The Orangutan Papers are provided via @TheKiltedTrader on Twitter.

KenGriffinLies.com in conjunction with @TheKiltedTrader are proud to host, analyze and add to the blockchain an expose on Citadel Securities trading practices with Broker-Dealers. KenGriffinLies take no credit whatsoever for the article, the contents which were provided to us by the author. Readers are reminded to use their own judgement when reading the document and take proper care.

The original reddit thread can be found here

TheKiltedTraders VIDEO can be found here

IMPORTANT UPDATE:

Shortly after going live, the author of the Orangutang Papers posts and videos came under attack by unknown as of yet unknown entities. The YouTube videos uploaded were promptly deleted by YouTube, and the author had multiple self harm / spam reports filed towards them on reddit. The author was also subject to a DDoS attack directed directly towards him. There was also a major amount of harassment towards him on Youtube and Twitter.

All of this has proven that censorship is real, and that this document needs widespread attention. Therefore, KGL has joined forces with the author to host everything on our website, where it can not, and will not, be removed.

Screengrab from one of the authors videos, supposedly deleted by the uploader.

Below you will find the original post by the author. KenGriffinlies has not edited any of this without the authors expressed permission.

TL;DR to the Orangutan Papers

This document shows, that Citadel can class the vast majority of orders given to them as "not-held" (opposed to held), not held-orders lose a whole wrath of protections and benefits that held orders get.

Citadel also uses this document to provide the framework to do pretty much unilaterally what they want.

This document also provides further evidence that Buy, DRS and hold is the best way to defeat this long term. Shorter term direct buying, and making sure your buying means your order is classed as a held order is the best.

All derivates (such as options) are classed as not held, but it seems that they are still important in the long term fight (but buying and holding the actual shares is more important, but the two exist in a relationship).

Intro

I present to you "The Orangutan Papers". A 22 page document, from Citadel to a broker dealer (the fidelities of the world who buy and sell shares for themselves, as well as clients) on it's "equity handling protocols".

Things to be wary of while reading.

1. This is dated Feb 2019. A full 34 months ago. That is a long time for some policy documents, at the same time my work has some policy documents from the 70s. It should be taken with a grain of salt.

2. This could be a very carefully crafted document (22 pages long) to mess with retail, and is a total fake.

3. My interpretation of this document may be wrong, this is also why I provided the link to the document so other everyone can pour over it and find stuff I missed, or correct things I got wrong.

That being said, I've done what due diligence I can on this.

And on the balance of probability this look like the genuine article.

Stand out sections.

There is a lot, so I've put the ones I think to be worth extra attention in italics, like I've done here.

The Orangutan Papers: page by page breakdown.

Let's go over every page in detail.

PAGE 1

Citadel states here what they are, and the two sides two their business. That they place orders as a market maker for their clients as well as the fact that they also trade for their own profits. Most importantly they CLEARLY state they may trade in tickers that they both trade as a market maker and as a non-market maker (aka hedgefund).

They also begin to explain their duty of best execution, which continues onto pg2.

PAGE 2

They speak about how best execution is a multi-faceted consideration.

i.e a market may show a better price, but have a lot less shares available.

But the take away I have is they go onto say, the people that review whether they have met the requirement of providing "best execution" meet on a quarterly basis, and comprise entirely of people employed by Citadel, including Senior management. There isn't a mention of a single person from the SEC, FINRA, FINTEL, DTCC or NSCC (even though these org are blended as it is).

Meaning Citadel decides if Citadel is giving best execution or not... nice that.

We then briefly mention that Citadel's duty to give best price execution is to the clients (The broker dealers) and not to the client's customers (us, retail, apes). Totally flying in all the shitty PR statements Citadel has tried to spin.

I can see the spin already tho, they provide best execution to clients, who provide it to us. If that happens don't let the fact they clearly state here who they consider their obligations to be to.

We then go onto discuss Automated & Manual order receipts (This continues onto Pg3).

PAGE 3

Citadel talk about how it's SOLELY up to them if an order is automated or manually processed. They also talk about the fact they can trade during extended hours (Pre-market/After hours).

They then go on to talk about how Citadel reverses Sole discretion to cancel or reject any client order and that they have no further obligations to an order once cancelled/rejected.

