A choppy but quiet week in markets makes options expiry a little calmer than expected. Main work - focusing uranium investments on producers and developers close to production.

Portfolio News

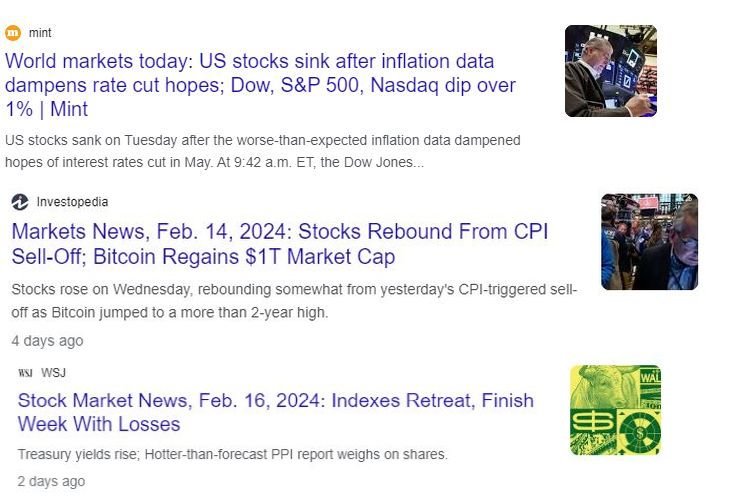

In a week where S&P 500 dropped 0.34% and Europe rose 0.77%, my pension portfolio rose 0.08%. Some plusses and minuses - Latin Resources (LRS.AX) up 6.3% and Blue Star Helium (BNL.AX) down 29% on ASX, Europe and UK almost all up, Japan - half down but down in aggregate, alternate energy in US up but drags from Fiverr (FVRR) and Treasuries (TLT) and lastly Canada uranium down - that was the week to be buying.

Big movers of the week were American Rare Earths (ARR.AX) (134.4%), MITSUI E&S Co (7003.T) (37.6%), Shibuya Corporation (6340.T) (27.5%), Articore Group (ATG.AX) (22.9%), Arafura Rare Earths (ARU.AX) (20.8%), Lanthanein Resources (LNR.AX) (20%), TechGen Metals (TG1.AX) (16.2%), Appen Limited (APX.AX) (16.1%), AMP Limited (AMP.AX) (14.4%), EML Payments (EML.AX) (13.4%), DevEx Resources (DEV.AX) (11.5%), 3D Systems Corporation (DDD) (11.1%)

A short list of 12 big movers. The stand out is American Rare Earths, two weeks in a row, on the back of a big increase of rare earth resources. Mitsui Engineering and Shipbuilding is back on the list. Been using the big movers list to scale in to holdings. Might get to profit one day. Is there a theme? Rare earths (2 stocks), lithium (1 stock), graphite (1 stock), Japan (2 stocks - 2nd week in a row)

US markets bounced between good earnings and hot inflation numbers - the inflation fear got the edge for a down week

Crypto Drives On

Bitcoin price pushed higher all week ending 8.2% higher with a trough to peak range of 10.6%

Ethereum price was nearly double that with a rise of 15% on the week and a range of 17.2%

Cardano (ADA) popped 20%. Polygon (MATIC) was a bit firmer with a 21.3% pop and still rising

The Graph (GRTETH) had the 2nd pump in a month rising some 50% to match the previous pump highs and takes my holding past the last entry point.

Uniswap (UNIBTC) has broken its downtrend path since early 2023 and is showing signs of life with a 17.4% pop this week vs Bitcoin

VeChain (VETBTC) getting a 2nd pump in 2024 with a 60% rise - need another one that size to reach the prior entry (the level of the blue arrow)

Bought

BHP Group (BHP.AX): Base Metals. Rounded up holding for changed multiplier to continue writing covered calls. Trading costs ate one third of the premium received for the covered call.

Cameco Corporation (CCJ): Uranium. The more I read the Cameco earnings, the more I think the market has put the wrong interpretation on it. Yes, there will be short term pain covering the shortfall in contracts BUT more important is the long term increases in capacity in the Athabasca Basin using existing mill resources. Added a holding to managed portfolio. Also added a March expiry 43/40 credit spread offering 33.3% ROI with 1.5% price coverage.

DevEx Resources Limited (DEV.AX): Uranium/Rare Earths. DevEx owns uranium and rare earths tenements in the Alligator River area, Nothern Territory, Australia adjacent to the large historic Nabariek mine. Added the holding as a wildcat opportunity. As NT has an established uranium mining history (Ranger Mine and Jabiluka as well) no fears about permitting.

Chart shows a 100 percentage point gap to Paladin Resources (PDN.AX). If the team can persuade the markets that they are getting to a half decent PFS - price will double. Of note, the other rare earth tenements might spin a a winner. The uranium is there to be had.

