March 1 Investment Moves

- March 1 Moves:

- Historical Data will be lost when switching the ticker

- Fees Explained

- Roth IRA Bitcoin Spot ETF

- ETHER Spot ETF?

- Yesterday post - update

March 1 Moves:

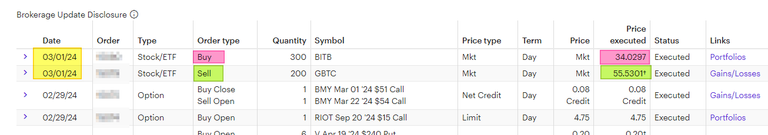

Here is what my brokerage confirmation looks like today:

Historical Data will be lost when switching the ticker

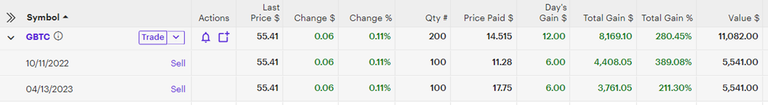

My GBTC gains 280% or a profit of 8K using 3K of cash/capital.

After the trade, it will display the cost basis based on the price of BITB today. If Bitcoins drop from 62K to 50K, it will show that I lost money, but in reality, I got into the trade when Bitcoin was under $30K.

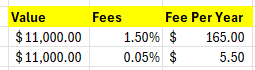

Fees Explained

I switched from GBTC to BITB due to lower fees. GBTC charges a 1.5% fee while the BITB is much less. I wasn't sure if it was around 0.05% or less. But the point here is many of the new SPOT Bitcoin ETF has fewer fees than GRAYSCALE Bitcoin Unit Trust.

Roth IRA Bitcoin Spot ETF

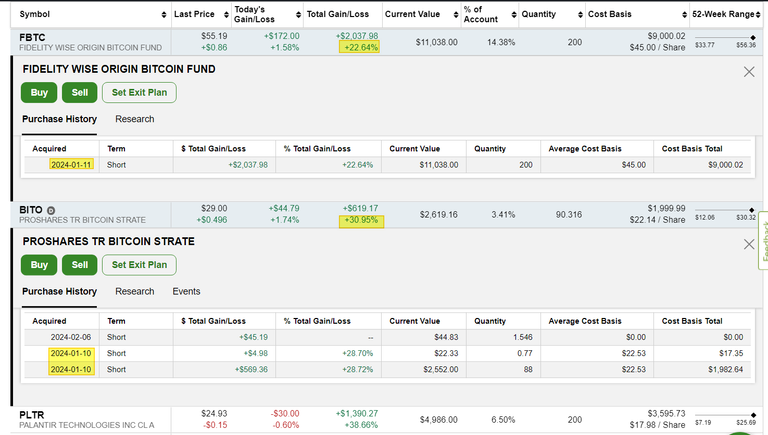

I have mentioned that I'm a fan of the Bitcoin Spot ETF products. It's hard for any average person to invest 5K, 20K, or 50K using Coinbase or other exchanges. But using a brokerage account, many people have a Rollover IRA or a ROTH IRA that can purchase any tradable Stock or ETF.

Back in January 2024, that is what I did (and I created a post about it a month ago). I ended up selling some boring DIVIDEND stock and I used that CASH to purchase more Bitcoin ETF back then.

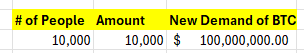

Imagine if there are 10,000 people like me. 10K people each with $10K getting into a Bitcoin ETF. That is 100 million dollars of new "Demand". I believe this SPOT ETF will be a long-term trend that will make it easier for people to move more money into BITCOIN.

ETHER Spot ETF is next?

Is ETHER doing the same thing in March? I believe that is the timeline. This will continue the "PUMP" of coins going into the April Halving of Bitcoin. Based on these trends, I have been adding more and more exposure to BITCOIN and ETHER. Over time, I believe most RETAIL investors will have between 1% to 5% of their assets in BITCOIN or ETHER.

Yesterday post - update

I posted about the move in GBTC was up based on the weekly (last 5 days) chart. However, RIOT and MARA were flat or down using the same weekly (5-day) chart.

On March 1, we can see both RIOT and MARA moved more than the change in BTC (Bitcoin) ETF. The ETF ranged from 1.58% to 1.77%!