April 3 (week 14) 2025 - Boom or Bust

- Current Markets are RED, RED, and more RED!

- April 3 Options Trades

- Current Update as of April 2

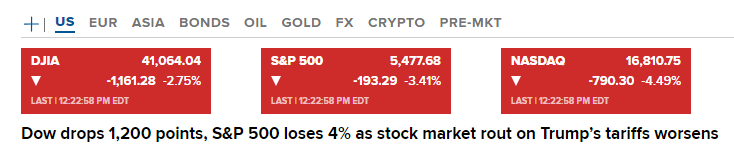

Current Markets are RED, RED, and more RED!

Down, down, and down.

Markets are adjusting to the RISK now.

This is GOOD.

I will BUY, BUY, and BUY.

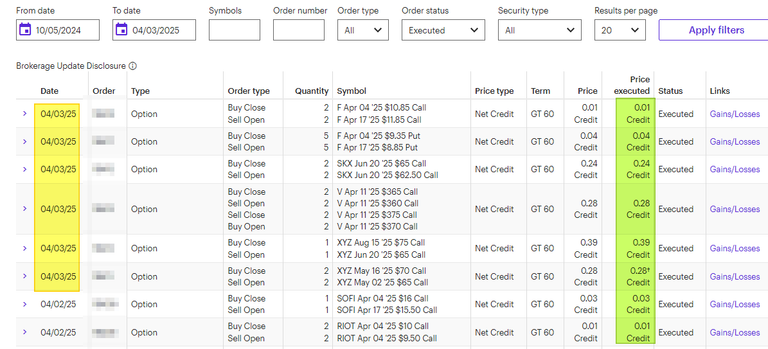

April 3 Options Trades

Here are today's Options trades at 12:10 pm EST:

High level detail:

- Rolled F covered call - Rolled up and out for $01 each.

- Rolled 5 F put credit spread- Rolled down and out for $4 each.

- Rolled 2 SKX covered call - Rolled down for $24 each.

- Rolled call credit spread - Rolled down for $28 each.

- Rolled covered call - Rolled down and IN for $39.

- Rolled 2covered call - Rolled down and IN for $28 each.

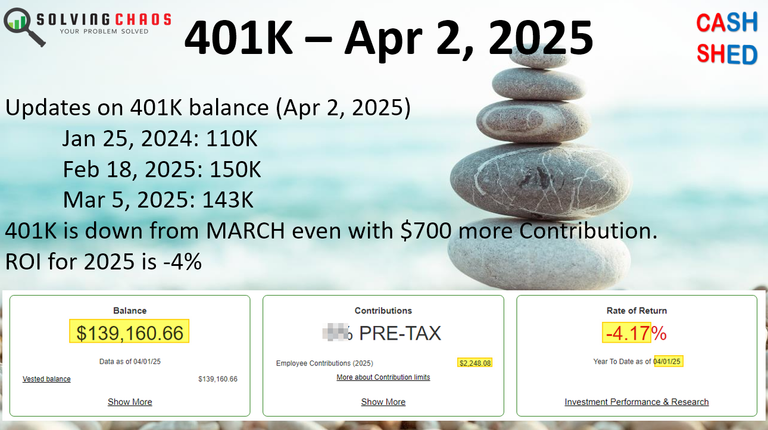

Current Update as of April 2

- I sold off some Dividend stock (21 shares of F) and purchased QQQM (2 shares).

This is part of my portfolio rebalancing from "safe" to more risky holdings I started in mid-2024. I will wait for the dividends to come in, then sell off a portion of my holdings (often at the size of the dividend) and buy into higher-risk/higher-return assets.

- My 401K is always buying more stock. This year, I have added about $2200 of new capital into the portfolio. The ROI is down 4% as of April 2. We peaked at 150K, and it is possible this portfolio can be worth 110K -120 K by the end of the year.

Am I worried? NOPE.

I have experienced this many times in the past 20 years, and I will continue to add more cash into the stock market. There is NO change in DIRECTION when it comes to my 401K plan method. As long as I have a JOB, I will use the 401K to buy stock using SP500 Index, while lowering my current year TAX Liability.

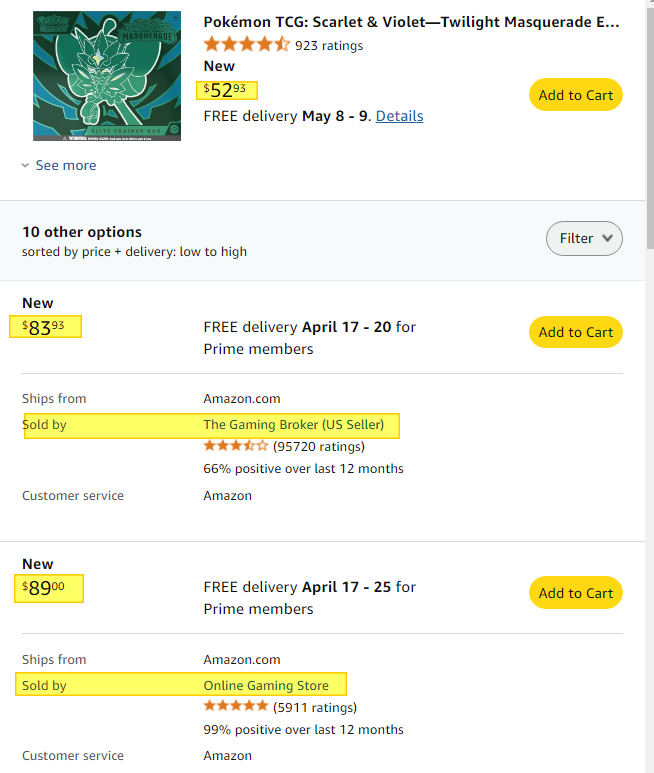

- Bitcoin / TCG - Pokemon Cards.

I started to diversify into other areas like Bitcoin and Trading Card Game (TCG) assets. TCG - assets are driven by supply/demand, and it's possible to buy products under Market price (often at MSRP).

There is a spread between the MSRP and the market price when the product are in print. Once is goes out of print, the value of the assets move upward over time. This is when you see the asset prices rise the longer its out of print (meaning there is no way to get NEW PRODUCT at MSRP or even at market). So the supply is oftren capped out, and with each time a SEAL product is open, it remaining products become more more scarce.

Posted Using INLEO