3.2.3. Crypto-assets and public institutions

-46. In Part 1 I have underlined the anarchic, “anti-government” intellectual roots of Bitcoin and its spiritual progeny, the cryptoverse, on one hand, but also the benefits that blockchain technology can bring to governments, which many authors have pointed out. I have explained (see Part 1, par. 71) that those authors, while extolling the qualities of the blockchain usually fail to account for the unavoidable trade-offs which it imposes.

-47. Governments exercise power through laws and institutions which create a system of coercion. Law is coercive and regarded as such because “there is provision for and the means by which it can be, and regularly is, enforced – by the courts, by the police, […]”. From a socio-historical perspective, coercion and “authority” (of the Church: “God wills it”, of an abstract moral system, or of the Fatherland) have for centuries been the main tools for solving the “collective action problem” and delivering public goods and services. More recently, especially in the United States, governments at all levels “are increasingly turning to the use of incentives and disincentives to bring about desired policy outcomes.”

-48. I have explained in Part 1 (par. 24) that through the introduction of crypto-asset-based incentives, blockchain systems propose a solution to the collective action problem which does not use coercion. In the paper quoted above, Ruth Grant offers the following definition of “incentive”: “an offer of something of value, sometimes with a cash equivalent and sometimes not, meant to influence the payoff structure of a utility calculation so as to alter a person’s course of action. The person offering the incentive means to make one choice more attractive to the person responding to the incentive than any other alternative. Both parties stand to gain from the resulting choice. In effect, an incentive, understood in this way is a form of trade.” She notes that coercion, “persuasion” (which in its more ethical form shuns deceit and boils down to an “appeal to authority”) and “bargaining” (incentives) are alternative forms of power, but the interesting thing to note is that far from being mutually exclusive, they are actually reinforcing each other.

-49. Unlike Member States which are sovereign and dispose of a full set of law enforcement institutions in regard to their citizens, the European Union cannot directly and effectively enforce its law and respect for its founding values unto Member States after accession, which has been called “the Copenhagen dilemma.” The mechanisms of coercion has therefore a lower effectiveness at Union level, a fact which has been highlighted in the past years by the “rule of law” issues in Hungary and Poland.

-50. Similarly, the second source of power and persuasion, “authority” is less effective at Union level between Member States than, say, in France where the hallowed “La République” is a de facto source of authority. By contrast, if the Schuman declaration and the “ever closer union” principle worked well as a common goal for the six founding members, successive enlargements have tended to dilute its authority.

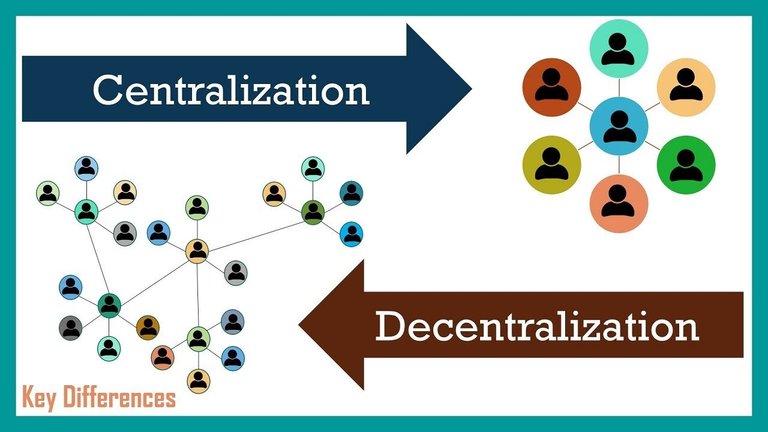

-51. It can be said that the Union is an essentially decentralized community of Member States. Therefore, it is precisely in the context of the Union that properly designed incentivisation mechanisms could strengthen and make the Union’s action more effective.

-52. However, Ruth Grant notes that some forms of incentives raise ethical issues and “are generally recognized as problematic, despite their formal similarity to other forms of trade.”

