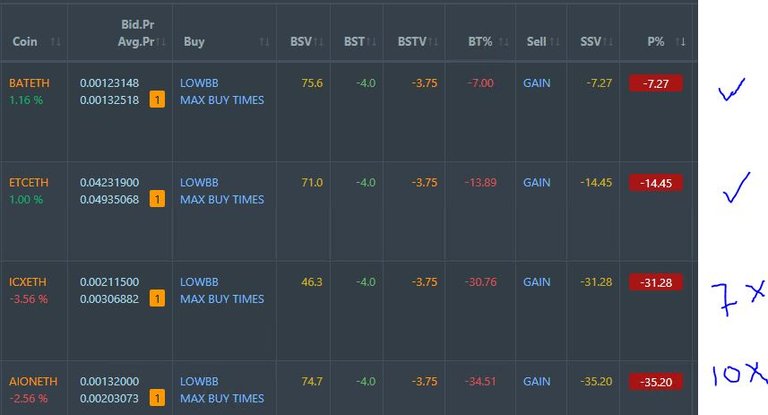

There are now 4 coins on the Dollar Cost Average (DCA) list with ZRX moving off and onto profit after one level of DCA.

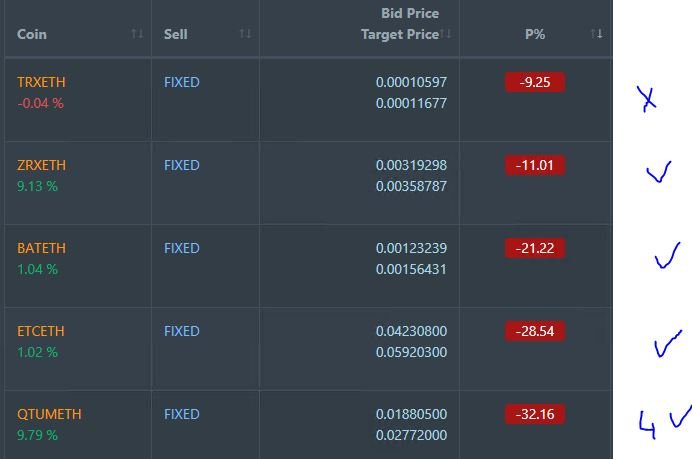

Pending list remains at 9 coins with 4 coins improving and 5 worse. This list and DCA list shows a divergence of coins between quality coins (e.g., BAT, ETC, ZRX) and risky coins (e.g., ICX, AION, KNC).

PT Defender continues defending 7 coins with one defence trade completed on ZRX.

New Trading Bot Trading out using Crypto Prophecy. No closed trades.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 1.7% (same as prior day's 1.7%).

Outsourced MAM account Actions to Wealth closed out 6 trades for 1.25% profits for the day.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work. Trade War image is copyright BangKok Post.

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

November 20, 2018

Markets are quite uncertain at this point. I have benefited from being net short but after scaling out of most shorts this week, I have sold all of my positions and calling it in for the holidays as I consider future moves. I am hoping to make some allocation changes as I think about where the markets are headed. Will definitely be reading your posts for ideas, as usual!

Holiday low volumes make for challenging markets to add to what is already a challenge. Smart move reducing exposure - allows you to enjoy the break more. Enjoy.