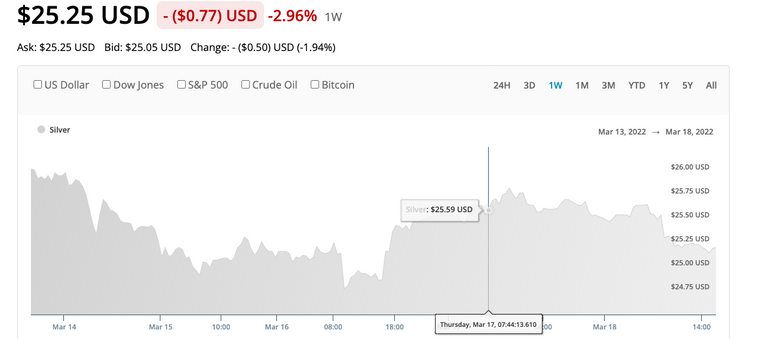

Silver Price Analysis

I'm making a bold prediction on this post. I think Silver could rise to $50 an ounce in the next two years! Silver prices are a bit lower this week. However, things are uncertain on the geopolitical front so we will continue to see swings in prices. Silver's next upside price target is at the resistance which is at $26.50. Downside price action would be a close prices support at $24.00.

Another note is I see supply issues seems to be getting worked out as out of stock items seems to be getting fewer. I still have not been to a LCS to check out how the local supply is looking.

Silver Chart

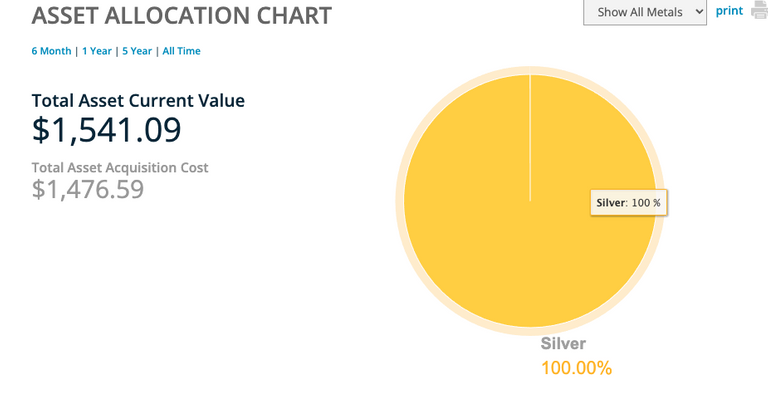

Portfolio Update

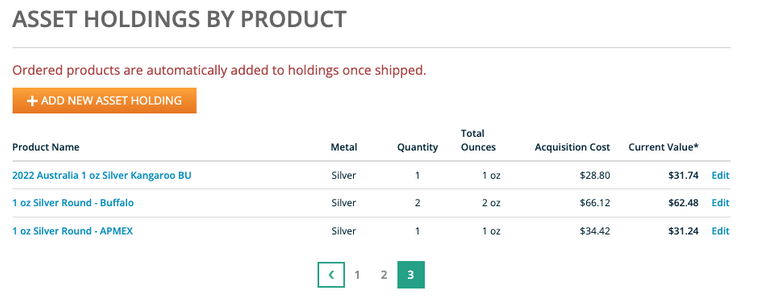

My current assets are valued at $1541.09% with a total acquisition cost of $1476.59. Silver is down almost 3% this week, but the portfolio is still in the black.

Asset Allocation Chart

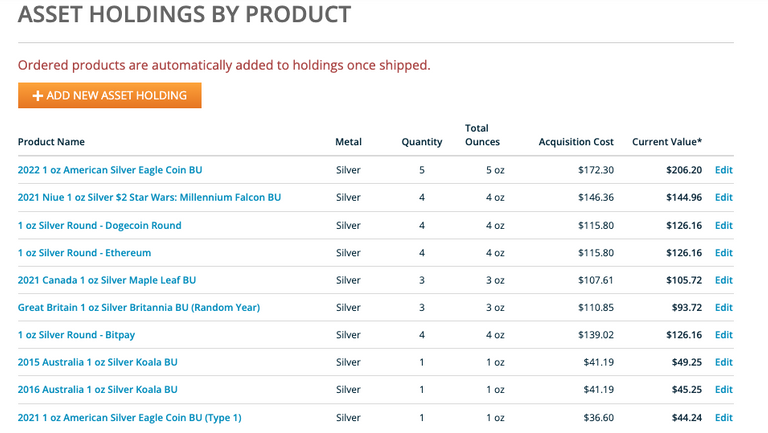

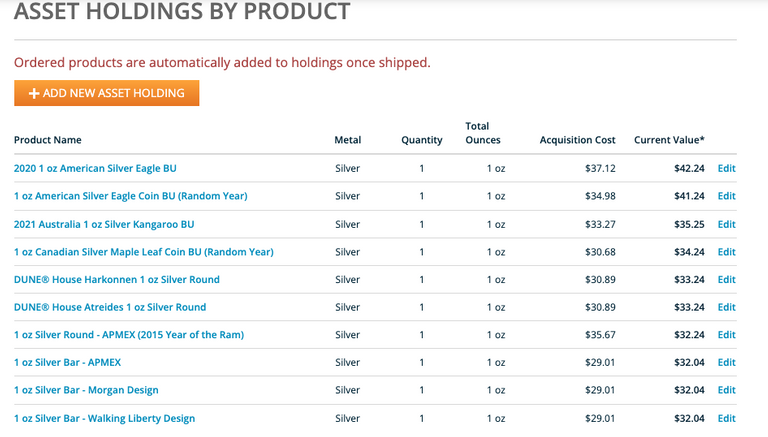

Asset Holding by Product

Premiums are stupid again hold off for a bit and stack your cash for a bigger buy when it comes back to reality

Smart call! I'll be waiting then.

Silver is king. I think that silver is going to rise quicker than gold. The ratio is 80:1. A more suitable ratio in my opinion should be 50:1. I just feel that silver is harder to get, or they charge s higher premium. Silver is cheaper to buy therefore is good for demand !

Yes I feel the same. I think the paper contracts hurt us, but don't know when that ponzi scheme is going to fail.

So good to know master stackers like you my man.

I have only enough attention for focus and having you cover this and share your observations is legit!

Good Stackin'

I feel you I'm spread thin at the moment too!

Thanks for the Silver updates, @cryptictruth. The LCS, in my area, seems to have plenty of inventory. It is an honest & fair, LCS, with reasonable prices. But, American Silver Eagles are $40, ($14-15, premium). Generic one-ouncers, $30. The Dealer says he is paying, the highest premium, he's ever paid, on ASE. Many talking heads are calling for $50, soon. A few, as high as $300. Even $600. 3/20/2022.

The theoretical Comex paper price of Silver is getting so irrelevant compared to the real physical one. The premiums may appear insane but it more closely reflect bullion value, the Dealer's buying price is often telling. That $50 prediction is not that far off.