Maverick Minerals (MVM.AX): Lithium. Applied for shares in IPO of this spin off from Latin Resources (LRS.AX). Got access via shareholidng in LRS in pension portfolio and from Next Investors allocation in personal portfolio - will see if the allocations are awarded - the deadline for submissions was extended a few weeks - likely to get an allocation.

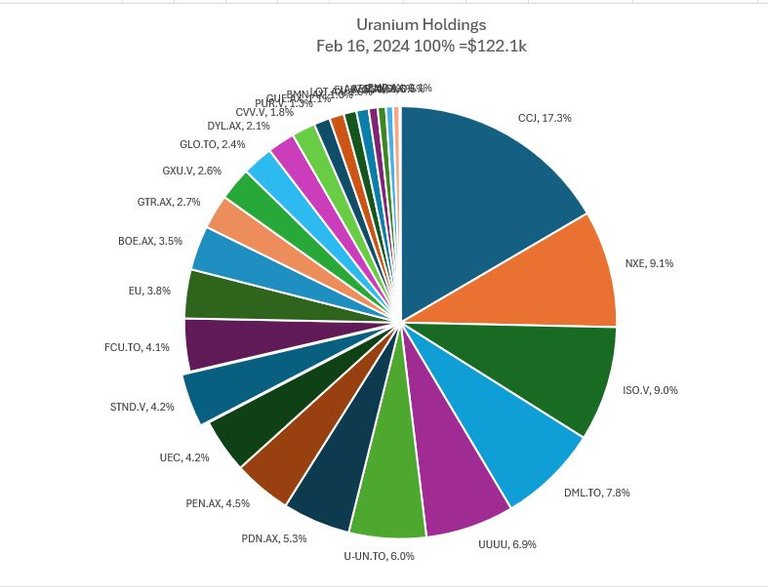

Working out my own strategy for uranium. Seems quite clear that we are at the start of the next nuclear cycle and the climate action momemntum is going to push the growth of nuclear power. Last week I mentioned a strategy of 50% in producers, 25% in producers likely to come on stream in 2 to 3 years, 20% in producers coming on stream in scale after that and 5% in wildcat opportunities.

Watched an interview with Uranium Insider founder Justin Huhn - made a lot of sense to me and filled in some big knowledge gaps. Joined the program and adopted some of their core list ideas as they align somewhat with my outline above - and they do all the work. One year fee will be recovered easily - exit the few more speculative trades at a profit and it is paid. Will allocate 10% of portfolio value to uranium and steadily scale in. This was a good week to start with the pullback following the Cameco (CCJ) earnings related selloff

Pick projects with solid teams - uranium mining is really hard - only a few will succeed. This is what Uranium Insiders helps with.

Started in managed portfolio which was 1.7% invested and had cash avaialble.

Sprott Physical Uranium Trust Fund (U-UN.TO): Uranium. Added to holding with a view of being connected to spot price movements. Will consider this as part of the 50% allocation to working production.

enCore Energy Corp (EU): Uranium. New position in this portfolio. Scaling up production in South Texas from late 2024 with other mines flowing in after that.

IsoEnergy Ltd (ISO.V): Uranium. New position in this portfolio. Do have it in others. Most likely to be able to fill short to medium term demands from reopenings in Texas.

Global Atomic Corporation (GLO.TO): Uranium. New position - building the largest mine planned to come on stream this decade - in Niger. Funding is certain to be be available with production possible late 2025 ramping up in 2026.

Denison Mines Corp (DML.TO): Uranium. Added to holding. Phoenix operation planned to start production 2028 as one of the lowest cost production mines in the world. Doing detailed design in 2024. Capital in place to cover expected capital requrements - some gaps to be managed are not big.

NexGen Energy Ltd (NXE): Uranium. New position in this portfolio. Large scale production planned for end of decade (say 2031)

Aura Energy Limited (AEE.AX): Uranium. Added another speculative holding in personal portfolio. Aura are developing a large scale mine in Tiris, Mauritania - all in life of mine costs are in the mid range ($28.7/lb) and 2Mlbs production from 2028 (my timing). Capital costs are modest - project financing is key next step.

Silex Systems Limited (SLX.XA): Nuclear Enrichment.

At the end of the week, allocation is up to 6.4% and the mix looks a little more solid - two thirds are tied to spot price and/or are close to production or planning to be at scale in the critical 2026 to 2030 timeline. Path from here is to keep scaling in to the top two thirds and deploy profits in a few wildcats (fewer than now) - once I can smoke out the weak teams not likely to produce. And there will be more options trades.

Sold

Latin Resources (LRS.AX): Lithium. Sold a parcel of stock in pension portfolio to fund application for IPO of Maverick Minerals (see above). Locks in 295% profit on the first tranche bought in March 2019. Applying average cost profit would be a 771% profit over tranches from March 2019, January 2020 and December 2022. Profits on the trade are large enough to cover the whole allocation applied for.

Rolls-Royce Holdings plc (RR.L): Aerospace & Defense. Assigned on covered call for 7.1% profit since January 2024 in personal portfolio. 5% profit in managed portfolio.

