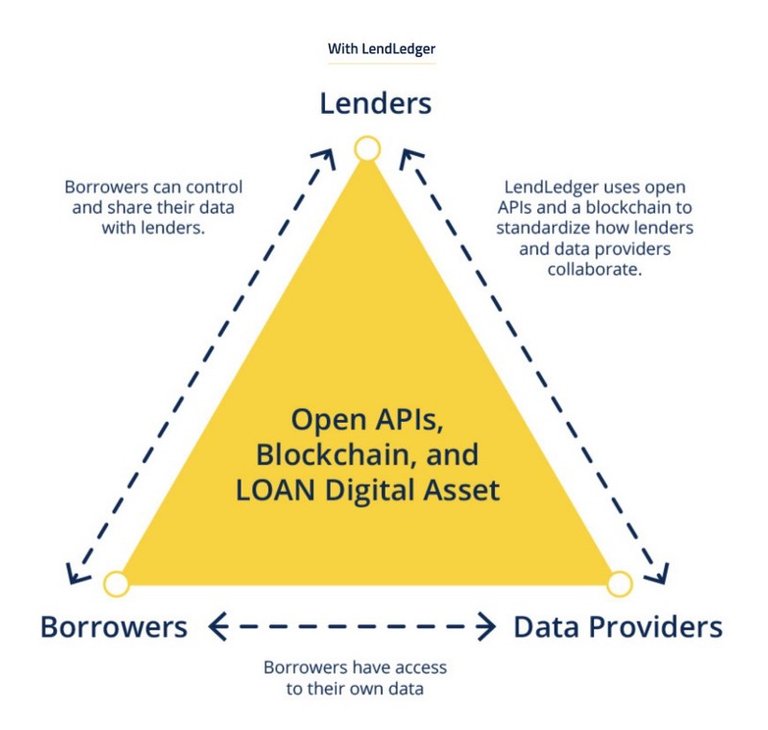

LendLedger is a blockchain project, whcih connects Lenders with untapped data to bridge the multi-trillion-dollar gap between financial institutions and informal Borrowers. It brings together Borrowers, Data Providers, and Lenders in an open and secure global ecosystem built on distributed ledger technology.

Moneylenders in developing markets battle to make advances to independent and small business and casual area borrowers, since they regularly have no record as a consumer or customary financial documentation. LendLedger tackles this data gap with the use of open APIs, the LOAN digital asset, and the Stellar blockchain technology.

LendLedger associates Lenders with undiscovered information to bridge the multi-trillion-dollar gap between casual borrowers and financial institutions. It unites Data Providers, lenders, and borrowers in an open and secure e based on appropriated record innovation.

Anybody can join loaning markets via the LendLedger Protocol. The protcol’s APIs1 permit parties that don't have any acquaintance with one another to trade value and information. Also, it utilizes Stellar's blockchain innovation to capture credit dispensing and repayment records continuously. Gradually, this results in straightforward and evident reputations for all members. By taking a look at the blockchain, Lenders can appropriately see Borrower’s conduct and price risk.

LendLedger will encourage small ventures and casual Borrowers secure moderate credit from financial organizations. Its open principles and believed shared record will expand market interaction, data sharing, , and loaning volumes. LendLedger empowers a more productive, moderate, and comprehensive loaning market.

LendLedger Users

Here is the way each lending business sector member will utilize LendLedger

Lenders Originate loans using credit data made available by Data Providers. Sign loan contracts with Borrowers and disburse loans to them.

Data Providers Provide credit information they collect on families and organizations to Borrowers and Lenders.

Borrowers Acquire their own or business credit information from Data Providers. Recognize credit offers from Lenders and apply for and get advances.

Credit Evaluators Provide advance choice proposals dependent on loan applications shared by Lenders.

Identity Verifiers Contract with Lenders to give check of Borrowers' KYC information.

Exchanging Data

LendLedger develops loaning to underserved sections by opening new wellsprings of computerized credit information. Borrowers acquire their credit information from Data Providers and offer it with Lenders so Lenders can evaluate the Borrower's financial soundness.

The LendLedger Protocol's Data APIs characterize how credit information and other data crucial to the loaning procedure is shared among members. They additionally guarantee that data remains secure and trusted.

