In the world of cryptocurrency, a lot of investors know this word: HODL. It started as a typo in a hastily typed post on bitcointalk, in which a fellow was telling everyone NOT to sell their bitcoin but hold on. Later it turned into a backronym, "hold on for dear life".

Now, whenever the market goes down, people bring on the old memes telling people not to panic, not to sell and above all, HODL. I'm here to tell you why that's really stupid.

Scroll down to watch and listen to Cryptonomics.

Welcome to Cryptonomics, principles of cryptocurrency and investing. Thanks for liking, subscribing and sharing. Check out the description below, be a crypto-bro, and connect with me on all social media.

HODL is for chumps

RIght now, March 2019, it looks like we're nearing the end of a bear market in crypto. So not many people are thinking about what they're going to do when it blows up again, how they're going to protect their gains. That's why I want to tell you to plan ahead now. Remember the 6 Ps of success: "Proper preparation prevents piss-poor performance."

It's great to be prepared for this now, to get your mind primed so you already have a plan for when the market takes off.

"Bitcoin to the Moon" Scenario

It's around the end of 2020 or 2021. Crypto has been going up, accelerating steadily for the last 6 months. Then suddenly, the market makes a big 20% jump in a single day. More people than ever are scrambling to put in their cash, and a week later the market drops 40%.

People start pulling out their doge memes and their HODL memes, saying you're a sucker to sell now when it's far down from the peak. You look at how much you have in dollar terms, and think about how much you had a week ago, and you feel ugly inside.

That feeling is important. Emotions are information, and in a market like this, they give you a clue about what everyone else is feeling. In this case, they can be a trigger to look at how much you've lost and consider how much more you might lose.

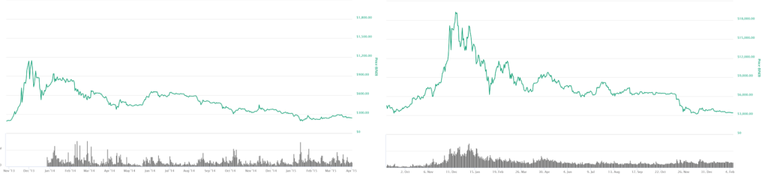

A lot of people will be saying "It's already dropped 40%, surely it can't go down much more" when they say that, look back to the charts of 2014 & 2018 and think yes, it can go down another 90%. Now you've had a dose of reality - don't resist it.

If you were blinded by hype, don't double down and again be blinded by hope.

Ideally, you'd already be out, with 90% of your holdings safely in other markets, with a lot of dry powder ready to launch back in when crypto settles down. In the likely case that you didn't get out as much as you wanted, it's time for damage control. Protect your downside, cover your backside, HODL is for chumps.

Peak tilt

When you've already lost a lot, the temptation is that the numbers don't matter any more. Thousands, 10,000s and even millions blend into one another.

So many gamblers have lost $200 at the table, and because they've peaked out their tilt or negative emotions, they don't feel any worse when they drop another thousand. Make no mistake, that $1000 will sting bad on the long walk home.

Comedian and former sports gambler Norm MacDonald tells a story where he lost most of his bankroll, and then went on to throw $60k in cash into the ocean. You might think Norm was kidding, but themes he describes are very real. Once you lose a little, you may even want to lose it all, just so you don't have to worry about losing more.

So be present, empathise with your future self. Protect your downside, cover your backside, HODL is for chumps.

Asset Allocation

When the market has gone down, you don't necessarily know how much farther it's going to drop. Nobody has a crystal ball, and nobody's timing is perfect. That's why you'll hear so many guys who are really experienced in the market sound so uncertain - so humble.

We have three ways to become better speculators. Pick better projects, pick better timing, and choose better asset allocation. The first two are really complex, but with just basic asset allocation we have a lot more control over our financial situation.

If you have 5% or even 20% of your portfolio in crypto, you don't stand to lose a lot. If you have 90% in crypto you do. You have 10%-20%, you can still easily double your entire portfolio within a couple of years, the kind of gains many traditional investors couldn't have dreamed of 20 years ago. Think about your number, how much do you really want to expose to an extremely volatile market like crypto? How much is going to give you a high chance of excellent gains, and a low chance of losing your shirt?

A Grand Opportunity

Again, my hope is that the gains don't just go to hedge fund managers and bankers, but to regular people like you. For that to happen you need to be prepared. It's really possible for you to outmanoeuvre the market, but you have to be a little smarter than the average. This is a market where being 5% smarter means you can gain 5x as much as the average guy loses.

When regular people understand more about hype and market cycles, when they're a bit more emotionally intelligent and better at recognising scams, and when they stop HODLing, the market won't be anywhere near as volatile.

Until then, protect your downside, cover your backside, HODL is for chumps.

Thank you

Thanks so much for listening, watching and reading Cryptonomics. Please be a crypto-bro, like, subscribe, have a look in the description and connect on all social media. Most importantly, have a look at the beautiful things around you, and stay grateful.

You can listen and subscribe on Anchor and other podcasting services here:

Cryptonomics - HODL is for chumps

This is fine and good advice on any NORMAL market day.

However, all indicators of the future show NOT NORMAL being the norm.

Getting in or out of the market depends on people getting out or in. If one side isn't there, there is nothing you can do.

Dollar Collapse - its coming. When? Don't know, but all signs point to the edge of hyper inflation. When the dollar starts going, you won't have much time to buy... and there might not be much to buy.

Actual Adoption - its coming. We are at the beginning of actual adoption. And when that happens all the curves are accentuated. You thought things went up fast before? I can easily see bitcoin never hitting 10k this time around. It goes 4k, 5k, 6k, 9k, 100k.

Exchanges Are Trading Air it is apparent to many analysts that the exchanges do not have the coins they are trading. So, it is a game of musical chairs. And, if you wait to get a chair, you will lose out completely. No $s, no cryptos.

So, for these reasons, it may be better to HODL.

(or, a more appropriate term is cost averaging. keep stacking bits.)

Thanks for your comment, those are important things for people to consider.

From my perspective, people have been talking about dollar collapses or other big crashes since the 70s or 80s. It seems like the dollar is a bit more robust than we give it credit for. Maybe it won't last forever, but it's not so easy to kill.

Even so, we have the choice of purchasing precious metals, which are a good hedge against fiat currency without being involved in crypto.

I think you might be right about the beginning of actual adoption. People are starting to use crypto as a serious store of value and medium of exchange in Venezuela and other places. Wider adoption might be more difficult, because people in developed nations are a lot more comfortable using dollars, euros and pounds... and even many people in developing nations are fine using dollars.

Do you have some sources about exchanges doing this kind of naked trading? I'm sure it's part of the reason so many exchanges have disappeared over the years. Do you think big exchanges like Binance, Upbit, Huobi are doing it?

To clarify your position, are you saying that people should have all or most of their portfolio in crypto? I'm not saying that people should ever necessarily sell their entire crypto position, just that they can limit their risk by selling crypto as it goes up, so it isn't a large percentage of their portfolio.