What is the easiest way to become a millionaire?

If your first thought is the lottery, gambling or game show you are sadly mistaken. The only luck you should count on is the luck that happens when you work hard for long periods of time. It is amazing how “lucky” some of the richest people have been through long hours of persistence and determination.

I am sure the next idea you will think of is that somehow real estate will make you wealthy. And finally starting your own business. Both of these ideas are great vehicles to create wealth, however vehicles are meaningless without competent drivers. The most important foundation of any competent wealth driver is the understanding of compound interest. I personally use the power of compound interest to gain wealth through the stock market as it is a vehicle I understand and easy to manage. What you use to gain wealth is up to you but please follow along and fully understand the power of compound interest or what Einstein is thought to have said is the most powerful force in the universe.

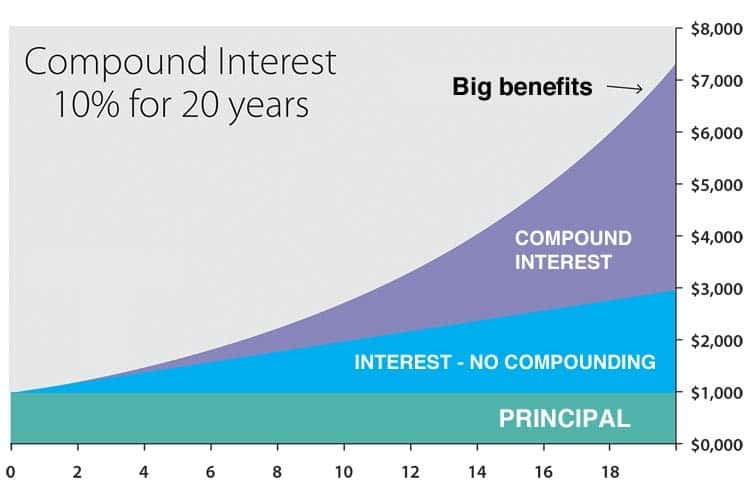

What does interest compounding mean? According to investopedia (a great resource of investment definitions by the way), “ Interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. Compound interest can be thought of as “interest on interest,” and will make a deposit or loan grow at a faster rate than simple interest, which is interest calculated only on the principal amount. For example say you have loaned $100 to a friend at 10% interest, after a year of simple interest you would have $110 ($100 principal plus $10 interest). Now instead of 10% simple interest let’s look at 10% interest compounded monthly. If we divide 10% by 12 the monthly interest rate becomes 0.83%. Logically you would think that at the end of the year you would receive the same $10 interest payment on your $100 loan. However, after Month 1 you have $100.83, Month 2 101.67, Month 3 102.51, etc. which levels the balance at the end of the year at $110.47. By compounding the interest every month your interest earned an additional $0.47 verse the beginning example. Now this may not seem like much however over many years the results really add up.

Now apply this thought with two investors A and B. Investor A starts a regular investing plan in an IRA account with a 40 year investment horizon. He deposits $2,000 into his IRA each year. He invests this money in a portfolio of safe stocks that pay 10% dividends. He continues these contributions until he retires.

Investor B has more time and starts investing in an IRA account with a 47 year investment horizon. He also deposits $2,000 each year and invests in the same 10% dividend portfolio. However, instead of contributing $2,000 per year until retirement, Investor B only makes seven contributions. After 7 years he makes no more payments.

Imagine their stock portfolios show no share-price appreciation. They just crank out 10% dividends each year. At the time of their respective retirements, the two investors compare the balances in their accounts.

| Investor A | Investor B | |

|---|---|---|

| Contributions | $80,000 | $14,000 |

| Account Balance at 65 | $975,721.33 | $1,035,176.93 |

| Earnings Actually Made | $895,721.333 | $1,021,176.93 |

| Return | 12-fold | 74-fold |

Cheers to your wealth

Disclosure: I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article. The information provided should NOT be considered advice. The topics discussed are risky and have the potential to lose a substantial amount. I am not an investment professional and therefore do not offer individual financial advice. Please do your own research before investing.

Posted from my blog with SteemPress : https://sweerch.com/2020/04/19/helpful-savings-motivation-for-all/