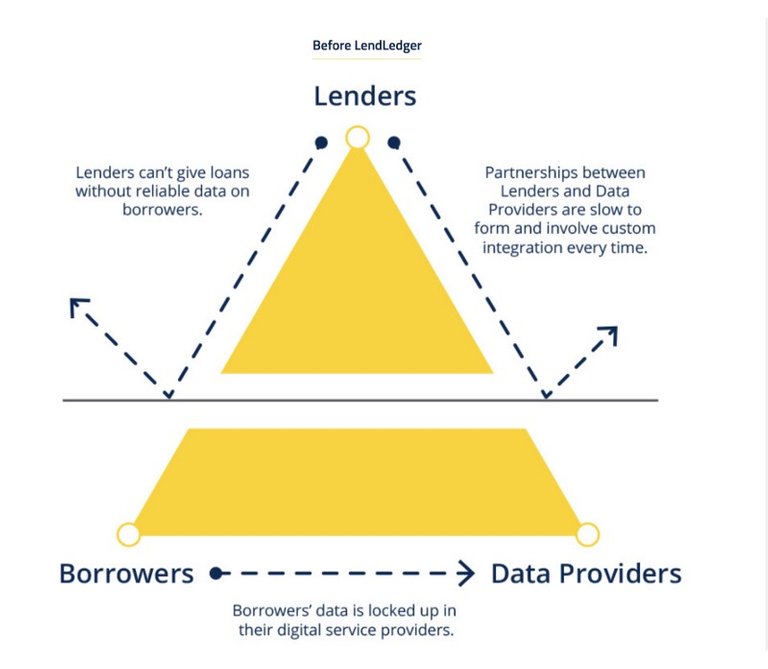

What LendLedger tends to Solve

LendLedher make borrowers' computerized payment information open to lenders will connect the multi-trillion loaning gap between institutional loaning cash and casual borrowers.

The loaning market needs a situation of trust and straightforwardness that can associate Lenders with Borrowers' data and empowers followed reimbursements after some time. At the point when the supermarket proprietor can safely and unquestionably send their Swipe credit data to Mumbai Bank, and build their reputation after some time as they reimburse the loan, at that point the casual segment tears open as a moderate and available market.

By opening elective credit information for the casual area, LendLedger will make another beneficial market for Lenders, Data Providers (DPs), and other specialist co-ops.

The open system will empower money related development in underserved territories as more Lenders gain admittance to qualified Borrowers through LendLedger. LendLedger is intended to empower a proficient, reasonable, and comprehensive loaning market.

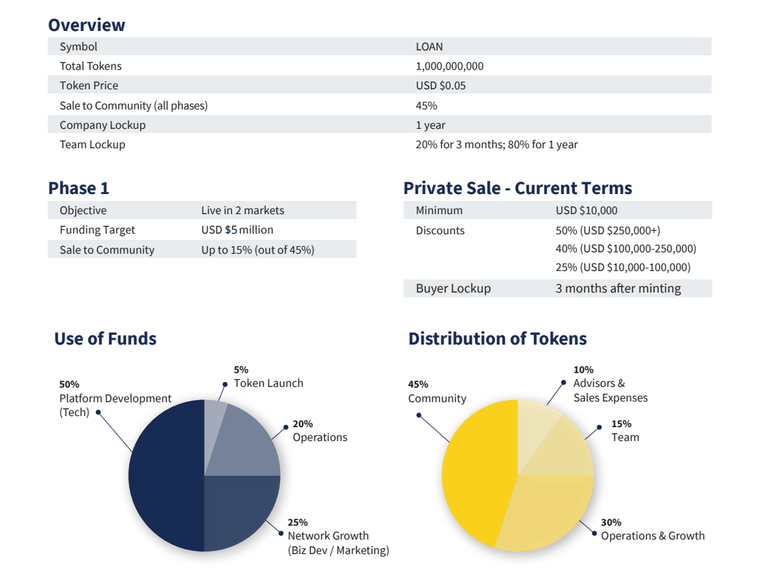

The LendLedger Token (LOAN)

The LOAN token is the restrictive route for system members to get to the highlights of the LendLedger network. LOAN fills numerous needs:

• For Lenders: It gives them the ability to get to the system, make loans, and pay for administrations identified with loaning

• For Data Providers: It gives them the opportunity to find approaches to adapt and share information

• For Borrowers: It gives them the permission to see and apply for advances

• For Credit Nodes: It gives them the ability to stake LOAN with the end goal to issue LedgerCredit (the methods for exchanges between all members on the system) LOAN is a Stellar-issued computerized resource that depends on the Stellar Consensus Protocol. It effortlessly incorporates into a current decentralized framework, including computerized wallets and the inherent Stellar exchange.

TOKEN INFORMATION

For more info about this platform, and also to join the network, endeavor to visit:

Thanks for reading. I am Victorheywhy on Bitcointalk

Hello! I find your post valuable for the wafrica community! Thanks for the great post! We encourage and support quality contents and projects from the West African region.

Do you have a suggestion, concern or want to appear as a guest author on WAfrica, join our discord server and discuss with a member of our curation team.

Don't forget to join us every Sunday by 20:30GMT for our Sunday WAFRO party on our discord channel. Thank you.