XTZ, my new HONEY POT 🍯

The linked article from Coindesk is a good summation of what I have witnessed from XTZ recently. I have a sizable stake in that coin, I could even run a BAKER ("node" or "witness") on console if I wanted to do all that rigamarole. But I am getting most of the gains just hosting on coinbase so it's OK for now. I will move to a private wallet later, and gain another level of returns. Currently, Coinbase is paying 4.9%, private wallets pay ~5.5% and "BAKING" (being a Tezos 'witness' or 'miner') is paying ~6.1%.

It takes 8000 XTZ to "BAKE" and I have well over that. XTZ also offers DELI (my term) or Delegation of Stake, and it works very similarly to our 'witness votes' but WAY BETTER. We have a bunch of gravy sucking dogs at the top (and some great people too, we just need to KICK the suckers and get more good ones!) But XTZ is totally democratic! If I am a small BAKER, I make the same % as a Mega Baker, just less due to my size. If I get DELI (*delegations) then I earn MORE. Wait, I meant MOAR!

If I stake the 8000, run the console and BAKE, I earn approx. 488 per year (actually MOAR because rewards are sent out every 2-3 days on average) so Compounding takes effect. If I receive DELI then I get 10% of my Delegators Stake (0.6%) and he or she receives the the 5.5% remainder. (In this case greedy CoinBase is taking a double slice and I am currently getting 4.9% total rewards.) So it is a Win-Win, the BAKERS and the STAKERS!

STEEM and XTZ came out around the same time, I am glad I did Steem/HIVE then but I wished I had grabbed a lot of XTZ then too 😭😭😭🤣

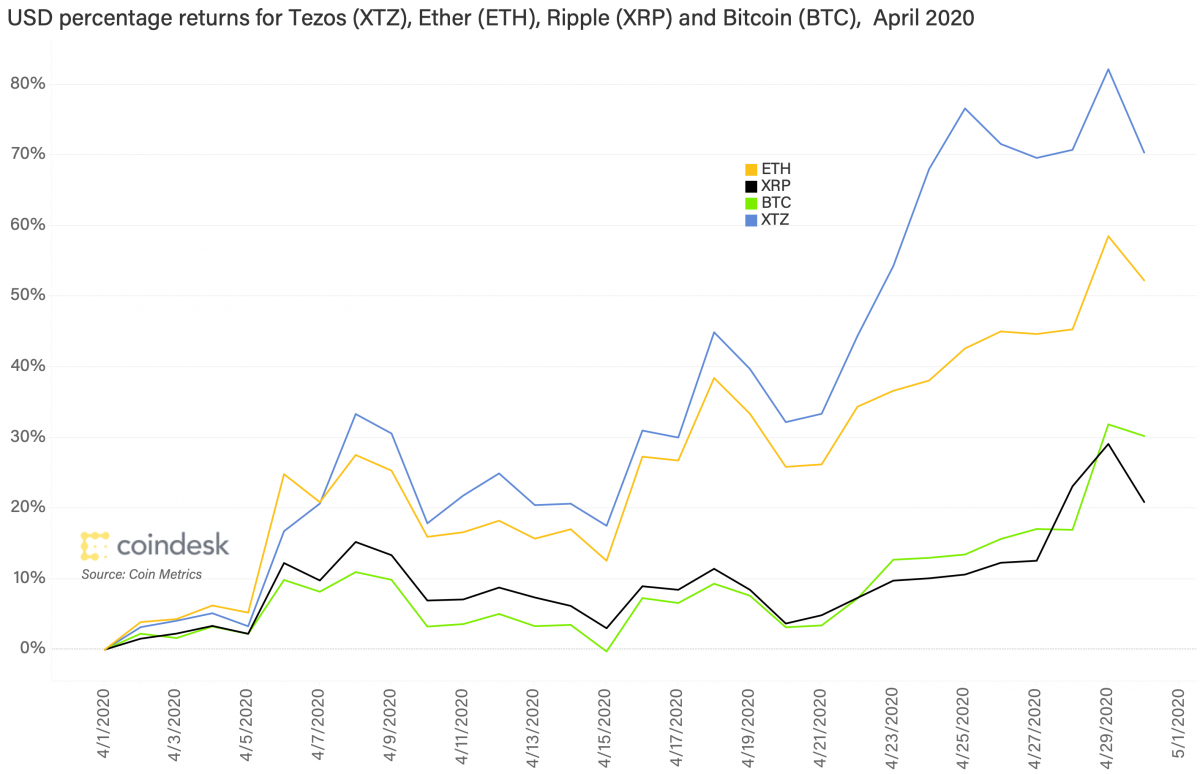

ONE Excerpt from the coindesk article, if true, would allow me to be in the profits nicely with XTC, for sure ;)

Tezos (XTZ), one of the largest and most prominent among a fast-growing roster of digital coins known as “staking tokens,” jumped 83% in April, the most among cryptocurrencies with a market value of at least $1 billion, based on data from Messari.

That’s more than double the 37% gain for bitcoin (BTC), the largest cryptocurrency by market value, which benefited from speculation that an inflation hedge will come in handy as the Federal Reserve and other central banks inject trillions of dollars of emergency liquidity into the global financial system.

Ether (ETH) rose 62% alongside a surge in growth for U.S. dollar-linked stablecoins built atop the Ethereum blockchain, and as investor interest grew in the white-hot arena of decentralized finance. Ripple’s XRP, a payments token, rose 30%.

Graph from COINDESK:

👻 ghost written by: @underground; @spinvest-neo

Until Next Week! 💪😎👍

Nice One, maybe next week you can tell us MOAR about the Future of XTZ and the structure

😝😝😝

HIVE could learn a thing or fifty about "governance"