-53. The European Commission has been pivotal in helping create the “European Blockchain Partnership” which has recently launched EBSI, the European Blockchain Services Infrastructure, on which a first blockchain protocol is already deployed, Hyperledger Besu, an Ethereum variant using a “proof of authority” consensus mechanism and … no crypto-asset! This is likely a consequence of both ethical qualms and the absence of a legal framework in a context that is unfamiliar with any other way of exercising power than coercion through law.

-54. Thus, while MiCA explicitly does not apply to the EU Institutions (Art. 2.2), its mere existence and the fact that it will lead to the apparition of a fully-fledged market infrastructure might paradoxically entice the Union’s bodies and institutions to seriously consider both the “Northern” and “Coasian” innovations made possible by crypto-assets and blockchain technology.

-55. I had the privilege, several years ago, of leading a pilot blockchain project for the European Commission, called “European Financial Transparency Gateway” (EFTG) which proved that adding incentives (not necessarily in a monetary form) can lead to political breakthroughs when “coercion” and “authority” were unable (in the soft context of the Union) of achieving consensus by themselves. In a more recent article, I considered the costs and opportunities of introducing a blockchain architecture in an IT system supporting a European service (“verifiable credentials”).

-56. To sum up, although public international institutions are not in MiCA’s scope, its existence legitimizes crypto-assets for them too and will also lead to the creation of a useful market infrastructure. As the European Union is, by its “decentralized” nature, an excellent customer for both the “Northern” and “Coasian” innovations, these indirect MiCA effects might well lead the Union’s institutions to innovate in the provisioning of public goods and services by devising specific economic mechanism backed with dedicated crypto-assets.

-57. In this chapter I started by revisiting ARTs and EMTs provisions from the point of view of an incumbent firm and concluded that MiCA seems bent on preventing these types of tokens from taking hold in Europe, to the point where even otherwise coddled financial entities will not feel encouraged to try to innovate. I then have searched and identified two potential sources of innovation in the field of crypto-assets and blockchain technology.

-58. Firstly, MiCA does its utmost to facilitate European financial entities entering the newly created market for crypto-asset services. The creation of a complete market infrastructure for crypto-assets will necessarily involve innovating, even though it might not be the type of disruptive innovation that makes headlines.

-59. Secondly, two of the indirect effects of MiCA, the legitimisation of the crypto-asset class and the apparition of a dedicated market infrastructure might entice the European Union institutions to attempt to create innovative solutions that add incentive structures to a naturally suited, decentralized group of Member States where both “coercion” and “authority” are only mildly effective.

[194] G. Lamond, “The Coerciveness of Law”, Oxford Journal of Legal Studies, Vol. 20, No. 1, 2000, p. 39-62

[195] M. Olson, “The Logic of Collective Action – Public Goods and the Theory of Groups”, Harvard University Press, 1971

[196] R. W. Grant, “Ethics and Incentives: A Political Approach”, Amer. Pol. Sci. Review, Vol. 100, No. 1, 2006

[197] ibid.

[198] V. Reding, “Safeguarding the rule of law and solving the "Copenhagen dilemma": Towards a new EU-mechanism”, 2013, accessible at https://ec.europa.eu/commission/presscorner/detail/en/SPEECH_13_348

[199] R. W. Grant, op. cit.

[200] I. Preiss, “European Union launches institution to build blockchain infrastructure across continent”, 2023

[201] S. Cristescu, “A Political Breakthrough”, 2019

[202] S. Cristescu, “Verifiable Credentials in a governmental setting”, 2023

Awesome

Awesome

Looks like MiCA is very important in the European market

Nice one and thanks for the information

As far as crypto is concerned, MiCA is the most important development in Europe

~~~ embed:1771350904647659939?t=uViSTa5EU2CgF-RAhOyaZg&s=19 twitter metadata:V2F5U2hvbGE4NDE1Nnx8aHR0cHM6Ly90d2l0dGVyLmNvbS9XYXlTaG9sYTg0MTU2L3N0YXR1cy8xNzcxMzUwOTA0NjQ3NjU5OTM5fA== ~~~

Congratulations @sorin.cristescu! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 19000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP