President and prime supporter of Tesla – Elon Musk only a couple hours prior affirmed the acknowledgment of Bitcoin as an installment strategy for Tesla vehicles. Mr Musk additionally added that Bitcoin won't be changed over to fiat.

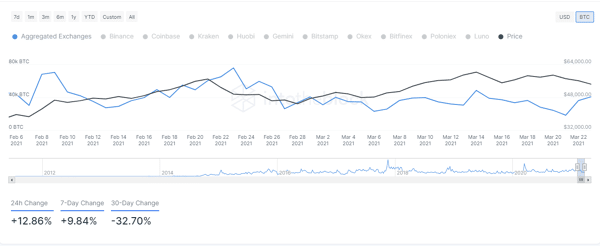

Not long after the arrival of the tweet, Bitcoin value moved to $56 250, adding 3% to the every day gain of the cost. On March 14, Bitcoin set another record high at $61 779 and remembered, not coming to $62 000 hotly anticipated by numerous financial backers. Since March 14 Bitcoin has been following a 10-day downtrend. Some details show theoretical exercises before the March 14 dump. There was a high trade inflow of BTC and around 17.9K BTC entered the trades. From March 14 up to March 21, the inflow volume dropped from 48 480 BTC to 18 200 BTC shaping a slide of 30 280 BTC, driving a 30-Day trade inflow volume to drop by 32.70%.

As seen on the diagram over the trade outpouring didn't influence the cost of Bitcoin much, as the measure of Bitcoin was leaving trades, the cost looked balancing out. Bitcoin might have begun the new climb sooner on the off chance that it wasn't the acquiring US Dollar. Indeed, even the statement from the FED Chairman Mr. Powell on Monday couldn't uphold the hop of Bitcoin and the explanation is during this statement Mr. Powell gave an edge to the US Dollar while saying "It's to a greater extent a theoretical resource, it is basically a substitute for gold, instead of the US Dollar". In his discourse, Mr. Powell additionally asserted that cryptographic forms of money are not sponsored by anything and that they are especially not being used as a methods for installment.

Presently with Tesla, the sixth positioned US organization by market cap, incorporating installments in Bitcoin it will be intriguing to observe how FED will act for this situation. Most likely Bitcoin will be acknowledged by numerous and turn into the installment instrument when, the inquiry remains is the point at which the legislatures concede the worth driven by Bitcoin. The way that Bitcoin is mined and the World's biggest economies have consented to go for a carbon-unbiased force, will give Bitcoin a heavier shortage for the forthcoming years.

Bitcoin's energy utilization contrarily affects the climate and in the end mining will be managed first and foremost to dispense with the carbon-impression of Bitcoin into the Global climate. At present Bitcoin mining devours 87.168 TWh each year, and as indicated by the Cambridge Bitcoin Electricity Consumption Index the absolute utilization could arrive at 136 TWh each year this year, taking out the whole Sweden in this race.

The guideline on mining and the new worldwide carbon-impartial development will affect excavators which will carry the shortage to Bitcoin and in the long run speed up and expenses, accordingly Bitcoin cost is required to rise.

Prior to getting excessively advanced and considering approaches to get mining to space, how about we investigate the Bitcoin graph to see the examples and levels for mid-term.

As seen on a 4 hour BTC/USD graph beneath, Bitcoin remembered from the powerful help of the principal motivation wave, starting on January 27.

There is a falling wedge being framed on an hourly Bitcoin diagram and as per the principles of this example, when the breakout from the wedge is affirmed, the cost will hop towards $66 950 if the breakout is affirmed soon and the February's high is tried as help and towards $65 825 if the breakout is postponed and Bitcoin follows 5-wave remedy arrangement.

As indicated by the Elliott waves hypothesis, Bitcoin is as yet in the fulfillment of an Intermediate wave 5, which ought to be finished soon as there are indications of the finish of the Minor check's wave 4 development.

When composing of this article Bitcoin on Overbit is exchanged at $56 267 and is confined somewhere in the range of MA200 and MA100 on a 4-hour time span. There are a few opposition lies ahead, the first would be at $58 450.

The climbing finishing corner to corner recommends that the accompanying new ATH could be at $64 300 if Bitcoin keeps the speed and breaks over the neighborhood dynamic opposition.

While the Wave investigation is engaging by it's excellence, it here and there is difficult to characterize the specific finishing of the drive wave arrangement.