They also mention that they can choose to ignore a cancellation order if they have already gathered part or all of the equities to fill the order. Again at their sole discretion.

We then go onto Order Handling, this section lasts until PG 14. As such I'll be breaking it down by subsection.

Within order handling they first discuss order routing. Citadel states for non-directed orders that they can basically filtered it partially or wholly where they like, including to Citadel Connect.

So where possible, direct your order to a lit-exchange such as IEX.

Citadel picks how it does this via it's "heat map" technology (NFD), which uses order flow (Another reason to dislike PFOF) they finish off by stating it's up to Citadel how much information on the client order goes to the market centers.

PAGE 4

Order Types- Citadel defines held and not held orders.(Held orders need to be filled immediately, not-held can be delayed as to try and get a better price.)

The requirements to be classed as not-held appear to be so vague to Citadel that near enough every order could be classed as not held. This isn't a good thing, as we discuss in detail through the entire DD.

PAGE 5

We continue with more about order type. Something (which might burst people's bubble) that stands out is that not-held orders include certain categories. One of these is Algorithmic trading. And the thing about not-held orders is there is no requirement, and therefore Citadel doesn't, display them. Which further means trying to divine information from the order book (at least as citadel is concerned) is largely pointless.

Doubly so as Citadel could easily choose what to display and what not to display in an order book to further mess with us,

But the next part really irks me, as it seems to fly totally in the face of the best execution statement.

Citadel may trade ahead of not held orders, and buy/sell at the same, or indeed better price for it's own accounts and in doing so doesn't even have to fill the not-held order.

We then go onto additional conditions in not-held orders in OTC equities (Stocks that don't meet the requirements to be listed on a main exchange, or derivatives such as options). This continues onto pg6.

PAGE 6

The OTC orders that have specific instructions (such as trading via VWAP) will be traded manually by a trader where the instruction is actionable, if not Citadel will go seek clarity on the order or reject the order.

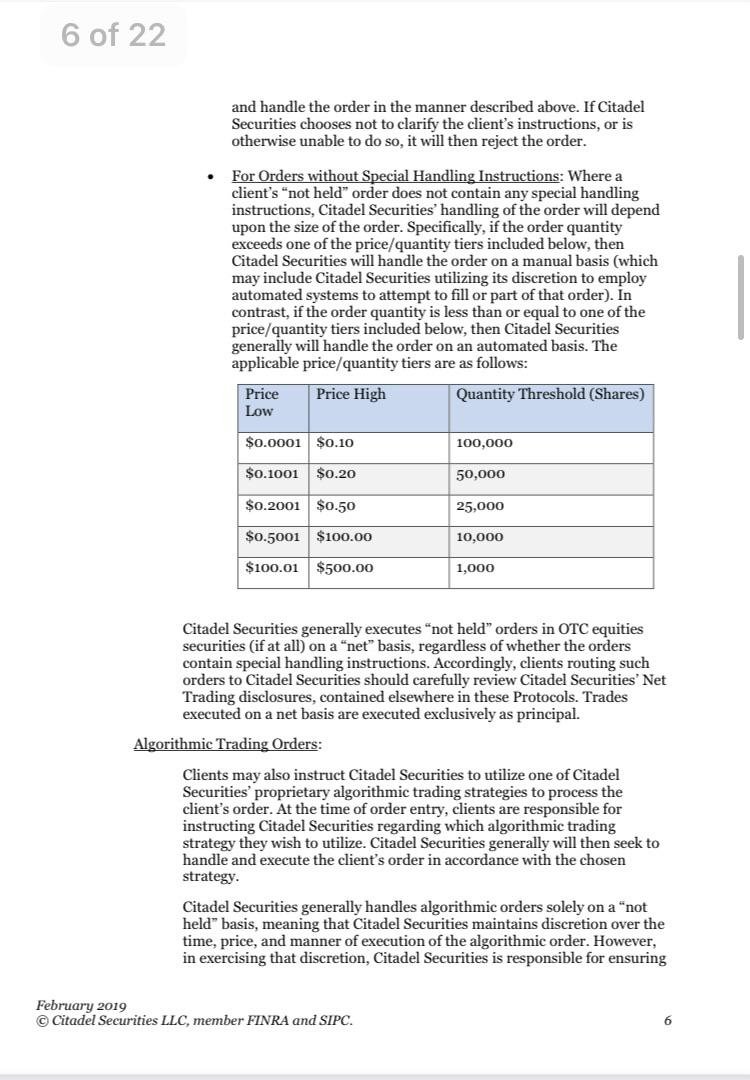

If there are no instructions on the OTC order than it will be determined as manual or automated depending on how big the order is, and how many shares are within that order (and the price of those shares).

