If you are like me I do not care much for my generation. The average 20-something is unmotivated, does not plan for the future and has turned into a narcissist thanks to social media and dating apps.

I do however think they get more crap than they deserve given the current financial situation. Considering we (as soon to be) college graduates have inherited a ludicrous debt burden from the boomer generation and the financial crisis in 2008. Also we are currently in the biggest bubble in the history of humanity. Everything is overpriced because of our debt fueled economy and speculation.

Taking a look at the American housing market

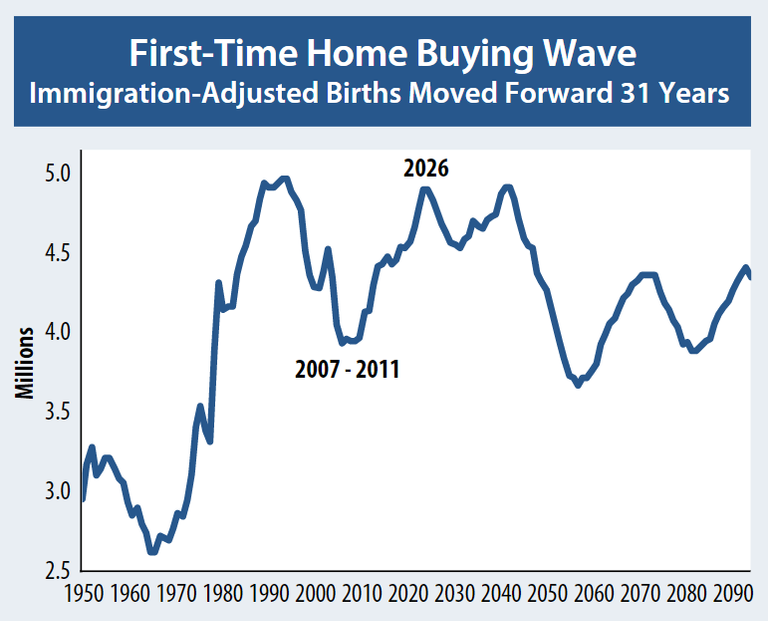

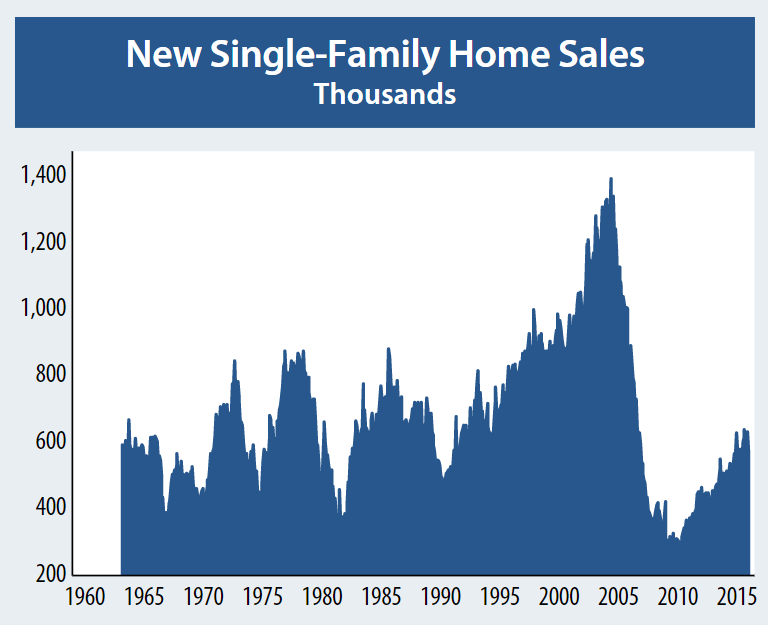

The American Millennial generation is starting to reach the age of buying their first home and starting a family. The typical first-time homebuyer is 31 years old. And Given the demographics of the U.S., we should be in the middle of a new-home-purchasing frenzy.

We’re halfway through what should be a booming new-home market, and yet sales remain stuck near recession levels.

That leaves us with the conclusion; this generation is broke. Most graduates already have a mortgage with their student loans so they naturally can't afford to buy a family home. And those that do decide to buy a home often put down no or almost no downpayment. With this little equity it should be fun if interest rates recover from their 2000 year low.

Sources used:

U.S. Census Bureau: https://www.census.gov/

Dent research: https://dentresearch.com/