ABN AMRO Bank N.V. (ABN.AS): Dutch Bank. Assigned on covered call for 8.2% profit since December 2023.

Banca Monte dei Paschi di Siena (BMPS.MI): Italian Bank. Assigned on covered call for 13.9% blended profit since December 2023

Safilo Group S.p.A. (SFL.MI): Medical Supplies. Assigned on covered call for 13.3% profit since January 2024

Alerian MLP ETF (AMLP): US Oil. Assigned on covered call for 7.9% profit since August 2023

ChargePoint Holdings Electric Vehicles. Exercised on bought put set up in error - had a mismatch in quantities when rolling sold puts - an expensive 78% blended loss since November 2022. Lesson learned - fix the error. That said, it seems the AAPlus thesis on ChargePoint is not working out - going to need a lot of time to win back. Short term 3/4/2 call spread risk reversal expired with price landing between the bouglt call (3) and the sold put (2). Might do that one again.

iShares Russell 2000 (IWM): US Small Caps Index. Assigned on covered call for 1.6% blended profit since November 2021/March 2022/January 2023. Averaging down in the last tranche produced the profit.

Posco (PKX): Korean Steel. Assigned on covered call for 23.8% loss since - August 2023. Had written this call at a lower strike as there are holdings that could be allocated for a profit - tax losses taken on FIFO basis reduces average cost for the next round of covered calls.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 30% profit or 20% if 52 week high is lower than 30% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

New Buys

Tyro Payments Limited (TYR.AX): Financial Services.

Scale Ins

Aurizon Holdings Ltd (AZJ.AX): Logistics. Dividend yield 4.30%

Top Ups

Ramsay Health Care Ltd (RHC.AX): Healthcare. Dividend yield 1.60%

Chart shows price making a 2nd one month high at the top of the new cycle - looks a bit sideways but it does make for more averaging down.

Coles Group Ltd (COL.AX): Retail. Dividend yield 4.10%

Chart shows price making 2nd cycle after the inverse head and shoulders - if the economy holds this should run especially some massive controversy about their main competitor, Woolworths (WOW.AX) withdrawing Australia Day products for sale.

Sold

Bell Financial Group Ltd (BFG.AX): Financial Services. 31% blended profit since December 2022/January/July/August/November 2023.

The chart shows the strengths and weaknesses of the strategy. Entry points tend to arrive at the tops of cycles. The first two entries are examples of entering at the tops when price is ranging. Topping up adds new entries for the time when price does break out of the range. The exit point may be just at the point when the stock is going to run a lot higher. BUT this is a trading strategy rather than an investing strategy. One way to reduce the risk is to sell part of a position and leave it to run (maybe with a stop loss in place)

Next chart adds in Bollinger Bands (the purple bands). There is a strategic option to top up after the initial buy entry when price touches the lower Bollinger bands. Takes a lot more work looking at charts.

Downer EDI Ltd (DOW.AX): Engineering Services. Closed out at profit target for 29.9% blended profit since May/June/July/September 2023.

Hedging Trades

Coeur Mining (CDE): Silver Mining. Assigned early on sold put.

Agnico Eagle Mines Limited (AEM): Silver Mining. Assigned

Cryptocurrency

Coti (COTIBTC): Price propped the week before - scaled into my holding figuring that there would be more pump action - while the amount was only $100, it was more than 3 times the number of tokens.

Chart shows price has been bottoming out for 4 or 5 months and making some spikes higher. 50% exit target is around the level of the price before the big fall off in mid 2023. Last entry is the level of the blue arrow. I do have a degree of confidence in the team as some of them I worked with in South Africa all those years ago.

Income Trades

70 covered calls went to expiry across 3 portfolios of which 7 were assigned (Canada 1 UK 5 (1) Europe 20 (3) US 44 (3))

13 naked puts went to expiry of which 2 went to assignment, both in silver mining (Europe 4 US 9 (2))

Rolled out and down a few sold puts at risk of going to assignment. Am quite happy to own these stocks - just a bit tight on margin.

- Commerzbank AG (CBK.DE): German Bank. 6.1% loss (less trading costs) 11.4% cash positive.

- Deutsche Bank AG (DBK.DE: German Bank. 52.3% profit (less trading costs) 47% cash positive.

One new naked put

Rolls-Royce Holdings plc (RR.L): Aerospace/Defense. Return 3%. Sold at cost price for holding that will be assigned

Credit Spreads

6 credit spreads went to expiry - average ROI was 10% in pension portfolio and 22% on Morgan Stanley (MS) in managed portfolio. Imagine scaling that to 30% of perfolio weight.

One new credit spread in addition to Cameco mentioned above

CVS Health Corporation (CVS): US Healthcare. ROI 11.4% Coverage 6.%

All the margin work in the week to expiry workd to end the options month in cash positive territory.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

February 12-16, 2023