Marx (the good one) in 'A Day at The Races'. Source

One of my favorite people right now is Scott Adams. If that name doesn’t ring a bell, he’s the guy behind Dilbert.

It turns out Adams has many interests other than doodling on paper. He is a trained hypnotist, a public speaker and a best-selling author. I highly recommend his book “How to fail at almost everything and still win big”, where he details his life trajectory and the habits that propelled him to success.

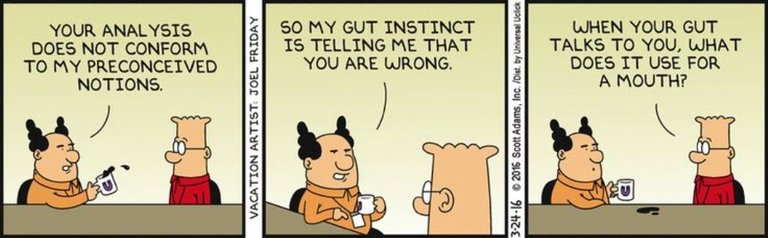

Adams has great insights on power dynamics and influence. He was one of the first public figures to “predict” that Trump would be elected president based on how he was able to completely dismiss any facts and direct people's attention to where he wanted.

You can have a better idea watching his interview with Bill Maher below:

But I’m not here to talk about Scott Adams.

Today I’ll focus on one of his mentors and author of the most recommended book in his reading list, "Influence: The Psychology of Persuasion" by Robert Cialdini. He’s a Psychology emeritus professor at Arizona State University and lives in the nightstand of many successful entrepreneurs.

Halfway into the book, I couldn’t help but notice that many of his principles are perfectly illustrated in the cryptocurrency environment. I found this section particularly interesting:

A study done by a pair of canadian psychologists uncovered something fascinating about people at the racetrack: Just after placing a bet, they are much more confident of their horse’s chances of winning than they are immediately before laying down that bet.

Sounds familiar?

It seems to me that the crypto space is turning more and more into a racetrack.

Wherever you go, you see legions of excited puppies referring to their favorite cryptocurrency like a teenage girl to a One Direction concert.

It gets better:

But immediately following the obvious failure of the prophecy, history records an enigmatic pattern. Rather than disbanding in disillusion, the cultists often become strengthened in their convictions.

-- “Relax, it’s just a healthy correction”. Well, it probably is. But you’re hardly basing that on facts.

-- “Just HODL. RandoCoin will pump again next week”. Yeah, why get out with a 5% loss when you can always close shop 95% poorer?

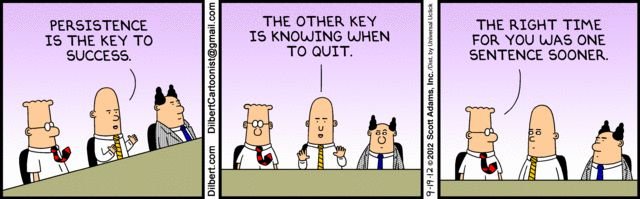

Cialdini explains why it is so hard to let go and take the proverbial "L":

It is, quite simply, our nearly obsessive desire to be (and to appear) consistent with what we have already done. Once we have made a choice or taken a stand, we will encounter personal and interpersonal pressures to behave consistently with that commitment. Those pressures will cause us to respond in ways that justify our earlier decision.

This is by no accident. I’ve seen many projects gaining an unjustifiable fan base in under a few weeks apparently out of nowhere.

Sometimes those are fake accounts set up by the project managers themselves, but sometimes it's even sadder than that. Many of the coins’ fans create those accounts on their own so the community appears bigger than it really is.

In a place where irrationality runs amok, it’s good to be munitioned with a solid understanding of how we can deceive ourselves.

You can believe in your horse all you want, but does it really run THAT fast?

Sage up,

Hi, how are you doing? I post regularly on subjects related to cryptocurrency and new tech. If you like my stuff and want to get it fresh off the keyboard, follow me @sek.

READ ALSO

- 5 Essential Cryptocurrency Investing Tools That You probably Never Heard About

- Ad Networks Could be Using Your Computer to Mine Cryptocurrencies Right Now

- How To Reduce Your Bitcoin Transaction Fees in up to 80%

- Bitcoin makes it to Davos and government talking heads are pooping their pants in excitement. Not really.

I'm not sure I could agree more - there are so many altcoins that are backed by absolutely nothing but speculation (some of the top coins are backed by tech and/or the ability to buy things with them).

I'm worried that at some point we'll hit a large altcoin dump that'll make everyone re-evaluate how much they value altcoins.

Yes. I think a market "reset" is way overdue. Hopefully it won't hurt the little gems out there.

done!