The final note on it, is that most OTC orders will be meet by "netting", more on this later.

We then go onto algorithmic trading, which continues onto pg7.

PAGE 7

A broker dealer may choose to place an order with Citadel using one of it's algorithmic strategies, in doing so Citadel treats it as a not-held order and has sole discretion on how to execute the order (but caveat they need to keep it in line with the chosen strategy).

Citadel can also break the order up, into smaller child orders each with it's own strategy.

This can include lit, dark or internalized venues.

Then we cover pre-order handling. There is nothing overtly new here, Citadel reserves the right to not execute the order, pretty much same as the rest of their orders.

PAGE 8

On close orders- It splits it into Market on Close (MoC) and Limit on Close (LoC), they are exactly what you'd expect but happen at close.

A big stand out is that Citadel may guarantee part or all of a MoC, if they do Citadel can hedge against that order (which in turn may effect the price) this is massive and may account for all those ridiculous 1 min to close/post close candles.

The language in the next paragraph seems to indicate that this is not limited to MoC and that LoC orders can also be hedged against. Though this isn't spelt out anywhere.

PAGE 9

OTC stocks have the same requirements for MoC/LoC as listed.

We then go onto IoC (immediate or Cancel) & FoK (Fill or Kill orders)

Both are at Citadel's discretion to fill or cancel or reject.

And likewise, they are considered not-held, so everything that applies to not-held orders applies to these guys.

AoN (All or None) orders are next. They make mention that these orders are not allowed on exchanges (which implies they must be dealt with by way of OTC), and as such present unique risk to them. As such they aren't considered not-held or held, but that Citadel's handling of these may effect their price execution.

PAGE 10

Day orders- Nothing contentious here, they state they may execute a few mins after close.

Again adding to the ridiculous minute before/after close candles.

Good till Cancelled/Good till Date Orders- Again nothing overly contentious here, they don't display them overnight. Which seems to fly in the face of the earlier statement about not displaying Not-held orders at all (again showing us that trying to divine info from the order book may be largely pointless).

Stop orders continues on to page 11.

PAGE 11

Stop orders, nothing overly contentious other than the fact Citadel looks to bunch triggers into a bulk order, and prioritizes speed over price improvement in a bid to compete with fast moving markets.

They do state that Citadel may engage in trading that may trigger these orders.

My big take away from this, if citadel has enough knowledge of stop orders (or trailing stop orders) they can force a crash to take advantage of that. AKA CITADEL CAN SEE YOU STOP ORDERS SO DON'T PLACE STOP ORDERS. March 10th anyone?

Short sale marking and locate requirements, not the same as Citadel Short selling (and this document doesn't cover that) it states the onus is on clients to mark shares sell long, sell short, sell short exempt. This is a hand washing statement nothing more.

PAGE 12

Risk management and market access control- This is the bit I've had to stop my self skipping ahead to read.

Citadel reserves the right to delay any order it wishes to make sure it's correct, accurate and despite all this Citadel accepts no responsibility for client errors. This is so vague a statement that in theory Citadel could delay any order in the name of ensuring it's correct, even if that order was to be a massive benefit to retail and to the detriment of Citadel.

Order protection, Finra rule 5320 and 5270.

5230, Citadel aren't allowed to trade a share for it's own account while they have a held order that would benefit more from that trade... shame for retail most orders can be classed as non-held.

5270, citadel aren't allowed trade in their own accounts on a security that they have non-public information about a block on... like say a block on the buy button. THIS LITERALLY SPELLS OUT THE RULE THEY BROKE IN JAN 28TH.

This doesn't seem to be broken down by not-held and held orders. So it literally spells out the rule that was broken.

