Economic Discrepancies among the countries of the world have made the genuine definition of Small and Medium-scaled Enterprises (SMEs) redundant . Notwithstanding this ambiguity, SMEs are the social-economic powerhouse of any nation given its immense contribution to employment and Gross domestic product developments.

As indicated by European Commission on what entity constitutes a SME; they are enterprises having somewhere in the range of 10 and 250 workers; not in excess of 50million Euros yearly turnover; and balance sheet total of 43million Euros or less.

Official figures maintain that more than 70% of registered businesses in the economies' of developing nations are to a great extent subject to the SMEs area, creating monstrous employments opportunities for the huge populaces.

Be that as it may, as a consequences of a few difficulties, the maximum capacity of the SMEs’ sector particularly in the developing countries is not yet fully realized. To a few, SMEs can improve the situation in perspective of its present contribution to Gross Domestic Product (GDP) growth. In the light this development, we discuss the most primary obstacle to SMEs developments as well as the blockchain-based solution offered by the Bitbond platform.

Capital crunch to SMEs

Absence of access to reliable credit facilities is the main challenge to the development of Small and Medium-scaled Enterprises. A portion of the difficulties faced by SMEs in getting credit facilities could be absence of guarantee security; stringent lending criteria, poor credit rating, absence of trust, high interest rates, government polices, poor business documentation, among others. Whatever the case may be, a good number of these challenges are peculiar to every nation—developing or advanced

Furthermore , not having access to international and local capital markets due to the inherent costs and the nearly inaccessibility of capitals from banks, venture capitals, etc(obtainable in a third world country) by SMEs, also tends to play a major role to the incessant credit crunch being experienced by small and meduim scale businesses.

Bitbond GmBH Solution.

Bitbond GmBH is the Germany’s first security token that aims to solve the financial challenge faced by business entities. By leveraging on the blockchain technology, it offers cash-strapped business founders an unfettered access to global capital pool without having to dilute their share ownership.

.jpeg)

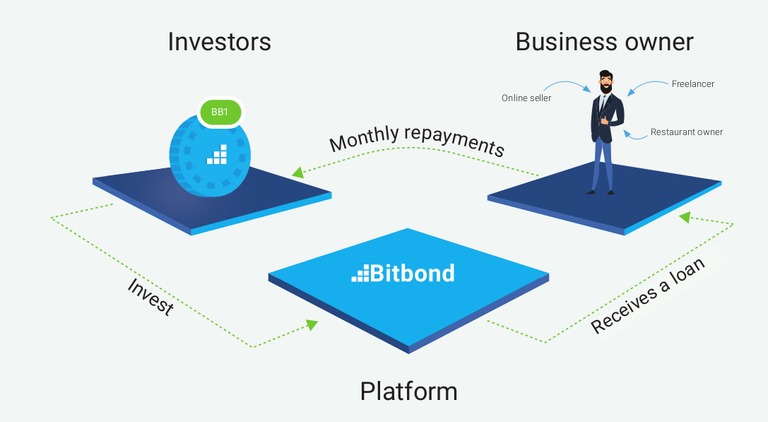

The Bitbond’s global business loan platform will increase accessibility to global business finance opportunities by allowing an investor in any corner of the globe to list its cryptocurrency loan, with the stated interest rate and maturities on the platform after paying a small listing fee. Then, the Bitbond GmBH ecosystem, through its smart contract technology will automatically connect to a business which satisfies the investor criteria.

SMES and startups can leverage on this platform to take care of their funding need without approaching the banks, VCs and other financial firms. Finally, Bitbond GmBH gives the small & meduim scale businesses located at the most remote part of the globe a financial succour and an unprecedented opportunity to hold on to their critical operational activities, pending when they become profitable enough to be self-sustaining.

Browse the links below for more information and participation in the ICO:

Website :

https://www.bitbondsto.com/?a=FDKWJO

Telegram :

https://t.me/BitbondSTOen

Facebook:

https://www.facebook.com/Bitbond/

ANN:

https://bitcointalk.org/index.php?topic=5130337.0

Whitepaper :

https://www.bitbondsto.com/files/bitbond-sto-lightpaper.pdf

Author

Arinze280

https://bitcointalk.org/index.php?action=search