We then move onto information barriers, Citadel claims their teams work in silos (that is to say isolated away from each other), so that the team that deals with it's own accounts doesn't have any information that the team dealing with client accounts has... shame we've all seen the videos and the relative open planning of the Citadel offices and know that they aren't even siloing on a physical level, never mind an informational one. It's not like WhatsApp, telegram, discord, <<Enter 100 other messaging services>> exists.

It goes to further define that "Not-Held" & "Institutional Orders" don't get the (limited) protection of 5230 (meaning citadel can trade ahead, if they trade the client order at all, for their own profit).

PAGE 13

We then cover facilitation, hedging & pre-hedging, In short it states Citadel can trade ahead of knowledge of a block in a security if it is for one of these three purposes.

The thing is hedging is such a broad term, as previously defined in this document and defined elsewhere, that it allows Citadel to unilaterally make trades to protect itself against black swan events in a way that pretty much no one else (other than other market makers presumably, such as Virtu) can.

I am not advocating buying puts but if you had prior knowledge of the Jan 28th buy block, you could have bought a ton of puts (dirt cheap may I add), made a killing and have done so in the name of "hedging". It's actually sickening to me.

We then cover something which may warrant further digging elsewhere, Retail Order Liquidity Programs, all Citadel state here is that Citadel won't treat an order as a retail order unless explicitly told to do so by a client (this also may be a way to provide themselves some cover if the program provides any additional protections or benefits to retail orders).

As I said, further digging into what this program is may be warranted but it's not covered in this DD, and after this DD I'm tapped out of anything other than my normal weekly/daily posts for a while unless I come across something like this again.

Corporate actions, citadel will adjust open orders based upon those asked corporate actions. It's a small vague, but seems relatively harmless.

Order routing & conflict of interest. Citadel states that it gets kickbacks and fees to route order to certain markets and if the kickbacks are larger than fees they will receive payments from these markets. As such Citadel reserves the right to route to certain markets provided it keeps in line with the "best execution principles" (That one that is judged solely by people of Citadel... again nice that).

PAGE 14

System failure and abnormal market conditions (Jan 28th and maybe this now), this is the last subsection of order handling section. And would you believe it, Citadel reserves the right to apply, cancel, partially apply or EVEN CHANGE client orders without prior notice during periods of system failure and abnormal market conditions.

Meaning Citadel can, and will, pull out every dirty trick WHEN (not if) MOASS happens.

We then go onto the Order execution section, again this lasts until page 18 and as such I'll be breaking it down by subsection also.

Price improvement, this subsection states that Citadel can determine whether or not to improve a clients order for a better price at their sole discretion, even if price improvement is within the NBBO (National best bid offer) and one of the factors in making this decision is Citadel's own positions.

PAGE 15

Customized execution strategies, Citadel allows clients to choose what metric to prioritize in execution if they wish, this may result in worse results in other metrics. Standard handwashing statement.

NBBO calculation (which is further broken down into even smaller subsections), as a whole Citadel relies on direct market feeds, then SIP feeds (Security information feeds).

For OTC trades it refers to the OTC NBBO bulletin board, and chooses the right to exclude any information from this bulletin board it deems unactionable. Which is important as remember non-held orders (which is most orders) can be put through as OTC trades, and the statement of what it deems to be unactionable is not further clarified and therefore suitably vague and full of leeway.

PAGE 16

We then go onto Net trading, Citadel re-states that most not-held orders (which is most of them) is dealt with by netting, if at all. This is the MOST IMPORTANT PART OF THE WHOLE GOD DAMN DOCUMENT. as it spells out how Citadel gets paid as a market maker, they net by taking the opposite side of the trade elsewhere in the market at a better price, and then fill the trade at the other end. The difference/net is what Citadel takes as payment.

For example you ask to buy stock ABC at $10, your broker gives that order to citadel who sees someone is selling it for $9.95, as such they buy it, give it to your broker, who gives to you and Citadel NETS the $0.05 difference.

They can only do this for not-held orders, which is most orders. (I know this is repeating my first sentence in this section, but it's important).

We then move onto trading halts, nothing contentious here. Citadel has to abide by them (nice to a see one of the rules apply universally for once).

We then go onto erroneous trades, Citadel has certain conditions it has to adhere to due to the SEC, FINRA etc but citadel also reverse the right to cancel or alter order/trades that don't fall within SEC/Finra/SRO rules if citadel deems it erroneous (much like when your older sibling babysat you and decided to add extra rules that mum and dad didn't have). Again nothing further is expanded on what Citadel would deem erroneous that SEC/FINRA/SRO don't.

PAGE 17

Deals with extended trading hours (pre-market/After Hours) Citadel states they will accept and trade client orders during these times but makes a warning on all the risks of trading during these times.

What is implied though, reading between the lines, is that Citadel will also trade for it's own accounts during these times as well.

PAGE 18

With Order execution done, we go onto another handwashing statement/section, regarding rules around OTC re-sale. Some OTC securities may not be re-sold, it is the client, not citadel's, responsibility to ensure that non-resalable OTC securities aren't traded.

We then go onto another section with multiple subsections, Orders from Canadian internalized securities and foreign markets.

First subsection is Canadian internalized securities, when a stock is traded on both U.S and Canadian markets citadel will only accept it if it's an Immediate or Cancel (IoC), or Fill or Kill order (FoK). If you cast your mind back you'll remember these orders are considered not-held, and therefore lose all the protection of held orders.

PAGE 19

Orders in a foreign market is next, first thing that stands out is that Citadel have a portal where the OTC prices sit, including foreign, Citadel gives access to this portal to clients but clients are forbidden from passing it on (I'd jump at the chance to have a look).

Next is currency, all orders should be placed in USD and then Citadel makes extra money by marking up or down the exchange rate (presumably on top of their netting).

Citadel then lays out the ways they may fill the order, they give preference to internalizing the order (i.e Citadel takes the opposite side and net trades it) but that they may use other methods, or a combination.

PAGE 20

This page explains the previous pages netting/best execution etc.

One part they spell out is that an order will still be considered best executed even if there was price improvement, provided Citadel make profit.

It then states what rule, FINRA 5320, that it needs to adhere to, so that it can be considered best execution, but remember two things one "the committee" that judges this is made up of citadel staff according to this document and two all foreign orders are dealt with by OTC and are therefore Non-held and therefore FINRA 5320 doesn't apply, makes me wonder why they brought it up at all.

PAGE 21

Use of client information is our next heading. Citadel states it may use the following information and how it's used, but that they don't need to tell their clients.

They can also state they can change what information, and how the information is used without informing the client (unless required to by law or ruling).

First it breaks it down by client order information, Citadel can use past and present trading information on determining how to handle that order. Also citadel may use the info for their own purposes (both market making and for their own accounts).

IOI/RFQ (Indication of interest, Request for quotation) Citadel can use past client, or client customer information to determine whether to supply this info and at what price/ranges.

Finally, and nice to see it spelled out at the end, citadel may share the information within Citadel or other Market Makers but on a time delayed basis when there should be an information barrier. They don't state how time delayed though which is nice and vague (not that I believe there is any time delay given the setup of the office and other factors, but that's speculation)but for them a time delay may be 1 second, 1 minute,1 hour... who knows, not us or broker dealers it seems as it's not spelled out.

PAGE 22

Last two sections deal with who a citadel reports trades to for the purpose of reporting to the consolidated tape. Nothing contentious here.

Thoughts

We always knew we were getting the raw end of the deal, but it seems that raw end of the deal extends to our broker dealers as well (and by laws of gravity, shit travels down so we likely are getting an even worse deal once our brokers add in their conditions as well).

This document clearly lays out the unilateral, and frankly frightening level of powers and unaccountability Citadel seems to have. I would presume that extends to other market makers as well.

But here is the thing, forearmed is forewarned.

None of these conditions seem to apply to though if you make your order both directed to lit exchanges (there is mountain of DD on this) and make sure your order comes under the held category the issue seems to be in getting it to apply to that held category.

So the next issue on top of that is making sure your shares are, well your shares, and registered in your name.

As such you need to make sure you are DSRing you shares.

WE ARE NOT LEAVING.

This information is not financial or legal advice, and is presented for entertainment purposes only. See more about the community at KenGriffinLies.com

https://reddit.com/r/amcstock/comments/16q7h4l/in_light_of_the_recent_sec_charges_against/

The rewards earned on this comment will go directly to the people sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.